The Rise of Transfer Pricing Disputes

Allan Madan, CPA, CA

The Rise of Transfer Pricing Disputes

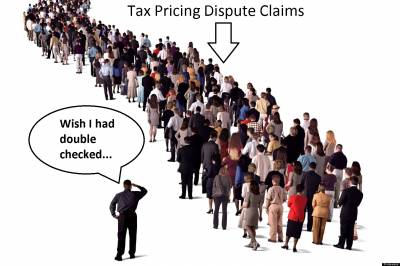

Many multinational companies are using techniques to either avoid or lower their taxes by taking advantage of the fact they have a parent company or subsidiaries in other countries. The CRA, IRS, and other tax authorities are auditing taxpayers with greater scrutiny in regards to transfer pricing issues so they are able claim their share of tax revenues.

What does this mean for corporations that use transfer pricing?

This means that there is greater uncertainty and a higher risk of reassessment during an audit which can result in additional taxes, penalties and interest charges.

For a local business, inter-company transactions often are a large portion of its’ total sales or costs. The “transfer price,” the price at which goods and services are sold or purchased by a Canadian Co. to a U.S. Co. is what tax authorities investigate. For example, if a Canadian Co. sells goods at a high price, the company will keep more of its’ profits in Canada as opposed to a lower price which will leave the U.S. with more of the profit.

A transfer pricing audit is usually triggered based on information (details on the types of transactions, methods used for pricing specific transactions, dollar value etc.) taxpayers provide as a part of their corporate tax return. A reassessment typically increases the taxes a corporation will owe in one country until you are able to get the tax authority in the other country to provide an offsetting reduction. To resolve the issue of being taxed twice, it can be a very lengthy process that can take around two years for authorities in both countries to meet and review the facts and circumstances to negotiate which country should tax the transaction.

The following are a few points to note:

- Canada Co file a T106 Information Return to provide details on transactions that involve transfer pricing with the CRA.

- US Co. file Form 5471 and 5472 with IRS to provide details on transactions that involve transfer pricing.

- Tax authorities identify red flags by using computer software to detect any errors or omissions that lead to a reassessment.

- It is reasonable to expect that transactions involving transfer pricing will result in more audits as tax authorities are improving their risk assessment systems.

- Canadian taxpayers may appeal their reassessment in the Tax Court of Canada.

So here’s the key takeaway:

Taxpayers should review their transfer pricing policies in order to mitigate the amount of uncertainty, the risk of an audit, reassessment as well as double taxation.

Disclaimer

The information provided on this page is intended to provide general information. The information does not take into account your personal situation and is not intended to be used without consultation from accounting and financial professionals. Allan Madan and Madan Chartered Accountant will not be held liable for any problems that arise from the usage of the information provided on this page.