How to Prepare Final Return of A Deceased Person in Canada

Allan Madan, CPA, CA

INTRODUCTION

This article provides an in-depth review of PREPARING THE FINAL RETURN OF A DECEASED PERSON in Canada, including taxation of:

- Dividends & interest

- Employment income

- Old Age Security

- Canada or Quebec Pension Benefits

- Pension Income Splitting

- Employment Insurance

- Investment Income

- Rental Income

- Death Benefit

- RPP, RRSP, RRIF

- Tax Deductions

When an individual passes away, he/she is deemed to have ‘sold’ all of his/her assets immediately before their death. Their death also initiates an immediate year-end. As a result, their property now becomes their estate. Ultimately, the death of a taxpayer requires a Final or Terminal Tax Return to be filed.

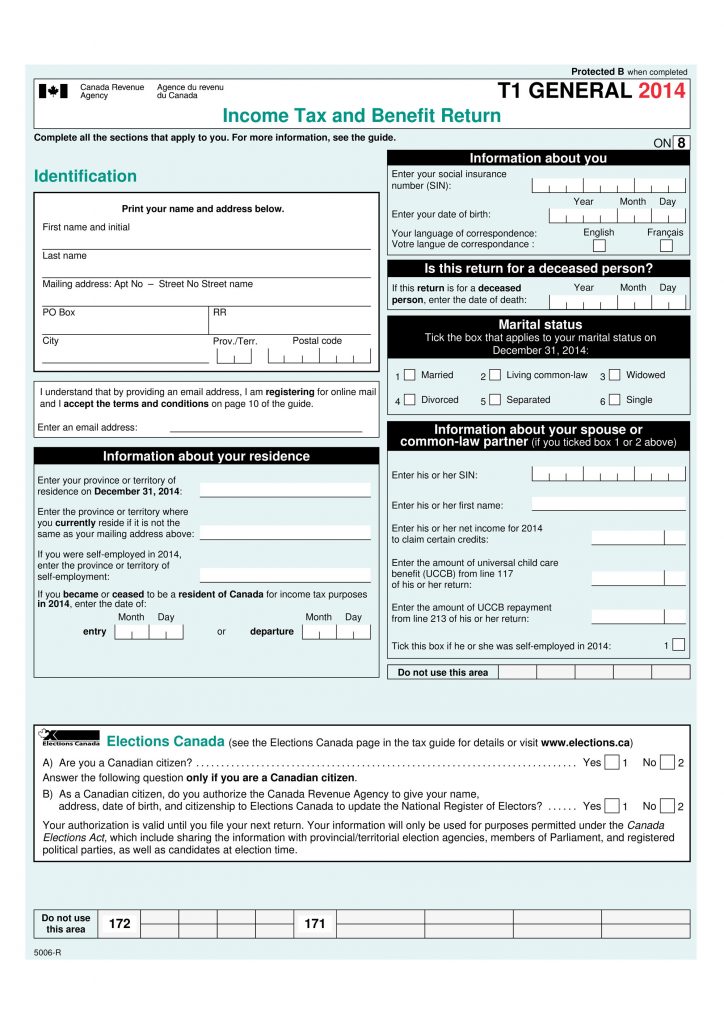

Completing the Final Return (Page 1)

Let’s take the example of John Smith, a widower, who died on February 2nd, 2015. The first page of his return would be completed by his estate’s executor/administrator as follows:

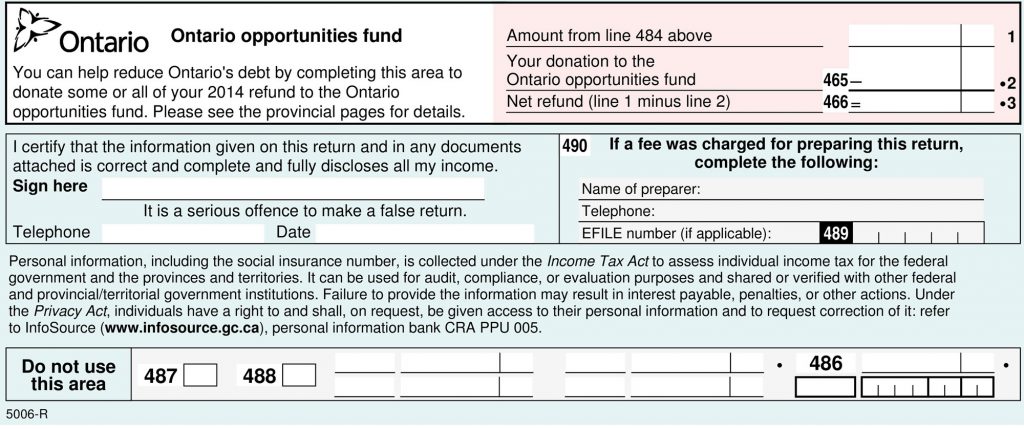

The estate administrator/executor would then also have to sign the return on behalf of the deceased (last page):

DIVIDEND INCOME

On the Final Return (Schedule 4), report dividends declared on or before the date of death. Any dividends declared after the date of death are reported on the beneficiary’s return. You can find the declaration date of the dividends on the website of the Company that’s paying the dividends. The Company will issue a T5 slip for the dividends paid by no later than February 28 of the following year.

| Example 1: Frank Smith’s date of death is October 31st, 2015. Frank is married and his wife is the sole beneficiary of his estate. He purchased 100 shares of Apple in 1997 and on September 1, 2015 Apple declared a dividend of $10 / share. The dividends were paid on November 15, 2015. What is included on the Final Return? · Since the dividend was declared before the date of death, the dividend will be included in Frank’s final return; amount included = $10/share x 100 shares = $1,000. Example 2: Assume the same facts as above, except that Apple declared a dividend of $10 / share on November 8th, 2015. · Since the dividend was declared after the date of death, the amount of the dividend will be included in the spouse’s return. So in this case Frank’s wife would include $1,000 worth of dividend income on her tax return. |

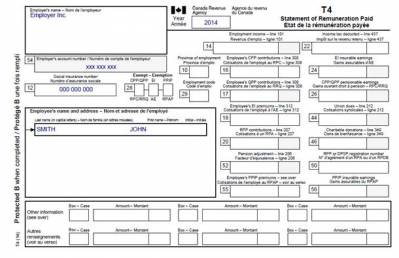

EMPLOYMENT INCOME

The employer of the deceased will issue a T4 slip on or before February 28 of the following year. On line 101 of the Final Return, report the amount disclosed on Box 14.

| Example 3: Frank Smith’s date of death is October 31st, 2015. He has an annual salary of $100,000. Box 14 of his T4 slip reported $93,000 comprised of employment income for $83,000 and unpaid vacation for $10,000. What is included on the Final Return? The amount of $93,000 will be reported on the final return as it was salary and vacation pay earned by Frank before his date of death. |

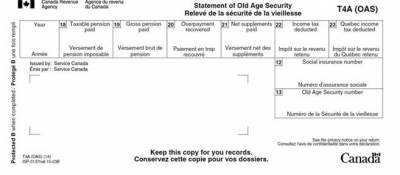

OLD AGE SECURITY PENSION (OAS)

Report the amount shown on box 18 of the deceased’s T4A (OAS) slip on his/her Final Return. Report amount disclosed on Box 18 on line 113 of the final return.

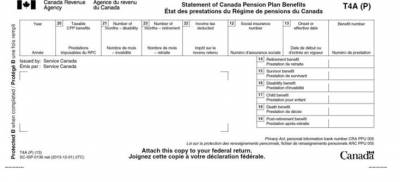

CANADA OR QUEBEC PENSION BENEFITS

Report the total Canada Pension Plan (CPP) or Quebec Pension Plan (QPP) benefits in box 20 of the deceased’s T4A (P) slip less any amount in box 18. A payment that is received after the date of death but still within the month where the individual died may still be reported in the final return. Do not report the CPP or QPP death benefit (shown in box 18) on the final return. Hence, in the example below, an amount of $9,000 {amount in box 20 less amount in box 18) will be recorded on the final return line 114.

PENSION INCOME SPLITTING

On the final return, the deceased individual may elect jointly with his/her spouse or common-law partner to split the pension, annuity and registered retirement income fund (RRIF) payments. In order to make this election, the deceased and their spouse/common-law partner must have previously elected jointly to split pension income by completing Form T1032 Joint Election to Split Pension Income. Form T1032 must be filed by the filing due date set for the return. This form must be attached to the paper returns of both the deceased and their surviving spouse/ common-law partner; the legal representative of the deceased person’s estate must sign the form.

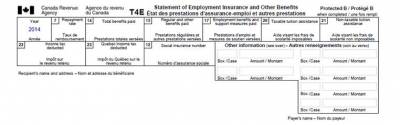

EMPLOYMENT INSURANCE BENEFITS

Employment insurance benefits (EI) payments the deceased received from January 1 to the date of death on the final return must be reported as these benefits are subject to claw-back in the year of death. These amounts are found in box 14 of the T4E slip and must be reported in box 119 of the final return.

INTEREST INCOME

Interest income earned from January 1stto the date of death must be reported on the final return. Interest income is deemed to have accrued in equal daily amounts. Amounts must be prorated based on days before death and after death. The date of payment does not matter.

| Example 4: Frank Smith died on June 30, 2015 and his wife, Jenny, is the sole beneficiary of his estate. Frank owned a corporate bond in General Motors that has an annual interest rate of 8% and a face value of $100,000. An interest payment of $8,000 was made to Frank’s estate on December 31. What amount is reported on the final return and what amount is reported on Jenny’s tax return? · Frank would report an amount of $3,967.12 on his final return as interest income is accrued in equal daily amounts from January 1st until his date of death: $8,000 x (181/365) [January 1st-June 30th] = $3,967.12 · Jenny would report the remaining amount of $4,032.88 on her tax return |

RENTAL INCOME

Rental income earned and rental expenses incurred up until the date of death must be included in the final return, form T776, Statement of Real Estate Rentals. Income and expense amounts must be prorated based on days before and after date of death.

Example 5: Frank and Jenny Smith, a married couple, own a rental property in Toronto, Ontario, Canada. The income and expenses from January 1, 2015 to December 31, 2015 is shown in the table below. Frank passed away on July 31, 2015 and Jenny is the sole beneficiary of his estate. What does Jenny report on her 2015 tax return and what is reported on Frank’s Final Return? Note: · For Frank, amounts are prorated from the beginning of the year until date of death (January-July): 7/12 · For Jenny, amounts are prorated from after the date of death until the end of the year (August-December): 5/12

|

CAPITAL GAINS & LOSSES

When a person dies, he/she is deemed to have sold of his/her assets at their market value on the date of death. This can trigger capital gains or losses on capital property that the deceased owned. There is an exception to this rule: if the property of the deceased is willed to a spouse, then the capital assets of the deceased are deemed to have been sold at their original cost, in which case a capital gain or loss will not result.

Example 6:Frank Smith died on February 1, 2015. He owned the following assets that he willed to his wife and only daughter on his death:

|

DEATH BENEFITS OTHER THAN CPP/QPP BENEFITS

A death benefit is an amount for the deceased’s employment service following their death. This benefit is income for the estate or the beneficiary; a maximum of $10,000 of the total of all death benefits is exempt from tax. If the surviving spouse and another individual received the death benefit, the spouse of the deceased is entitled to claim the $10,000 tax deduction first and any remaining portion goes to the other person.

REGISTERED PENSION PLANS (RPP)

Amounts paid out of a pension plan or superannuation is taxable to the recipient. The spouse/Common-law partner of the deceased must transfer the payments out of the plan and directly into their RRSP/RRIF/RPP. If the pension plan outlines a lump sum payment to be made to a minor child or grandchild of the deceased, the payment needs to be made to purchase a qualifying annuity (non-tax deductible plan). This annuity will provide payments based on a period of no more than 18 years less the child’s age at the time this annuity is purchased. Payments to the plan must be made within 60 days after the end of the year.

REGISTERED RETIREMENT SAVINGS PLAN INCOME (RRSP)

For the deceased with a RRSP:

| Scenario | Result |

| No surviving spouse/ Common-law partner | Balance in the RRSP account must be reported in the final return of the deceased |

| Surviving spouse/common-law partner is the chosen beneficiary of the RRSP | Will receive the remaining RRSP payments from the plan and has to report as income. |

| Surviving spouse/common-law partner is the beneficiary of the estate | They and the legal representative of the estate can jointly elect to treat the amounts paid to the estate out of the RRSP as being paid to the spouse/common-law partner. |

| Payment out of RRSP is paid to a financially dependent child/grandchild | Qualifies as a refund of premiums. The legal representative of the deceased annuitant can claim a reduction to the amount the annuitant received at the time of death. The qualified beneficiary and the deceased annuitant can now pay the least amount of tax that the law allows. |

How is income reported?

- A T4RSP slip is issued to the deceased annuitant and the income must be reported on the deceased’s income tax and benefit return. The amount is shown in box 34.

- When the beneficiary of the estate receives income from the RRSP after the annuitant dies, a T4RSP slip is then issued to the beneficiary. The amount is shown in box 28.

Example 7: The individual’s date of death was May 31st, 2015. The deceased has a matured RRSP with a market value of $100,000.

|

REGISTERED RETIREMENT INCOME FUND (RRIF)

When a deceased individual has an RRIF the amount that would be included in the deceased’s income would vary depending on the circumstances.

- If the deceased receive payments from the RRIF for the period from January 1 to the date of death, then that income should be reported on the final return. If the deceased was over 65 or under 65 and received the RRIF payments due to the death of their spouse/common-law partner, it must be recorded on their T1 General Benefits Return.

- If the annuitant made a written election in the RRIF contract or in their will to have the RRIF payments transferred to his/her spouse/common-law partner after their death, the spouse/common-law partner becomes the annuitant. This election can be made by attaching a letter of notice to the final return stating that the surviving spouse will continue making repayments.

| Example 8: The individual’s date of death was April 30th, 2015, and their spouse is the sole beneficiary. The deceased received monthly pension income from their RRIF of $1,000. ü Amount reported on the deceased’s final return is: $1,000 x 4 months [January to April] = $4,000. ü The deceased’s spouse will report monthly income from the RRIF for the remaining portion of the year given that she is the named successor annuitant or her and the legal representative made the election for her to become the successor annuitant.: $1,000 x 8 [May to December] = $8,000. |

DEDUCTIONS FROM INCOME

RRSP OR PRPP CONTRIBUTIONS

Any RRSP or PRPP contributions that the deceased made to their own RRSP/PRPP/spousal plan prior to their death must be deducted. When an individual dies, no one else can contribute to their PRPP/RRSP, however contributions can be made to the RRSP/PRPP of their surviving spouse (given that they qualify) within 60 days of the end of the year in which the taxpayer died. The amount that can be deducted from the deceased’s final return is limited to their RRSP/PRPP deduction limit.

NON REFUNDABLE TAX CREDITS

If the deceased was a Canadian resident from January 1 to the date of death then full personal amounts (lines 300-306, 367 & 315) may be claimed on the final tax return as well as on an elective return.

MEDICAL EXPENSES

These particular expenses can be claimed for any 24 month period that includes the date of death given that they have not been already claimed on a past return. You may claim amounts paid for a full-time attendant or for full-time care in a nursing home as a medical expense. In order to make such a claim, a doctor must sign on a letter or a valid Disability Tax Credit Certificate (form T2201) confirming that the individual receiving such care had a severe physical or mental impairment in the current taxation year.

DONATIONS AND GIFTS

If the deceased happened to have made a donation or a gift to a province or to Canada during the year or in their will, in this case the donation is deemed to have been made in the year of death by the taxpayer and thus it may be claimed on the final return or on an elective return.

DONATIONS MADE THROUGH THE WILL

As long as the donations are supported, charitable donations made through the will can currently only be claimed on the final return. The proof that needs to be provided depends on when the registered charity or done will receive the gift.

- Gifts received right away – must provide an official receipt

- Gifts received later – must provide a copy of the will, a letter from the estate to the charitable organization that will receive the gift (includes what the gift is and its value), and a letter from the charitable organization acknowledging and accepting the gift.

For more information on what additional tax related items you need to take for a deceased individual, please consult our tax guidefor the legal representative of a deceased family member.

Disclaimer

The information provided on this page is intended to provide general information. The information does not take into account your personal situation and is not intended to be used without consultation from accounting and financial professionals. Allan Madan and Madan Chartered Accountant will not be held liable for any problems that arise from the usage of the information provided on this page.

Who signs the final tax return ? Do we need to send a copy of the last Will to CRA ?

Hi Pierre, the executor signs the final return. It’s a best practice to attach the Will to the final return.

Hi Allan

My wife’s Dentalco shares are owned by a Trust. Her parents are beneficiaries of the trust. Dentalco meets all the requirements of a “pure” SBC. Can we utilize the ~800K LCGE on a deceased parents return (e.g for crystallization purposes)? Haven’t done so far due to AMT and OAS claw back reasons.

Hi Rajeev, yes, you can claim the lifetime capital gains exemption on a deceased taxpayer’s final return.

my uncle passed away in 2017 in British Columbia with no will. He disposed of all of his assets before his passing. I have all of his records for preparing his final tax return. Can I be his representative in this case ?

Hi Anna Maria, where there is no will, the probate court will appoint an executor for the estate of the deceased. You should speak with a lawyer for further advice.

My father in law passed away in September 2017. We filed his taxes through an accountant for his final return. In September of 2018 we had a preparation of T3 final done and a Preparation of TX19 clearance certificate filed as well. This month we received a T5 in the mail from his bank with only box 13 filled in for 283.76. Do I file another return for him with that as the only income after his death?

Hi Tracey,

You should amend the T3 final return to include the income (per the T5, interest) that was not reported. Attach a covering letter to the amended return explaining the situation.

can you claim rent that you paid to someone else Can it be used in your income tax when you passed away on April 10/23

Hi Shirley,

If you live in Ontario, you can apply for the Ontario Energy and Property Tax Credit (OEPTC). This tax credit is based on your net family income and is based in part on the amount of rent paid during the year. A deceased individual can claim this credit on his/her terminal return.

Very informative…thank you!…in regards to the RRSP for deceased person, who had no will, or beneficiary to the estate, can the surviving spouse transfer transfer it over to their RRSP with no tax implications?…The spouse is the administrator of the estate.

Hi Juliet,

Yes, the balance held in an RRSP of a deceased spouse can be rolled over tax-free to the surviving spouse’s RRSP.

Hi Allan, my sister died in2020 with no Will. I was granted the appointee by the Lawyer.The 2020 tax was done the year she died then we found out 1998&1999 tax was never done but we have no records.

H Anne,

I’m sorry for your loss. You should contact the CRA to appoint you as the authorized representative of your sister’s estate. Then ask the CRA for copies of her tax slips for the years your late sister’s tax returns were never filed. In most cases, the CRA will not process tax returns that are more than 10 tax years past due.