Personal Real Estate Corporation

The Ontario government has made changes to the Real Estate and Business Brokers Act, which allows real estate agents to carry on business using a Personal Real Estate Corporation (PREC). This can have huge tax benefits for agents.

What is a Professional Corporation?

A professional corporation is a corporation that provides professional services and is regulated by a professional governing body. In this case, realtors are regulated by the Real Estate Council of Ontario ("RECO") and are permitted to form Professional Real Estate Corporations ("PRECs").

- Only realtors can be voting shareholders of a PREC

- PREC is subject to oversight by RECO

- A PREC does not limit professional liability

Should I incorporate a Professional Real Estate Corporation?

Consider these factors to help you determine if a PREC will be beneficial for you:

- Are you earning enough to meet your required daily living expense?

- Do you plan to save money towards retirement?

- Do you plan on income splitting with your family members?

- Have you just begun your career or are you planning to retire soon?

Benefits of incorporating?

- Tax Deferral

A corporation is taxed at a rate of 12.5% on the first $500,000 of profits. This is much lower than the highest personal tax rate of 53%.

A corporation is not required to pay out all of its earnings. As a result of incorporating, the individual tax paid by a real estate agent will be lower because the agent only pays tax on income that has been drawn from the corporation.

- Income Splitting

Income can be split by paying dividends to spouses and adult children over the age of 25 who are actively working in the business. Income can also be split by paying a reasonable salary to a spouse and adult children.

How do I incorporate?

As per guidelines provided by the Ontario Real Estate Association (OREA), each realtor must incorporate their own PREC and only the realtor can hold equity shares. Non-equity shares can be issued to family members who are not realtors. The corporation must be registered provincially with the Ontario Ministry of Government Services. Any realtor using a PREC must inform RECO. However, the PREC does not need to register with RECO. Contact MadanCA today for help to incorporate your PREC.

Why do I need to perform a Section 85 Rollover?

When a real estate agent converts his/her business into a corporation, the CRA views this as a sale of a business for tax purposes. This can trigger a Capital Gains tax. A Section 85 Rollover allows the business to be transferred at cost rather than fair market value. This avoids capital gains associated with the sale of the business.

Do I have to register a new business number?

A newly incorporated PREC must register for a business number and open a HST account.

Can I choose any name for my PREC?

The only naming limitations imposed by OREA is that the name cannot suggest that the corporation is trading real estate. All other restrictions are those set out in the Ontario Business Corporations Act.

Who can be a Director/Officer?

The directors are elected by the shareholder and are responsible for representing the interest of the shareholders. In an owner-operated business, the shareholder is usually the director.

The officers of a corporation are responsible for the day-to-day operation of the corporation. Officers are appointed by the directors and, together with the directors, form the management of the corporation.

What is a Corporate Minute Book?

A minute book is a binder filled with all of the corporations record's. All corporations in Ontario are required to maintain an up to date minute book as required by the Ontario Business Corporations Act.

Ways A PREC Can Operate

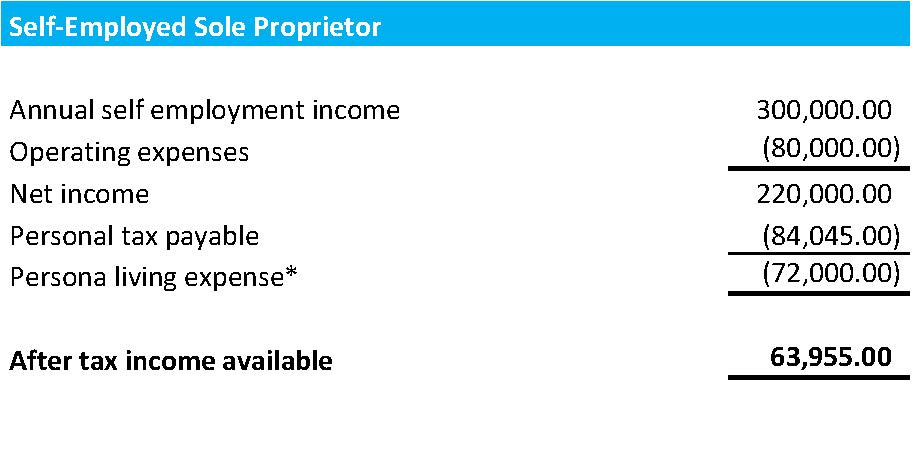

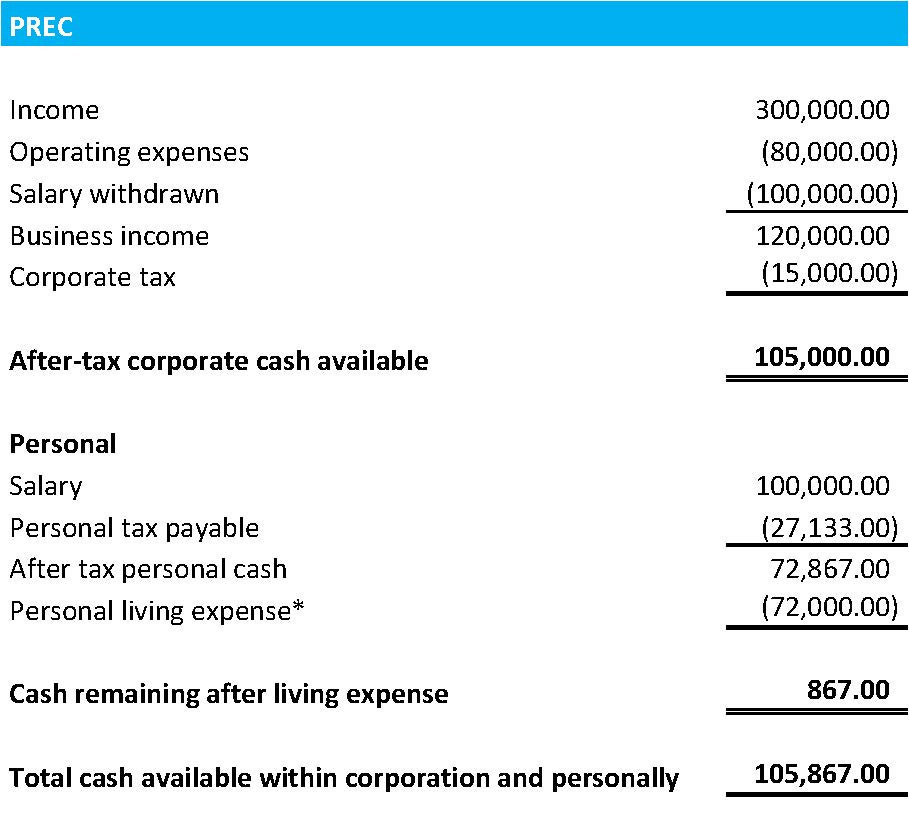

Example of Tax Savings - Sole Proprietor vs. PREC

Assume that you have gross commissions of $300,000 per year, business operating expenses of $80,000 per year and personal living expenses of $72,000 per year.

If you operate a sole proprietorship, you will have $64,000 left in after tax income compared to a $105,867 if you use a PREC.

What are the annual tax filing requirements?

A PREC must file an annual Corporate Tax Return and HST Return with the CRA. The corporate filing deadline is the same as any standard corporation, which is 6 months after the year end to file and 3 months after the year end to pay the corporation tax balance due. The HST filing and payment deadline is 3 months after the year end.

How much does RECO charge if i incorporate my business?

RECO does not have any charges associated with incorporating a PREC.

Does RECO need to approve my articles of incorporation?

RECO does not need to approve the articles of incorporation for a PREC.

Business Restrictions?

The main restriction set out by RECO is that the business cannot engage in the business of trading real estate.

Madan's Fees to Incorporate?

Madan CA’s fees are $918 + HST, and this includes the incorporation charges as well as the minute book costs.

Client Testimonial:

I am genuinely impressed with Allan and his team’s professionalism and client-centered approach. Highly recommended! - Mirwais N.