Americans Working in Canada and Taxes

Allan Madan, CPA, CA

Are you an American working in Canada? Consider the major tax consequences that will directly affect you! Here are 7 seven major tax implications that Americans working in Canada should watch out for.

1. Non-Resident versus Resident

Non Residents of Canada

Residents of Canada

Canadian residents are liable for tax on their world wide income, i.e. income from all sources in all countries. Being a non-resident will limit your Canadian tax exposure as opposed to being a resident of Canada.

As an American, am I a resident of Canada or non-resident of Canada for tax?

So how do you know if you are a resident or a non-resident of Canada for tax purposes? There are four major factors that you need to look to when determining your residency status:

1. Where is your permanent home? If you’re permanent home is in Canada, then you are a Canadian resident. On the other hand, if your permanent home is in the United States, you’re more likely to be a non-resident of Canada.

2. Where are your spouse and children residing? If they are living with you in Canada, then you are more likely to be a resident of Canada than a non-resident.

3. Where are your personal possessions kept? Personal possessions include your furniture, your clothing, appliances, financial assets, and so forth. If the majority of your personal possessions are kept in Canada, then you are more likely to be a Canadian resident than a non-resident.

4. Are your social ties stronger to Canada or to America (United States)? If your social ties are stronger to Canada then you are more likely to be a Canadian resident as opposed to a non-resident for tax purposes.

It is important to look at the four factors as a whole when determining your residency status for Canadian tax purposes.

2. The 183 Day Rule

As an American working in Canada, how do you get around the 183 day rule? The Canadian – U.S. Tax Treaty can provide tax relief, because it overrides the 183 day rule. Within this treaty there are rules surrounding your residency, which are very similar to the four Canadian residency factors discussed earlier. If you are found to be a resident of the U.S. under the Canada – U.S Tax Treaty, then you are a non-resident of Canada, even if you were in Canada for 183 days.

3. You must file a Canadian income tax return

If you are an US citizen working in Canada, you still have to file a Canadian income tax return by April 30th. Employment income earned in Canada from January 1st, 2016 to December 31st, 2016 must be reported on your Canadian income tax return. Any income taxes owing must also be paid by April 30th.

4. 3 tax filing requirements for US citizens working in Canada

There are 3 Basic Categories for Filing Personal Tax Returns in Canada.

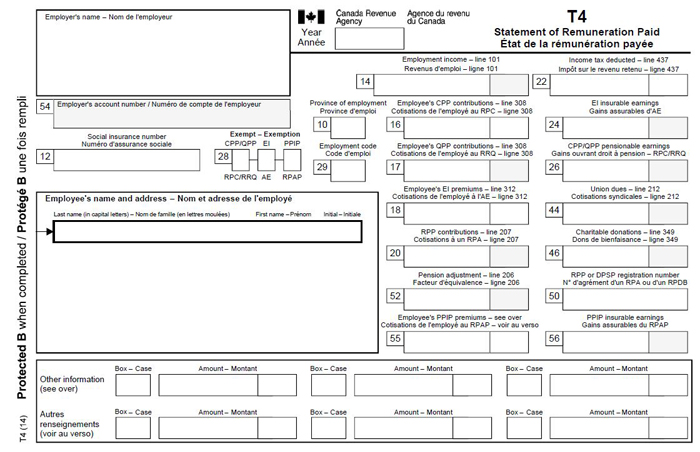

Category 1) T4 Slip from Employer

You are working for a Canadian employer and you receive a T4 slip from your Canadian employer. A T4 slip is very similar to a W2 slip. The T4 slip reports the amount of income you earned in Canada and the amount of taxes that have been deducted your pay cheques. The amounts on the T4 are reported on your Canadian personal income tax return, and you pay tax accordingly.

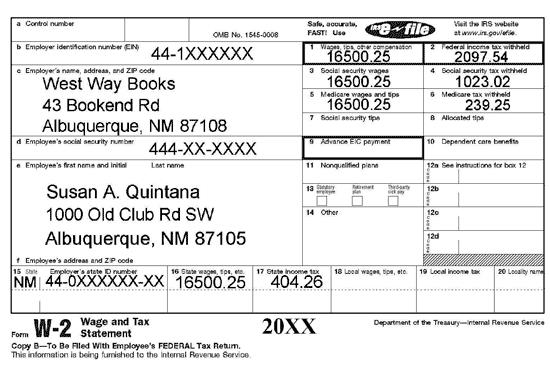

Category 2) Taxes if did not Receive a W2 Slip

You receive a W2 slip from your U.S. employer and have only worked a couple of months here in Canada. Even if you did not receive a T4 slip, you still have to pay Canadian income tax based on days you have worked in Canada.

For example, assume that you earned $100,000 dollars from your employment in the year, and this amount is reported on your W2. If, for example, 10% of all of your working days in the year were in Canada, then $10,000 of employment income must be reported on your Canadian personal income tax return.

Category 3) Double Taxation

You receive a W2 slip from your U.S. employer and you also receive a T4 slip from your U.S. employer. In this case, taxes are being deducted from your pay cheques twice: once for U.S. payroll taxes and the second time for Canadian payroll taxes. This doesn’t leave you with as much money leftover.

How do you avoid double-taxation? File a waiver for the reduction in your U.S. withholding taxes, i.e. Form W4 must be completed.

5. Foreign tax credit

As a U.S. citizen or a green card holder, you are required to file a U.S. personal income tax return and report and pay tax on your world wide income. You must also file a Canadian tax return and pay tax on the employment income earned in Canada. To avoid double taxation (i.e. tax in Canada and in the US), a foreign tax credit will be applied on your U.S. tax return to compensate you for Canadian taxes paid.

6. Social security taxes

If you work in the US, you are probably making contributions to your 401K and are paying social security taxes. Similarly when working in Canada, you will also have to contribute to the Canada Pension Plan (CPP) and to the Employment Insurance Plan (EI). You end up paying social security taxes twice, once in Canada and once in the US.

In order to avoid double taxation, you can obtain a Certificate Of Coverage from the Canada Revenue Agency, which will exempt you from paying Canadian social security taxes, also known as CPP and EI premiums. For more information regarding social security and additional related payroll taxes, please consult our article on the tax implications for US companies expanding to Canada.

7. Foreign assets in access of $100 000

If you are a Canadian resident for tax purposes, you will be required to disclose all of your foreign assets having a total cost of more than $100,000. If you fail to disclose your foreign assets, you will be subject to significant penalties.

For more information about US or other international tax advice check out our blog on International Tax Accountant in Canada. Here you will learn ways you can save on taxes when expanding your business to Canada.

Disclaimer

The information provided on this page is intended to provide general information. The information does not take into account your personal situation and is not intended to be used without consultation from accounting and financial professionals. Allan Madan and Madan Chartered Accountant will not be held liable for any problems that arise from the usage of the information provided on this page.

SOCIAL CONNECT