FBAR Checklist

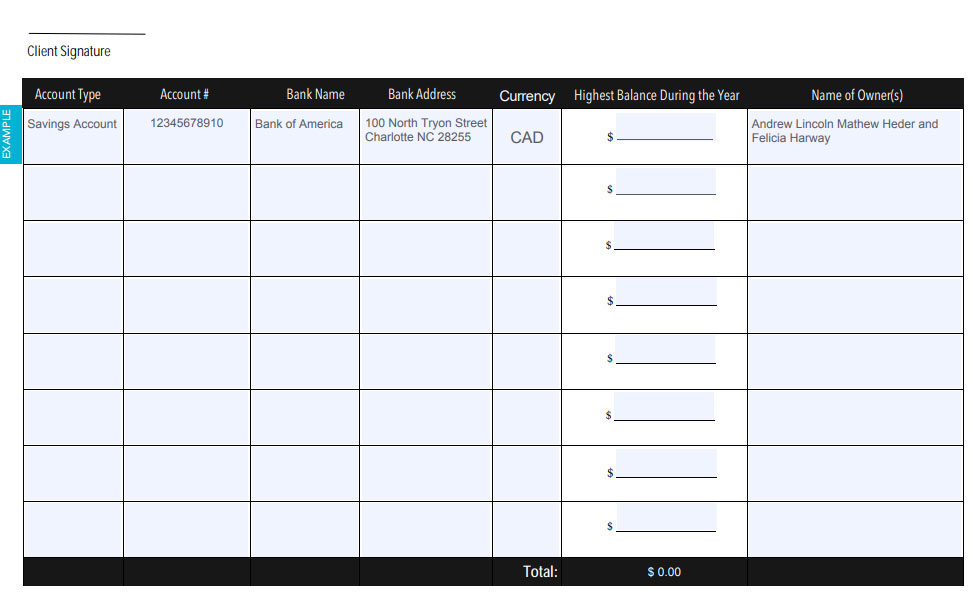

If you have a financial interest in or signature authority over a foreign financial account, including a bank account, brokerage account, mutual fund, trust, or other type of foreign financial account, the total of which exceeds $10,000, then you have to file the FBAR with the IRS. The information provided is complete an accurate and I have disclosed all of my bank and financial accounts outside of the US.

SOCIAL CONNECT