SR&ED Tax Credits for Technology Companies in Waterloo, Ontario

Allan Madan, CPA, CA

Many technology companies in Waterloo do not realize that they may be eligible for the SR&ED tax credit. This tax program provides them with an enormous credit for expenditures related to research and development.

Canada’s high tech boom owes much of its success to Waterloo, Ontario, commonly referred to in the tech world as the ‘Silicon Valley of the north”. This city in Southern Ontario, who received the title for most intelligent community in 2007, is home to hundreds of tech startups and companies. What a lot of these companies do not realize is that they are eligible for one of the most favourable refundable tax credit in Canada, the scientific research and experimental development tax credit (SR&ED).

The Canadian Government has long recognized the importance of research and technological innovation. These tax credits for technology companies in Waterloo is simply part of an initiative to help foster and facilitate this technological boom, by providing billions of dollars every year.

SR&ED Tax Incentive Program

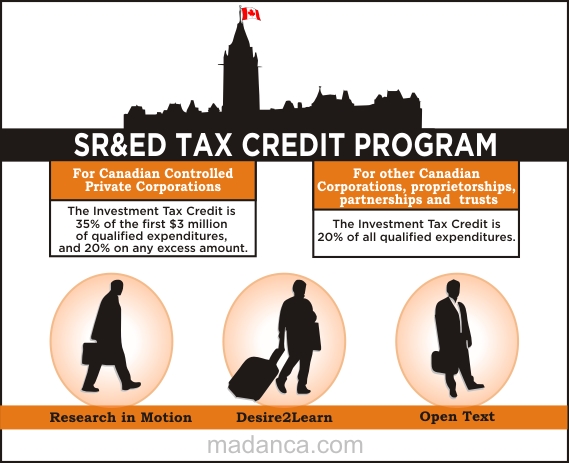

Also known as the research & development tax credit, this program can provide Waterloo tech companies with a substantial credit for qualified expenditures related to research and development. The rate for the investment tax credit differs on the type of corporate structure.

Incorporated Canadian-controlled private corporation (CCPC) can generally claim an investment tax credit (ITC) of 35%, a 100% refund on qualified SR&ED current expenditures and 40% refund for qualified capital expenditures up to a limit of $3 million of research & development expenses and 20% on any excess amount. Qualifying expenditures include not only materials and equipments, but also salaries and wages, third party payments, SR&ED contracts, and some overhead costs. Additionally, there is also a provincial investment tax credit, in Ontario this rate is 10%.

The ITC rate for other Canadian corporations, sole proprietorships, general partnerships and trusts is 20% and 40% of the expenditure is refundable. So as a tech company in Waterloo, it is probably a good idea to become incorporated not just for the increase credit rate, but for many other significant tax advantages. To learn more about these advantages please consult our article on sole proprietorship versus corporation. This refundable credit also means that your business does not need an operating profit in order to get the appropriate refund back in cash.

Let’s look at an example for a CCPC startup Tech Company in Waterloo:

The company has $500,000 in SR&ED related and eligible expenditures. Their eligible investment tax credit and refund would be as follow:

Provincial Investment Tax Credit – 10% = $50,000

SR&ED Tax credit – 35% = $175,000

Total Credit = $225,000

Eligibility for SR&ED

There is a general misconception that SR&ED is only applicable to big biotechnology companies with high-tech laboratories conducting cutting edge research. This is completely false; anyone from a one man startup to billion dollar multinational corporations is eligible for SR&ED as long as the related activities and expenditures qualify. Also, the success of any R&D is not needed to qualify for the program, the process is all that matters; failure is an essential part of innovation.

According to the CRA, “the work must advance the understanding of scientific relations or technologies, address scientific relations or technologies, address scientific or technological uncertainty, and incorporate a systematic investigation by qualified personnel.

There are three classifications of research:

a) Basic research – involves work aimed at the general advancement of scientific knowledge without any specific practical application in mind

b) Applied research – also involves the general advancement of scientific knowledge but is aimed at a specific practical application or objective

c) Experimental Development – involves the practical application of prior research to produce new materials, products and processes

The work does not include the following:

a) Market research or sales promotion,

b) Quality control or routine testing of materials, devices, products or processes,

c) Research in the social sciences or the humanities,

d) Prospecting, exploring or drilling for, or producing, minerals, petroleum or natural gas,

e) The commercial production of a new or improved material, device or product or the commercial use of a new or improved process,

f) Style changes, or

g) Routine data collection

For many Waterloo tech companies and startups, their activities easily fall under these requirements. Many are part of the high-tech industry engaging in both hardware and software related development. These require a substantial amount of research & development to compete in such a highly innovative and competitive industry. This should allow them to be eligible for the SR&ED tax credit and other related tax incentives.

Consider applying if your company has attempted any of the following:

1) Has your startup/company attempted to solve new technological problems?

2) Have you conducted experiments related to those problems in an attempt to solve them?

3) Have you worked on issues relating to improving efficiency, process speed for current solutions?

4) Is your company developing new products or improving existing products?

5) Applied for a patent

Applying for the SR&ED Tax Program

In order to claim this credit, the form T661(13) Scientific Research and Experimental Development (SR&ED) must be filed as part of the corporate tax return. To learn more about filing, please read this article on how to prepare corporation income tax return for businesses in Canada.

Corporations must additionally file, form T2SCH31 Investment Tax Credit – Corporations

Individuals must also file form T2038(IND) Investment Tax Credits (Individuals)

Conclusion

As the global economy shifts from being resource based to technology based, it is important that high technology companies in Waterloo remain competitive on an international stage. In an economic regional cluster that is lacking in venture capital, it is essential that these companies utilize all sources of funding available. Therefore claiming the scientific research & experimental development tax credit for Waterloo tech companies is an absolute necessity.

Disclaimer

The information provided on this page is intended to provide general information. The information does not take into account your personal situation and is not intended to be used without consultation from accounting and financial professionals. Allan Madan and Madan Chartered Accountant will not be held liable for any problems that arise from the usage of the information provided on this page.

SOCIAL CONNECT