Tax Implications of Divorce and Separation in Canada

Allan Madan, CPA, CA

Divorce and separation can be an extremely emotional and difficult time in your life. To make matters worse, these life changes can lead to unwanted financial stress. Nevertheless, there are various tax saving opportunities that can help save you money throughout your marital transition.

1. Split Your Family Assets

You should consider the after-tax cost of family assets when splitting them up upon separation or divorce.

For example:

Assume that you and your spouse both own the family home, which has a fair market value of $400,000.

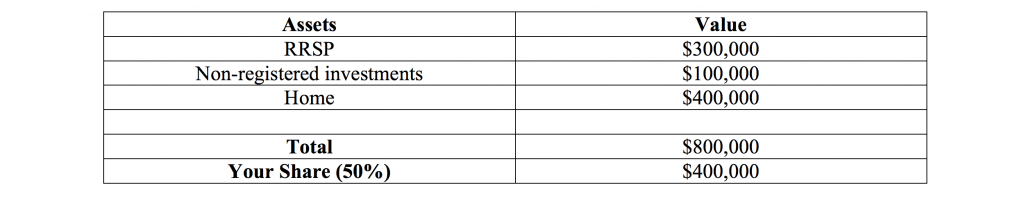

Your spouse has $300,000 of RRSPs and $100,000 of non-registered investments.

The total value of all family assets is $800,000:

Your share of these assets is $400,000, or one-half. Upon separation, which assets should you ask to keep? In making this decision, your goal is to maximize the after-tax value of your share of these assets.

The after-tax values of these assets are as follows:

If you keep the RRSPs and non-registered investments, you would end up with an after-tax value of $260,000 ($180,000 RRSP + $80,000 non-registered investments). This is because when the RRSPs are cashed in, a tax of 40% (in this example) is payable on the gross amount of $300,000. Likewise, when the non-registered investments are sold, a tax of 20% (capital gains rate in this example) is payable, leaving only proceeds of only $80,000 after-tax.

However, if you keep the family home, you will end up with an after-tax value of $400,000. This is because you can claim the principal residence exemption on the sale of your home, making the entire amount tax-free.

In summary, you should ask to keep the home, and let your ex-spouse take the non-registered investments and RRSPs. Click here to view “What happens to my assets upon divorce?”

2. Do Not Cash in RRSPs

Do not cash in your RRSPs when splitting your family assets. There is a special rule in the Income Tax Act that allows one spouse to transfer their RRSP to the other spouse upon separation or divorce. This is very helpful if you have to make an equalization payment to your spouse.

If you do not take advantage of this special tax rule, then you may end up having to cash in your RRSPs (included in your income), in order to make an equalization payment to your spouse.

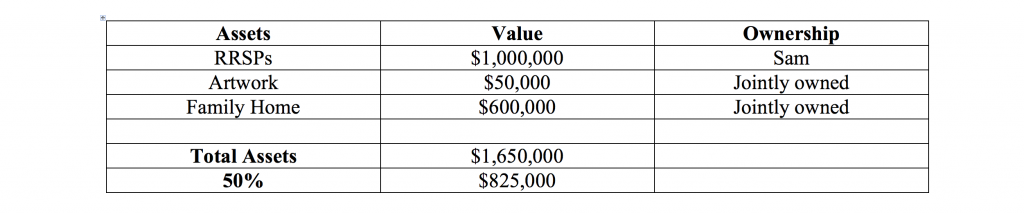

Let’s take the example of Jenny and Sam who are in the process of divorcing each other. Their assets are as follows:

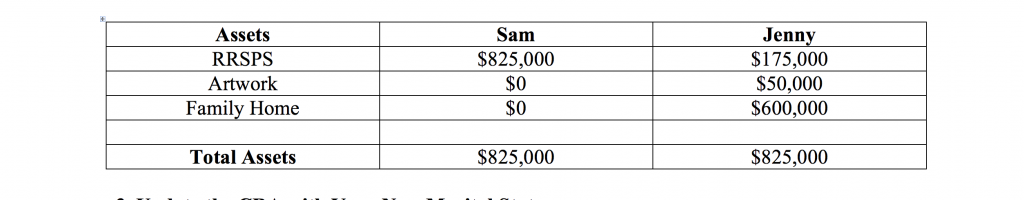

The total family assets have a value of $1,650,000, or $825,000 for each of Jenny and Sam. Jenny wants to keep the family home and artwork, while Sam will keep the RRSPS, which they both agree to. With this splitting of assets, Jenny will receive $350,000 less than Sam, because the RRSPs are worth so much. To be fair to both Sam and Jenny, Sam makes an RRSP transfer (i.e. and equalization payment) to Jenny’s RRSP account for $175,000. After the transfer, Jenny and Sam end up with $825,000 of assets each.

3. Update the CRA with Your New Marital Status

If you have children, it is important to update the CRA on your new marital status after you have been separated or divorced. The Canada Child Benefits that you receive for your children is based on family income; this includes the combined income of you and your spouse.

If you are separated or divorced, then only your income will be factored into the calculation for the Canada Child Benefit that you are entitled to. Your spouse’s income will no longer be a part of the equation.

Therefore, it’s likely that you will receive an increased amount of the Canada Child Benefit by changing your marital status to divorced or separated.

4. Split Your Property Ownership

If you and your spouse own two properties together, then allocate one property to each of you. As a result, each spouse can separately claim the principal residence exemption.

5. Certain Legal Fees Are Tax Deductible

If you have to pay legal fees to your lawyer to collect support payments, then those legal fees are tax deductible on your personal tax return. However, legal fees paid to your lawyer to prepare a separation agreement or for disputes going back and forth on the split-up of family assets are non-tax deductible.

6. Claim the Eligible Dependent Tax Credit

If you have children through joint custody, then decide which spouses gets to claim this credit. Both spouses cannot claim the credit.

Conclusion:

In conclusion, these 6 major tax implications will ultimately help save you money during divorce or separation and lessen any financial stress during your marital transition.

Disclaimer

The information provided on this page is intended to provide general information. The information does not take into account your personal situation and is not intended to be used without consultation from accounting and financial professionals. Allan Madan and Madan Chartered Accountant will not be held liable for any problems that arise from the usage of the information provided on this page.