Why do LLCs Result in Double Taxation for Canadians?

Allan Madan, CPA, CA

If you are a Canadian interested in making a U.S. property investment, using an LLC will ultimately result in double taxation for you.

How is a Limited Liability Company Taxed?

Under the U.S. taxation system, an LLC may be treated as:

1) Disregarded Entity

An LLC with a single member is classified by default as a disregarded entity by the IRS. The IRS does not consider the LLC as being separate from its owner and, as a result, the LLC’s income is reported on the owner’s personal tax return.

2) Partnership

An LLC with more than one member is by default classified as a partnership by the IRS. Form 1065 (U.S. Return of Partnership Income) should be filed, and each owner should show his or her share of the partnership income.

3) Corporation

A unique feature of an LLC is that it can elect the manner in which it is taxed. Thus, an LLC which, by default, is either a disregarded entity or partnership can choose to be treated as a corporation by filing Form 8832 (Entity Classification Election).

However, designating an LLC as a corporation will result in a heavy taxation burden since the corporation pays tax on its income first and once the after-tax corporate income is distributed to the individual shareholders through dividends, the shareholders are required to pay personal tax on the dividends received. Therefore, income is essentially taxed twice.

Why are LLC’s a Major Headache for Canadians?

If you are a Canadian resident who owns U.S. property through an LLC, the IRS will first tax any income you earn from the property. On the U.S. side, you will elect to treat the LLC as a designated entity, partnership or corporation. However, it is recommended that you treat the LLC as a designated entity as the income will be taxed directly in your hands resulting in it being taxed at the lower individual tax rates.

As a Canadian resident, the income earned from the property in the U.S. must be reported to the CRA. The issue for Canadians is that the CRA deems an LLC to be a corporation and is therefore taxed as a separate entity. Consequently, the CRA will tax the owner on the full amount of income and will not allow the use of foreign tax credits for any tax paid to the IRS. Thus, resulting in the dreaded double taxation.

Practical Example:

Let’s look at a simple example to help illustrate the tax implications for Canadians investing in the U.S. through an LLC.

You, as a Canadian investor, purchase a U.S. rental property through an LLC. Being the sole owner, you decide to treat the LLC as the default disregarded entity for U.S. tax purposes.

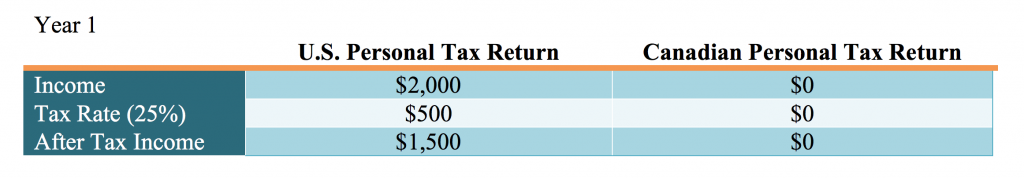

In the first year, you earned $2,000 in rental income and none of the income earned was withdrawn and distributed. For simplicity, let us assume the tax rate for both countries is 25%.

Since the LLC is classified as a disregarded entity, the income is reported and subject to tax on the U.S. personal tax return. Total tax paid on the U.S. return is $500 (25% of $2,000). The income would not be taxed on the individual’s Canadian personal tax return. If the income was withdrawn and distributed then on the Canadian Personal Tax Return, the income received would be treated as a foreign dividend and would be subject to Canadian tax. Let’s take a closer look into this.

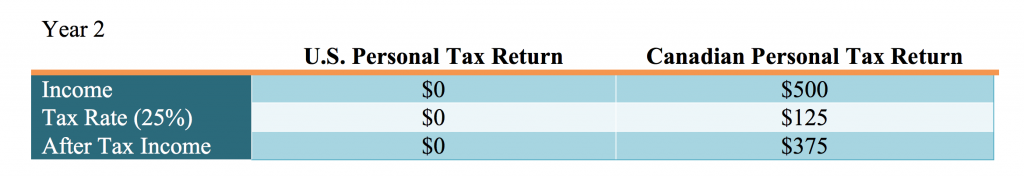

In the second year, no income was earned but you decided to withdraw $500 for yourself.

Since no income was earned you are not subject to tax on your U.S. personal tax return. However, the $500 withdrawal is treated as a foreign dividend and is subject to tax on your Canadian personal tax return. Tax paid on your Canadian Return is $125 (25% of $500).

Consequently, on the $2,000 income earned, you paid a total tax of $625 ($500 year 1 and $125 year 2) and as a result, you were double taxed.

What is the Best Alternative for Canadians?

Canadians should not be deterred from investing in the U.S. as there are ways to avoid double taxation one being purchasing property by setting up a U.S. Limited Partnership (USLP). The benefit of a USLP is that the flow through of the structure is recognized both in the U.S. and Canada, unlike the LLC, so it allows Canadians the use of foreign tax credits granted for tax paid to the IRS.

In conclusion, using an LLC to make a U.S. property investment may not be beneficial to you, as a Canadian, due to the result of double taxation. However, U.S. investments can still be positively made through a USLP in order to avoid double taxation.

Disclaimer

The information provided on this page is intended to provide general information. The information does not take into account your personal situation and is not intended to be used without consultation from accounting and financial professionals. Allan Madan and Madan Chartered Accountant will not be held liable for any problems that arise from the usage of the information provided on this page.

SOCIAL CONNECT