Why is Bay Street soaring, while Main Street suffers?

Despite one million Canadians being out of work since the pandemic took hold and while small businesses struggle to pay the rent and stay in business, how is it that Canadian stocks almost broke even for 2020?

The answer is “easy money.” Monetary authorities around the world, including the Bank of Canada, have cut interest rates and enhanced liquidity to financial markets to support economic activity and stem further economic impacts related to COVID-19.

While the rhetoric of Bank of Canada officials and politicians has focused on how these actions will support small businesses and Canadian workers, the reality is that a big chunk of the provided liquidity has found its way into financial markets, and financial assets have grown as a result. The outcome is a bifurcation between the real economy (Main Street) and financial markets (Bay Street).

Stock markets

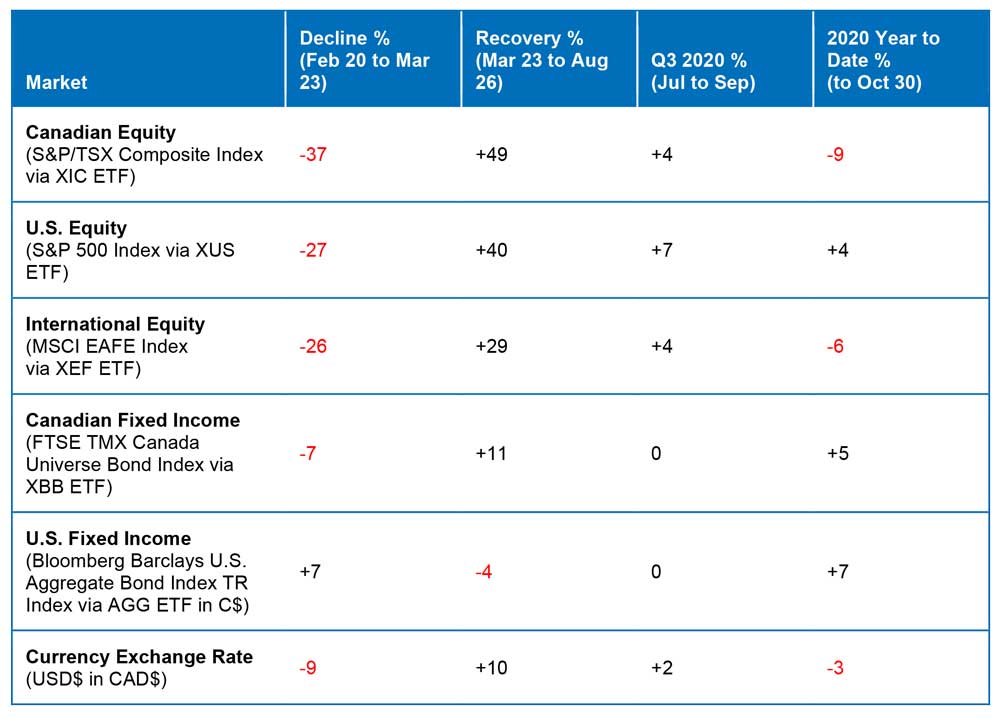

Canadian and U.S. stocks rallied back strong from the depths of the pandemic in March (all data to Oct 30, 2020, total returns, in Canadian dollars). Canadian stocks rose 49% from trough to peak (meaning from their lowest level reached to their highest, which took place during the timespan from late March to mid-August) and ended down 9% overall for 2020, to date. In the U.S., stocks rose 40% from trough to peak and are positive 4% for 2020, to date.

Markets will likely continue to be volatile amid ongoing concerns related to COVID-19. Nevertheless, companies in North America have begun to report their third quarter 2020 operating performance, and the vast majority of companies are doing much better than expected.

In addition, the economy in both Canada and the United States is recovering from shutdowns in early 2020 at a much faster rate than most market participants expected. This strong performance should provide a supportive backstop to any continued uncertainty stemming from COVID-19 in the months to come.

Bond markets

Bonds were flat in the third quarter of 2020. Policymakers in Canada and in most other developed market economies have eased monetary policy in response to COVID-19, to combat concerns about financial market liquidity and credit. Credit spreads, an indicator of investor risk sentiment, have recently decreased, signalling that investors are becoming more comfortable with corporate lending despite the ongoing economic headwinds posed by COVID-19.

Credit conditions should continue to improve as policymakers spare no expense to talk down interest rates and use their central bank accounts to enhance market liquidity.

Canadian dollar

The Canadian loonie has been on quite a rollercoaster ride this year so far. In the first quarter of 2020, the loonie depreciated about 9% versus the U.S. greenback, with the perceived safety of the American dollar attracting investors in the face of COVID-19 uncertainty. Since the end of March, with its exposure to economically sensitive commodity prices (such as energy), the loonie has come roaring back. This is in part because investors became more aggressive on seeing economic impacts of COVID-19 becoming less dire.

Market performance (as of October 30, 2020, total returns in CAD$, rounded. Data source: Refinitiv Eikon)

Investing wisely during these market conditions

With COVID-19 entering its second wave, elevated uncertainty continues to weigh on financial markets. Although we cannot control financial market fluctuations, we can control your financial plan and individual investment strategy. By focusing on this plan and strategy long term, you will see a materially larger impact on your financial success than you would by worrying and speculating on short-term market events.

Disclaimer

The information provided on this page is intended to provide general information. The information does not take into account your personal situation and is not intended to be used without consultation from accounting and financial professionals. Allan Madan and Madan Chartered Accountant will not be held liable for any problems that arise from the usage of the information provided on this page.

SOCIAL CONNECT