Year-end tax planning tips for business owners.

Allan Madan, CPA, CA

Thank you, everyone, for joining today’s webinar regarding year-end tax planning tips for Canadian business owners. My name is Allan Madan. For those of you who don’t know me, I am a chartered accountant and CPA,

practicing in the greater Toronto area. So let’s please start and thanks again for your attendance, I really appreciate it. In today’s webinar, we’re going to cover the following topics:

- Declaring a Bonus at Year-End

- Writing-off Assets

- Income Spitting with Dividends

- RRSP Strategy

- Tax-loss Selling

Let’s start with the bonus strategy and I think it’s best explained by an example. Let’s say that you have a Canadian Corporation, a small business with a taxable income of three hundred thousand dollars in the year. You understand that the corporate tax rate is 13%, which will amount to $39,000 in taxes. What if you decided to declare a bonus of $100,000, what does that mean? Well, that means in the financial statements of the company a bonus expense of $100,000 would be recorded and a payable of a hundred thousand would also be recorded the bonus payable is a liability or a debt owing to you. So without even paying the bonus as of December 31st, the corporation can record a bonus payable and claim a tax deduction for $100,000 bonus payable recorded that results in a tax savings of approximately $13,000 now. There is one catch the bonus must be paid within six months of the company’s year-end, so that would be June 30th for those with December 31st year ends, but heck that’s a six-month tax deferral. Another strategy involving a bonus declaration has to do with the small business deduction limit and tax rates.

Let’s take an example. Let’s assume that ABC Inc. a Canadian controlled private corporation has a taxable income of $600,000 for the year-end, December 31st, 2019. How much taxes payable corporately? Well, the first $500,000 of taxable income will be taxed at approximately 13% the next $100,000 would be taxed at 26%. In other words, taxable income over $500,000 belonging to a corporation is taxed at the higher rate of 26%. If you do not want to pay that high corporate tax rate of 26% consider declaring a bonus at the end of the year. For example, if a bonus of $100,000 were declared as of December 31st, the corporate taxable income would be reduced from $600,000 in this example to $500,000 that represents a $26,000 tax savings. As I said the bonus must be paid within six months the year-end and when it is paid it will be included in your income.

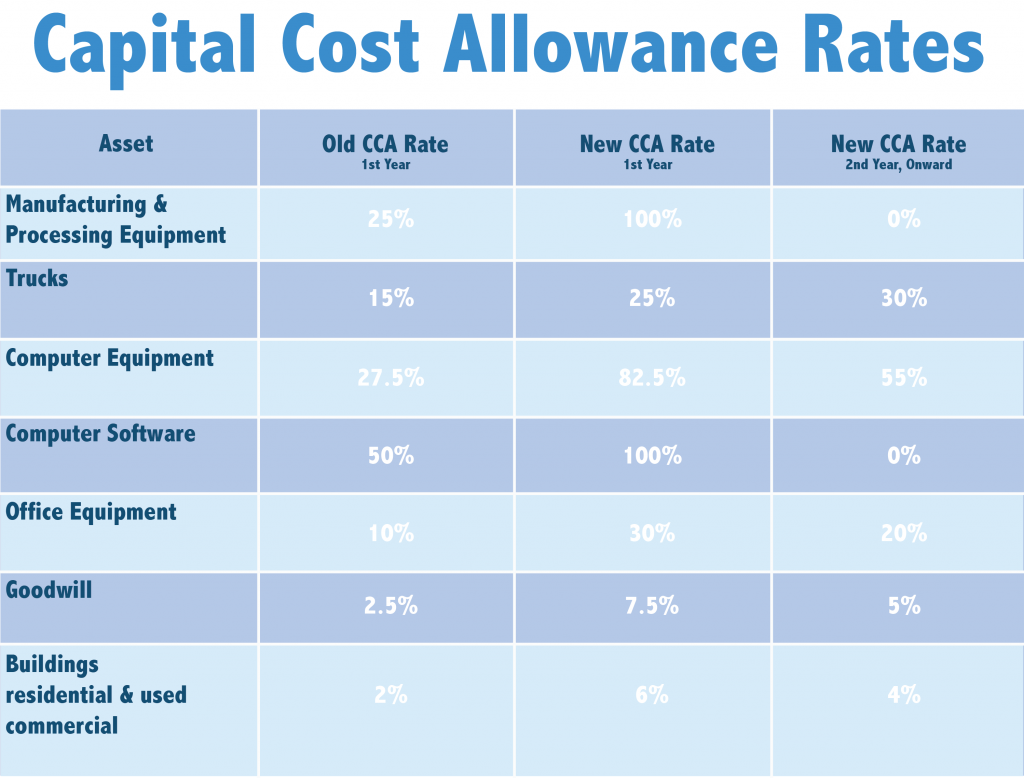

Moving on to the next slide. The next topic is writing off assets and it’s a good time of year to buy assets. Why? You can claim depreciation for six months or even a Full-year in certain cases, even if you’ve held the asset for only a few days or a few weeks. So why not buy assets corporately now and claim tax depreciation. So let’s look at some rates and I’m going to look at capital cost allowance rates specifically the ones that have changed as a result of the 2018 budget.

So these rates apply for purchases made on or after November 1st, 2018 In this chart it’s broken up into four different columns. The First Column represents the description of the asset, the second column lists the old depreciation rate and the third column lists the new depreciation rate for the first year the fourth column lists the depreciation rate for the second year and onward. So let’s go 3 rows down and see how this chart works. Let’s look at computer equipment, for example, assume you bought a laptop for $1,000 under the old rules the corporation would claim a right off of 27.5% for Dollar purchase that would come to 275 dollars under the new rates. Look how much it’s increased to 80 2.5%. So, that one thousand-dollar laptop purchase would result in a tax deduction of eight hundred and twenty-five dollars in the year of acquisition. The remaining balance would be depreciated at a rate of 55% each year thereafter. Continuing with writing off assets if your company has bought Services that have been rendered as of the year-end or received products that it’s using its business, but the supplier or vendor has not yet issued an invoice your company should record those expenses in their accounts payable. Even though the invoice has not yet been received. These are called accrued operating expenses and reduce the company’s taxable income for the year.

The next topic deals with income splitting with dividends. Before Trudeau in the good old days, we could split income through dividends in any manner we chose you could pay dividends to your family members without restrictions so long as they were shareholders, but now the liberal government has eliminated the tax benefit from paying dividends to family members. However, there are three exceptions. Before we go to the exceptions, let me give you what the new rule says, let’s say that your spouse is working in the business and is doing absolutely nothing in the business and your spouse receives a $100,000 dividend. Well, that $100,000 dividend under Trudeau’s new rule would be called TOSI (tax on split income) and taxed at about 40%, which is the highest rate on dividends. So that eliminates any tax advantage that the family would have otherwise received by dividend splitting.

Okay, so now that we know that dividends are highly taxed when paid to family members. What are the exceptions how do we get around the TOSI rules? So I’m going look at three specific exceptions.

Exception 1: Non-Service Business

The first one has to do with a non-service business and let’s look at an example. Let’s assume that a business derives less than ninety percent of the total income from services. Then that business can pay dividends without worrying about the high rate of tax of 40%. Let’s look at an example, Al Bundy a Canadian resident is the owner of Ugly Shoes Inc. A Canadian controlled private corporation sells designer shoes at the local mall. Al’s daughter, Kelly, who is 25 years old, owns 10% of her father’s company. Ugly Shoes Inc. can pay a dividend of $50,000 for example to Kelly and that dividend will not be subject to the new tax rate of 40%. Why? Well for three reasons! Number one, Kelly is 25 years of age. Number two, she owns at least 10% of the shares of her father’s company and number three the company derives less than 90 percent of its total income from services. In fact, all of its income is derived from the sale of goods as such Kelly will pay income tax at the regular rate on the dividends.

Exception 2: Family Member Works in the Business

Let’s look at a second exception. As you can see, we still have Mr. Al Bundy here. So let’s look at this family member working in the business the second exception to the new income splitting rules on dividends applies for family members working in the business a family member can receive dividends from a Canadian private Corporation and not be subject the new TOSI rules. If the following conditions are met: a family member works in the business for at least 20 hours per week continuously in the current year or for at least 20 hours per week for five prior years and be the amount of the dividend is the amount of the dividend paid is reasonable based on the work performed. So let’s look at this example. Bundy’s delinquent son is 19 years old. He works 20 hours per week at Ugly Shoes Inc. as a stock room clerk. That’s the most we can expect him to do Bud’s job is to keep the stock room neat and tidy. Stockroom clerks generally get paid on average $1200 per month for part-time work. He also receives a monthly dividend from Ugly Shoes Inc. for $1200 per month. So what’s the result in this scenario, Bud would be exempt from the new dividend rules. Why, because he’s working at least 20 hours per week in the family business and the dividends paid to him is reasonable, plus he is 18 or older.

Exception 3: Family Member Invests in the Business

This is the third exception to the TOSI rules. TOSI being the high dividend tax rate of 40% uh on dividends paid to family members. We want to avoid that right? A family member that invests in the business family members who are at least 25 years of age and to receive reasonable dividends. Based on the financial investment that they make in the family business are exempt from the new rules. The reasonability of dividends paid is determined by looking at factors such as the amount of the investment made the risk assumed and the work performed. Let’s look at this example here; Kelly Bundy a Canadian resident decides to sell high-end women’s shoes online. She incorporates a private Canadian company called KB Inc. Kelly’s business is short of money. It needs start-up funds and so her mom Peggy invests $100,000 in Kelly’s company in exchange for her investment Peggy receives a 12% dividend each year amounting to $12,000 a year, 12% times $100,000. Before asking her mom for help Kelly approached private investors who also wanted a 12% return on investment. In this scenario, Peggy is exempt from the new dividend rules. Remember that’s a high tax. Why, because Peggy is at least 25 years of age, She made a substantial financial investment in the family business and she is receiving a market rate of return.

Okay, moving forward to the RRSP strategy. The RRSP limit is 18% of your previous years earned income up to a maximum of $26,50. We also know that ours be contributions are tax-deductible and any income and or gains derived from investments held in an RRSP our tax shelter. So this is a great, not only tax deduction tool but also a tax shelter tool. Why not, as a business owner consider paying a bonus to yourself and then using the bonus money to contribute to your RRSP in effect if you contribute the same amount to your RRSP as the gross bonus received before tax you will pay no income tax whatsoever on the bonus amount. This is because the RRSP deduction will wipe out the tax payable on the bonus.

Here is another strategy to consider, tax-loss selling. Let me explain a few basics. First, capital gains, are profits realized on the sale of stocks bonds mutual funds and rental properties. One half of the gain on the sale of an asset or share is included in your personal income in the year of sale. In other words, one half of the gain is exempt and the other half is taxable. Capital losses are losses realized on the same as our losses realized on the sale of assets or shares but these losses these Capital losses are restricted. Capital losses can only be deducted from capital gains. Furthermore, capital losses can be carried back to the previous three years to offset any capital gains in those years and can be carried forward indefinitely and definitely means Capital losses do not have an expiry date. They can be carried forward forever to apply against future capital gains if you have accrued losses in your stock portfolio or maybe you have non-performing rental properties. The losses must be realized before the end of the year December 31st to take advantage of the tax-loss selling strategy.

I thank you for attending, I do appreciate it. I wish you a Merry Christmas, Happy Holidays and a Happy New Year. Thanks for attending and have a wonderful day.

Disclaimer

The information provided on this page is intended to provide general information. The information does not take into account your personal situation and is not intended to be used without consultation from accounting and financial professionals. Allan Madan and Madan Chartered Accountant will not be held liable for any problems that arise from the usage of the information provided on this page.