Foreign Tax Credits for Canadians

Allan Madan, CPA, CA

This webinar will provide you with an insight into what you need to know about foreign tax credits for Canadians.

The following subjects will be discussed:

- What is Foreign Tax Credit (FTC)

- Conceptual Approach

- Definition of Foreign Tax Credit

- Calculation Formula

- Example

- Creditable Foreign Taxes in Canada

- Take Away Tip

Introduction

Good afternoon taxpayers. My name is Akhil Jha and I have over five years of experience in cross-border taxation I will be driving this presentation today. Thank you for joining our webinar, by joining you did the right thing – showing interest that you care for your hard-earned money and plan to minimize your tax burden by proper planning and avoiding taxes with tax evasion. Today’s topic is foreign tax credits for Canadians. I am sure some of you have encountered a situation where your U.S. or Canadian source income is getting taxed. Today, we will cover how to claim FTC and the mechanisms behind it.

The agenda for today’s presentation is as follows – we will look at the definition of the foreign tax credit, what you need to know about FTC. For simplicity, we will refer to a foreign tax credit as FTC. Then we will explore the conceptual approach, the formula to calculate FTC followed by an example. We will also look at creditable foreign taxes in Canada and its effect of tax treaties as well as foreign tax credit issues with part-year residents. In the end, I will provide you with a takeaway tip.

Definition of Foreign Tax Credit (FTC)

Okay, let’s move on. This definition is very comprehensive and it’s from the Income Tax Act. Foreign tax credit (FTC) depends on (a) foreign taxes, and (b) foreign income.

So foreign tax credit depends on foreign taxes and foreign income. Let’s take an example. In the U.S. – I will keep on using the term U.S. because I am under the assumption that some of you or most of you will have some sort of income in the U.S. If you are a Canadian resident and happen to work in the U.S. your income may get taxed twice. When your income gets taxed twice, this is when FTC comes in the picture. So think for a second, what is foreign on your home return? In this case, on your Canadian T1 Return what is foreign, and have you paid taxes in the foreign country on that particular income that is getting taxed twice. So yeah, what is foreign tax and what is foreign income.

Foreign tax deduction [foreign tax credit – non- business income] – A taxpayer who was resident in Canada at any time in a taxation year may deduct from the tax for the year otherwise payable under this Part by the taxpayer an amount equal to:

- Such part of any-business-income tax paid by the taxpayer for the year to the government of a country other than Canada (except, where the taxpayer is a corporation, any such tax or part thereof that may reasonably be regarded as having been paid by the taxpayer) as the taxpayer may claim, not exceeding, however, foreign affiliate of the taxpayer) as the taxpayer may claim, not exceeding, however,

- That proportion of the tax for the year otherwise payable under this Part by the taxpayer (related to income from that foreign country)

The general principle indicates that traditionally all foreign income taxes included, regardless of tie to foreign income. One exception to the general principle is that both, Federal and Quebec governments do not include: (a) Taxes owing as a result of foreign citizenship that is attributable to Canadian source income. I know this definition is comprehensive but I’ll simplify it in the next slide.

What You Need to Know About FTC

Moving forward, what do you need to know about FTC? I have broken down the definition of FTC defined above into three simple points. (1) It is a mechanism to avoid double taxation on foreign source income. Remember, with your U.S. source income; with your being a Canadian resident and happen to leave for a few months to the U.S. – once you file a U.S. return that income gets taxed in the U.S. and since you’re a Canadian resident the same income will get taxed in Canada as well. This is an example of double taxation. (2) Ultimate tax is the highest of domestic or foreign taxes paid and, (3) Without FTC the same dollar of income would be taxed twice. Note, FTC is a mechanism to avoid double taxation.

Conceptual Approach

So, the conceptual approach states that when Canadian tax rates are higher than the U.S. If you happen to pay tax on the same income in Canada and the U.S., you can claim the entire amount in Canada because tax rates are high.

On the other hand, the conceptual approach states that when Canadian tax is higher than foreign tax; your residual Canada Tax on foreign source income – there will likely be a full FTC (no unused FTC).

In the case where Canadian tax is lower than, or equal to, foreign tax; all Canadian taxes paid are eliminated – there will be unused FTC. Don’t worry, you may not be able to take advantage of the current year, but the unused FTC can be carried over to the next year.

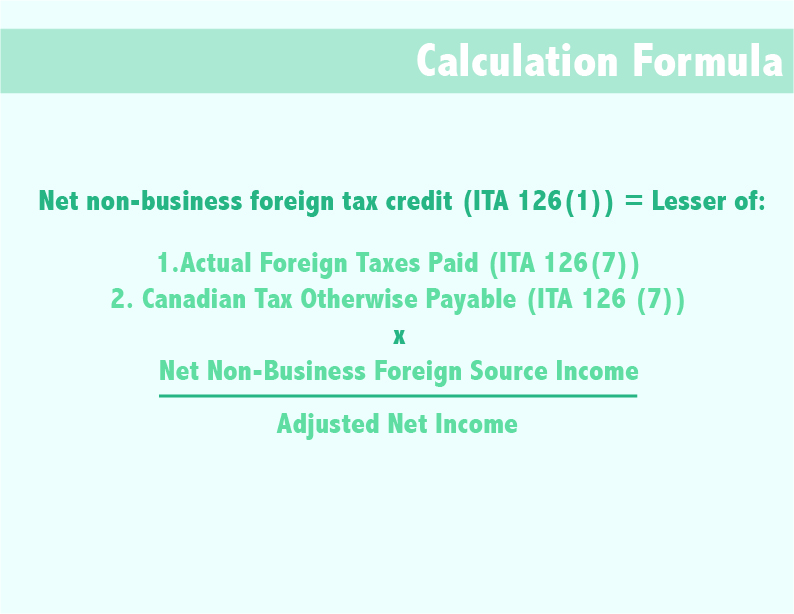

FTC Formula

This is the formula for how we claim FTC. The section we are going to be talking about is Section 216, where Net non-business foreign tax credit is lesser than (1) Actual foreign tax paid or (2) Canadian Tax Otherwise Payable x Net Non-Business Foreign Source Income / Adjusted Net Income. An important thing to consider is that FTC may be limited by the treaty of 15% of Foreign Investment Income (Section 20, subsection 11) and (Section 20, subsection 12). This is technical information but good to know.

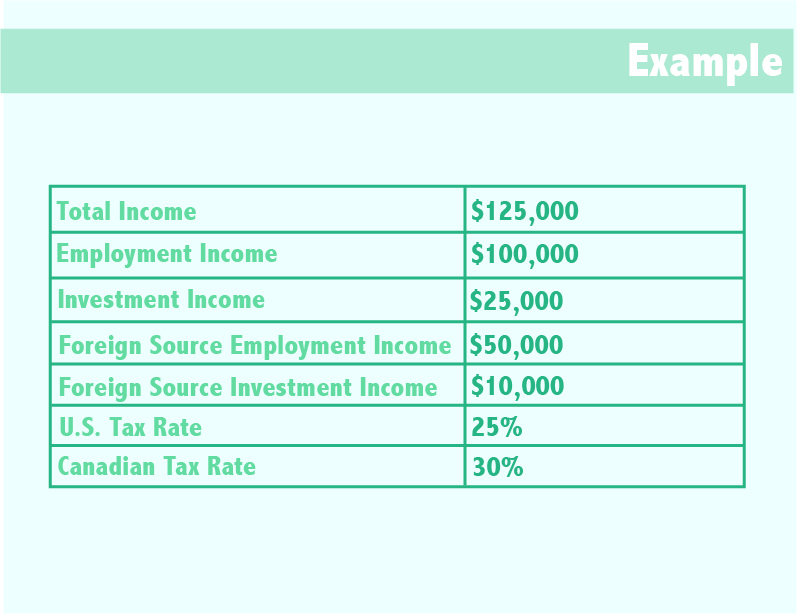

Example

Let’s talk about an example. So whatever conceptual knowledge we covered in the previous slides, this will help you understand. Let’s assume that your total income is 125k during the year of which your employment income is 100k, investment income 25k, foreign-sourced employment income 50k, foreign-sourced investment income 10k. Then let’s assume your U.S. tax rate is 25% and your Canadian tax rate is 30%. We will be claiming FTC on your Canadian return. Hence, being a Canadian resident, your total income of 125k will be taxed in Canada. What you need to know is what is foreign on your Canadian return. If you see, there are two foreign source incomes on your return – one is your employment income of 50k and your investment income of 10k.

Creditable Foreign Taxes in Canada

Creditable foreign taxes in Canada must be an income or profits tax such as U.S. federal/state/city/ income taxes. Let’s keep building on our example, if you have a U.S. filing and happen to file a state (New York State) and city (New York City) return; assuming all income from the U.S. is getting taxed in Canada, you will pay taxes to different tax authorities, in this case, state, and city. These three are credible, including your U.S. FICA taxes assuming you have a W2 (box 4 and 4 you can also claim). Creditable taxes are all foreign taxes paid for the year: whether paid for the period of Canadian residency or not; the date of payment of taxes is irrelevant.

Exclusion includes “Voluntary Tax”, a foreign tax that can be reduced/eliminated by a treaty. For instance, if U.S. tax on dividends is 30%, only 15% can be claimed (the excess 15% withholding should be recovered in the U.S.) This concept is based on the CRA policy, not found in the Income Tax Act. It relates to income that is Treaty Exempt in Canada, and is tax-deductible under Section 20, Subsection 11 or deducted under Section 20, Subsection 12; it relates to capital gains deducted under section 110.6.

Foreign Tax Credit Issues

Wonder what are the common foreign tax issues? The CRA and MRQ (revenue agency for Quebec) have become smart and have recently reduced the eligible foreign taxes relating to Part-Year Residents. Both have allowed a prorated amount of foreign taxes paid, relating to the income that was reported on there Canadian/Quebec return. Below are hypothetical examples:

Example 1 Xioling: MRQ reduced the amount of foreign taxes to the same percentage of foreign income reported in Canada.

Example 2 Sean Roy: MRQ also reduced the foreign taxes, however since the amount of foreign tax credit allowed federally was greater than the prorated amount. MRQ gave no foreign tax credit.

Example 3 Frank Donia: This client is in a higher taxable income bracket in a foreign country compared to Canada. As a result, certain amounts are not being taxable in Canada under Section 6, subsection 6. The CRA reduced the number of foreign tax credits on an assessment equal to the percentage of U.S. taxable income reported in Canada.

Example 4 Embert Wong: A U.S. citizen who has both a Canadian & U.S. source income, usually have some additional tax liability. As a result, the Canadian source income is being taxed at the marginal rate while the U.S. provides a foreign tax credit at the average tax rate.

True or False

- Only foreign taxes that were paid during the tax year can be claimed on the Canadian return.

- FALSE: Remember its either incurred-bases or accrued-bases.

- The foreign tax credit is always calculated at 15% of the foreign income.

- FALSE: It is based on income and treaty. Not necessarily 15% but it depends on the type of income in question.

- Federal and state taxes can be claimed on the Canadian return as foreign taxes.

- TRUE: Provided the same income is getting taxed in Canada.

So Here’s a Tip:

As I promised, in the beginning, the take-away tip from this webinar is the exchange rate used and the address on CRA’s file.

Tip 1: The exchange rate is used to convert foreign amounts in Canadian dollars for purposes of reporting on Canadian return. Use average exchange rate if translate foreign income earned evenly throughout the tax year in foreign country VS reporting a capital gains actual exchange rate on the date of transaction should be used.

Tip 2: Your address on CRA’s file should be current. CRA sends notices to verify that income, deductions, and credits are properly supported. The CRA may send you a letter requesting that you submit supporting documentation for one or more tax return line items. If your address is wrong, you will not get the notice.

Disclaimer

The information provided on this page is intended to provide general information. The information does not take into account your personal situation and is not intended to be used without consultation from accounting and financial professionals. Allan Madan and Madan Chartered Accountant will not be held liable for any problems that arise from the usage of the information provided on this page.