New income splitting rules for Canadian corporations.

Allan Madan, CPA, CA

Do you own a Canadian private corporation and want to pay dividends to your family members? The new income splitting rules introduced by the federal government make it more difficult to do so. Keep reading to find out what you need to know about these new rules.

The Old Rules

Prior to 2018, a dividend could be paid without restrictions to family members (18 or older) of the owner of a Canadian private corporation. By splitting the company’s income among several family members, the family could reduce the overall tax it paid to the Canada Revenue Agency.

The New Rules

As of 2018, dividends paid to family members of the owner of a Canadian private corporation will be taxed at the highest marginal tax rate for dividends, which could be as high as 40% in some provinces. As a result, there is no longer a tax benefit from dividend sprinkling.

For example, assume that ABC Inc., a Canadian private corporation, paid $100,000 of dividends to the owner’s adult son, who doesn’t work in the business. The annual dividend is the son’s only source of income.

Under the old rules, the son would only pay $17,000 of income tax on the dividend received. Under the new rules, the son will pay $40,000 of income tax on the dividend received.

As you can see, the new rules on dividend sprinkling have eliminated the tax benefit from paying dividends to family members. However, there are certain exceptions to the new rules.

1. Non-Service Businesses

Businesses that derive more than 90% of their income by selling anything other than services are exempt from the new dividend rules so long as:

a) The family member receiving the dividends is at least 25 years of age and owns at least 10% of the voting shares and value of the family business.

b) The business is not a professional corporation. Professional corporations are corporations owned by doctors, lawyers, accountants, and engineers.

What exactly is a non-service business? Examples of non-service businesses include retailers of goods, wholesalers, manufacturing businesses, and import/export businesses.

Let’s look at an example. Al Bundy, a Canadian Resident, is the owner of Ugly Shoes Inc., a Canadian private corporation. Ugly Shoes Inc. sells designer shoes at the local mall. Al’s daughter, Kelly, is 25 years old, and she owns 10% of her father’s company. Ugly Shoes Inc. paid a dividend of $50,000 to Kelly on May 1, 2018.

In this scenario, Kelly is not subject to the new rules, which tax dividends at a high rate. This is because she is 25 years of age, she owns at least 10% of her father’s company, and the company is a non-service business. As such, Kelly will pay income tax at regular tax rates on the dividend she received.

2. Family Member Works in the Business

The second exception to the new income splitting rules on dividends has to do with family members working in the family business. A family member can receive dividends from a Canadian private corporation if the following conditions are met:

a) The family member worked in the business for at least 20 hours per week continuously in the current tax year or for at least 20 hours per week for 5 prior years; and

b) The amount of the dividend paid is reasonable based on the work performed.

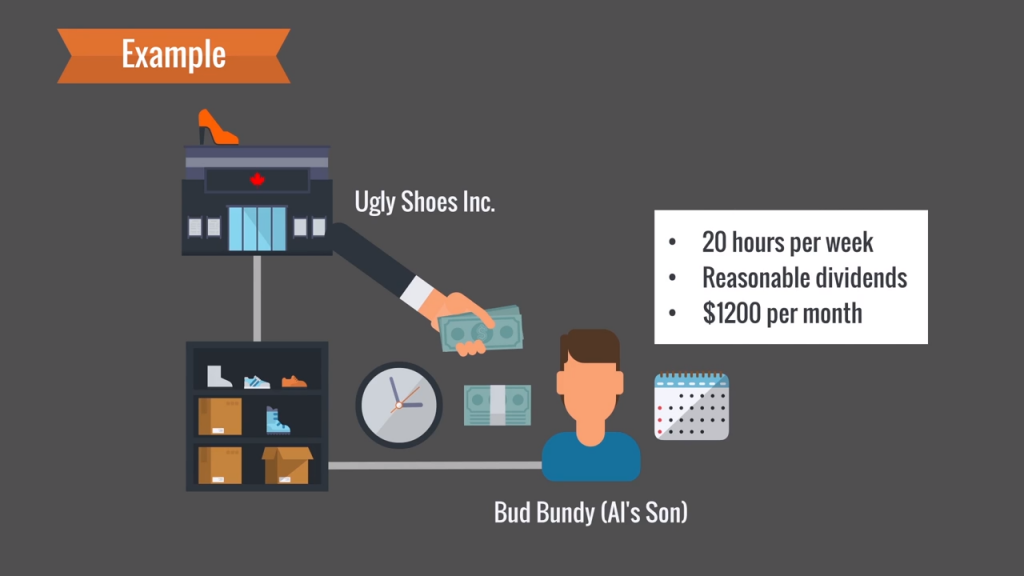

Let’s look at an example. Bud Bundy, who is Al’s 19-year-old son, works 20 hours per week at Ugly Shoes Inc. as Stock Room Clerk. Bud’s job is to keep the stock room neat and tidy. Stock Room Clerk’s get paid on average $1,200 per month, for part-time work. Bud receives a monthly dividend from Ugly Shoes Inc. for $1,200 per month.

In this scenario, Bud would be exempt from the new dividend rules, since he works at least 20 hours per week in the family business and the dividends paid to him are reasonable.

3. Family Member Invests in the Business

Family members who are at least 25 years of age and who receive reasonable dividends based on the financial investment that they make in the family business are exempt from the new dividend rules. The reasonability of dividends paid is determined by looking at these factors:

• The amount of financial investment made

• The risk assumed

• The work performed

• Other relevant factors

Let’s look at an example. Kelly Bundy, a Canadian Resident, decides to sell high-end woman’s shoes online. She incorporates a private Canadian company called KB Inc. Kelly’s business needs start-up funds, and so her mom, Peggy, invests $100,000 in Kelly’s company. In exchange for her investment, Peggy receives a 12% dividend each year, amounting to $12,000/year. Before asking her Mom for help, Kelly approached potential private investors who also wanted a 12% return on investment.

In this scenario, Peggy is exempt from the new dividend rules, which impose the highest tax rate on dividends received by a family member. This is because Peggy is at least 25 years old, she made a substantial financial investment, and she is receiving a market rate of return.

Disclaimer

The information provided on this page is intended to provide general information. The information does not take into account your personal situation and is not intended to be used without consultation from accounting and financial professionals. Allan Madan and Madan Chartered Accountant will not be held liable for any problems that arise from the usage of the information provided on this page.