Taxation of stock options for Canadian employees clarified.

Allan Madan, CPA, CA

Did you receive stock options from your Canadian employer? If yes, then it’s highly recommended that you go over the points in this article. In this article, I explain how the “Taxation of Stock Options for Employees in Canada” directly affects you.

What is a stock option?

An employee stock option is an arrangement where the employer gives an employee the right to buy shares in the company in which they work usually at a discounted price specified by the employer. There are different types of stock options that can be issued to employees – more information can be found on the Canada Revenue Agency’s website.

For employers who are looking to sell the shares of their company, please have a look at our article, “Planning on Selling a Business?”

CCPCs (Canadian Controlled Private Corporations) – Employee Stock Options

A CCPC is a company that’s incorporated in Canada, whose shares are owned by Canadian residents. By definition, a CCPC is a ‘private company’ and is therefore not listed on a public stock exchange like the New York Stock Exchange or the Toronto Stock Exchange.

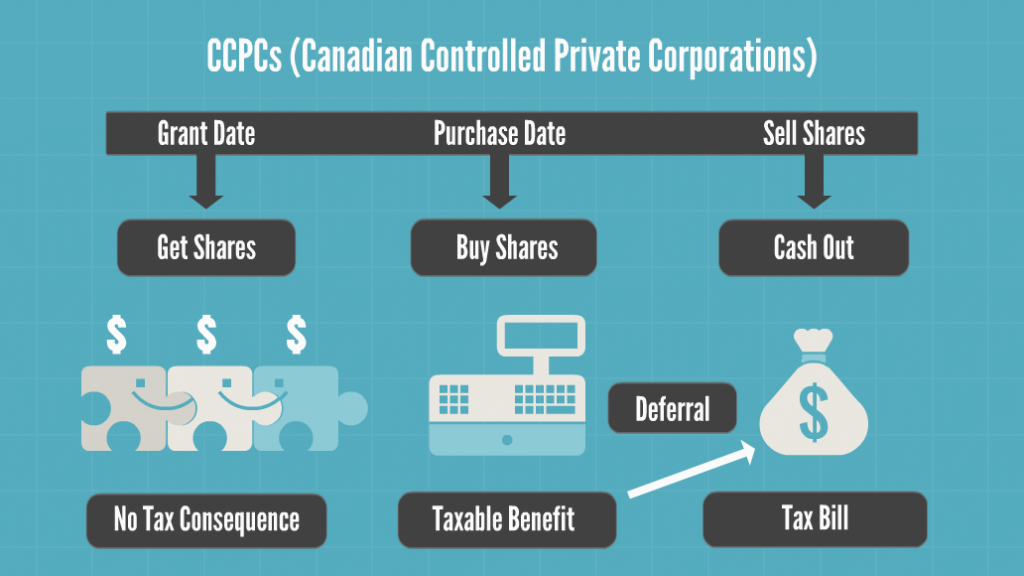

When your employer grants or gives a stock option to you, you do not have to include anything in your taxable income at that time. In other words, there is no tax consequence to you at the grant date.

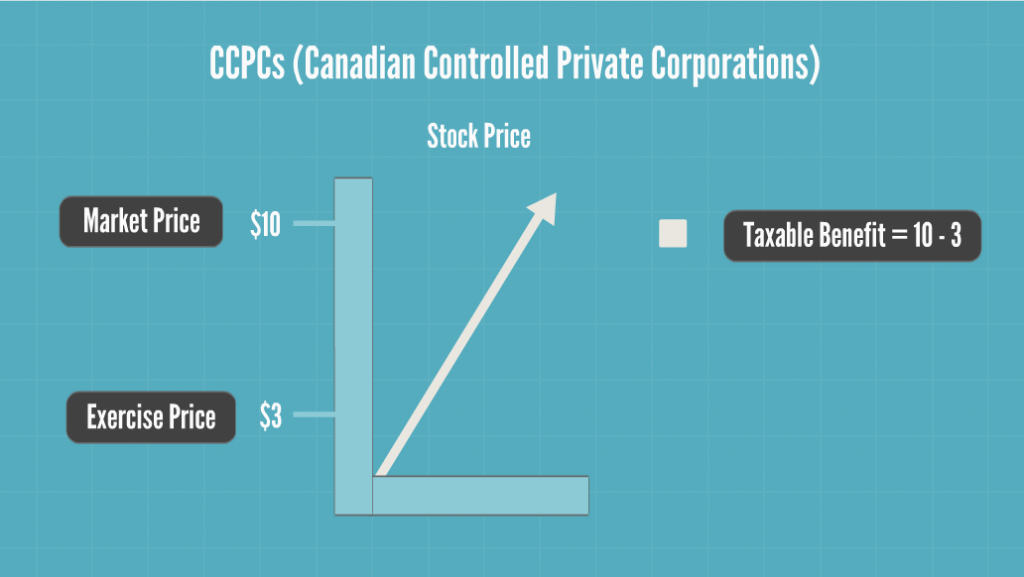

When you exercise a stock option, which means to purchase the shares through your employer, you must include a taxable benefit in your income. The taxable benefit is equal to the difference between the exercise price (i.e. the price you paid to buy the shares) and the market value of the shares at the time of purchase.

There is a special tax deferral for employees of CCPCs. The taxable benefit can be postponed to the date the shares are sold. This makes it easier for employees to pay tax because they will have cash available from the sale of the shares.

Example:

Let’s look at an example. Assume that the exercise price is $3 / share, and the market value is $10 / share. When you exercise your right to buy the shares, a taxable benefit is realized for $7 / share ($10 minus $3). Remember, for employees of CCPC’s the taxable benefit is postponed until the shares are sold.

If you meet one of these two conditions, you can claim a tax deduction equal to ½ of the taxable benefit, or $3.50 in this example (50% x $7).

- You have held the shares for at least two years after you have purchased them

- The exercise price is at least equal to the fair market value of the shares when they were granted to you

Public Companies – Employee Stock Options

Now, let’s move on to the taxation of stock options for public companies.

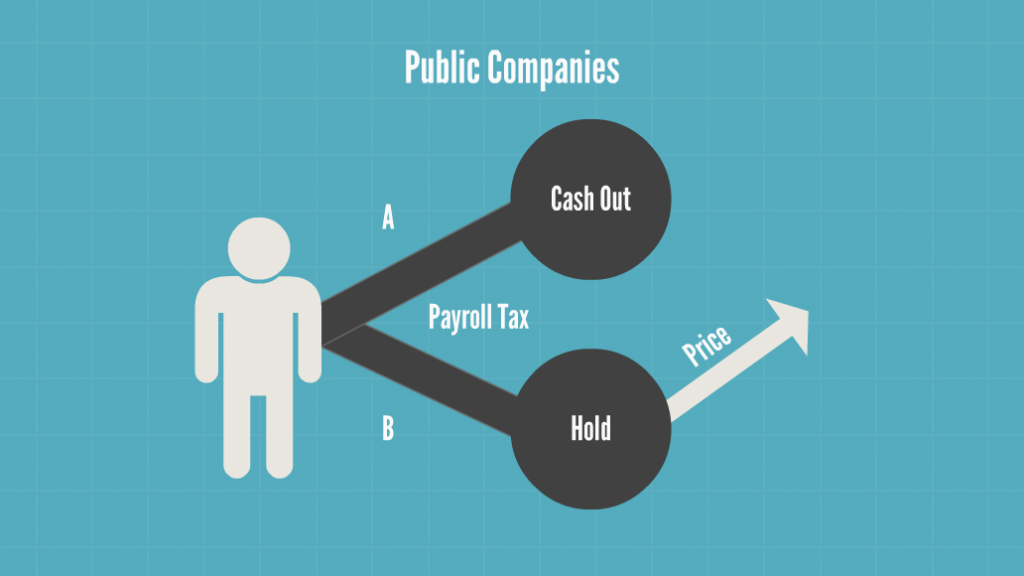

On the date that you are granted or receive stock options in an employer that is a publicly listed company, you do not have a personal tax consequence. However, on the date that you purchase the shares, you will get a taxable benefit equal to the difference between the exercise price of the shares and the market value of the shares on that date. You cannot postpone the timing of this taxable benefit.

Let’s assume you work for Coca-Cola Canada and the fair market value of the shares today is $30 / share. According to the option agreement, you can exercise or buy the shares for $10 / share. Therefore, the taxable benefit that will be included in your income at the time of exercise is $20 / share.

After buying the shares, you have two choices: (A) You can immediately sell the shares or (B) You can hold onto them if you believe they will increase in value in the future. If you choose to hold onto the shares and sell them in the future for a profit, the profit made from the sale will be classified as a capital gain and subject to tax. Whether you sell the shares or hold onto them, taxes will be deducted from your paycheck to account for the taxable benefit you realized on the purchase of the shares.

However, don’t hold onto the shares for too long after purchasing them. This is because if the price of the stock drops you’re still liable for the taxable benefit realized on the purchase date.

You can claim a tax deduction for ½ of the taxable benefit realized on the exercise date. To do so, all of these 3 conditions must be met:

- You receive normal common shares upon exercise

- The exercise price is at least equal to the fair market value of the shares at the time the options were granted

- You deal at arm’s length or on a third party basis with your employer

Disclaimer

The information provided on this page is intended to provide general information. The information does not take into account your personal situation and is not intended to be used without consultation from accounting and financial professionals. Allan Madan and Madan Chartered Accountant will not be held liable for any problems that arise from the usage of the information provided on this page.