2015 Canadian Federal Election and Taxes

Allan Madan, CPA, CA

With the Canadian Federal Election coming up, it’s important to know where the three main parties stand in regards to both personal and corporate tax.

Small Business Tax Cut

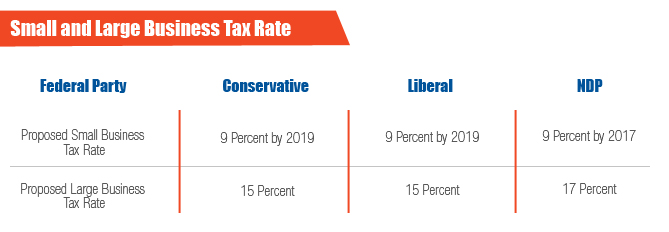

Small business has been a major focus for each of the three parties. As announced in the 2015 Canadian Federal Budget, the Conservatives plan to reduce the small business tax rate from 11 percent to 9 percent by 2019. The NDP also plans to reduce it to 9 percent but will do so within 2 years. The Liberals also support dropping this to 9 percent but want to ensure that wealthy Canadians are not using this as a way to avoid paying taxes.

In terms of the large corporate tax rate, both the Conservatives and Liberal plan to keep it at 15% while the NDP plan to increase it to 17%.

Canadian Pension Plan and Employment Insurance

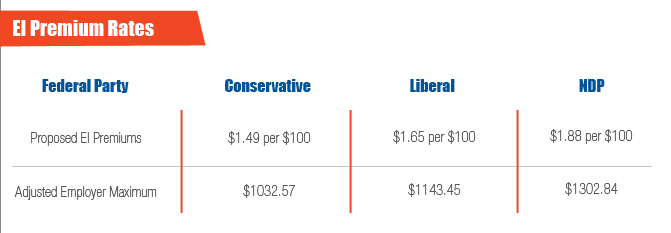

The Conservative recently announced that if elected, they will introduce a new ‘tax lock’ legislation that will prohibit any increases to federal personal and business income taxes, sales taxes, and “discretionary payroll taxes” such as CPP and EI. They also plan to reduce EI premiums from $1.88 to $1.49 per $100 by 2017. The Liberals also promise to reduce EI premiums but only to $1.65. The NDP plan to freeze EI premiums but promise to use the extra funds generated to improve access to EI Benefits. With these new rates and a 2015 maximum insurable earnings of $49,500 the adjusted employer maximum under each party would be as follows:

The Conservative, $1032.57, the Liberal $1143.45, and the NDP $1302.84

The Conservatives have long opposed any expansion to the Canadian Pension Plan but did make minor changes previously to allow seniors to collect it as early as 60. Both the Liberal and NDP have stated that they support an extensive expansion of the current CPP and plan on working with each province to gradually increase CPP premiums.

Families and Individuals

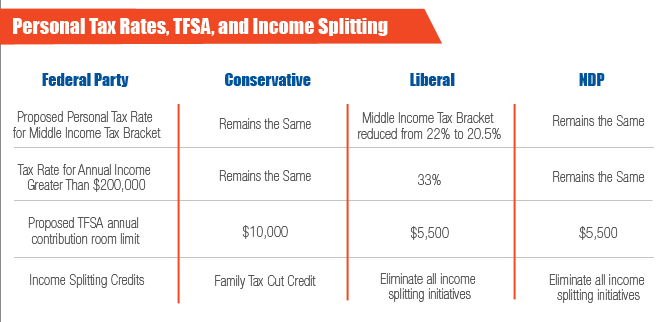

For individuals, both the Conservative and NDP promise to keep personal tax rates at their current levels. The Liberals, however, plan to reduce the middle-class income tax bracket which is between $44,700 and $89,401 from the current 22 percent down to 20.5 percent and create a new tax bracket of 33 percent for individuals with annual incomes greater than $200,000.

For Child Care Benefits, the Conservatives had already announced the expanded UCCB which increased from $100/month for children under 6 to $160/month and $60/month for children between 6 and 17. The NDP also promise to honor the expanded UCCB introduced by the Conservatives and develop a $15-a-day universal child care. The Liberals want to replace the existing UCCB with a new tax-free childcare benefit that would boost payments to all families with children and annual income below $150,000.

One of the major announcements by the Conservative in their 2015 Federal Budget was the increase of the TFSA annual contribution limit to $10,000 from $5,500. Both the Liberal and NDP have vowed to reverse this decision back to $5,500. The second major development of the budget was the introduction of the family tax cut, which allows couples with children under 18 to split up to $50,000 of taxable income with a maximum tax savings of up to $2,000.

Again, both the Liberal and NDP would cancel the FTC and the various other tax splitting initiatives for families but will maintain this for seniors.

These are the main tax highlights for the three main parties. Hopefully, this has better helped you make a decision. Remember to cast your vote on October 19.

Disclaimer

The information provided on this page is intended to provide general information. The information does not take into account your personal situation and is not intended to be used without consultation from accounting and financial professionals. Allan Madan and Madan Chartered Accountant will not be held liable for any problems that arise from the usage of the information provided on this page.