Avoiding U.S. estate taxes with a two-tier partnership.

Allan Madan, CPA, CA

US estate taxes can bring heavy and unwanted charges that can affect the money you have earned. Setting up a two tier partnership can save you millions.

US Estate taxes are a major concern for many Canadian investors in US real estate. The US estate tax is very punishing because of its extremely high rate of tax. In fact, it can be as high as 40% of the value of your US assets in excess of One million dollars. What’s worse is that US estate taxes are charged on the fair market value of your US assets upon your death. Imagine if you had to pay $400,000 in US estate taxes on $1,000,000 of assets. Fortunately, most Canadians won’t have to worry about US estate taxes. This is because US estate taxes are triggered if your worldwide assets are more than $5,340,000 as of 2014. There is a practical solution to the US estate tax problem called the two-tier tax structure.

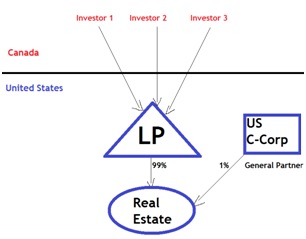

The first tier is represented by a Canadian Limited Partnership. You and your family members are Limited Partners, in this Canadian partnership. The second tier is represented by a US Limited Partnership. In this setup, the Canadian partnership owns 99% of the partnership units in the US LP. The remaining 1% is owned by a US C-Corporation which acts as a general partner. When one of the partners of the Canadian partnership, US estate tax is not triggered. This is because partnership units owned in a Canadian partnership are not considered a US asset for US estate tax purposes.

Remember, only US assets are subjected to US estate taxes. The other advantages of this structure are that it provides for limited liability protection to the investors, and prevents double taxation by the US and Canadian tax authorities

Here’s the tip, if your portfolio of investments is approaching $5,000,000 or more, you should set up a two-tier partnership in order to avoid US estate taxes. For more answers to your questions, make sure to check out our Canadian tax forum.

Disclaimer

The information provided on this page is intended to provide general information. The information does not take into account your personal situation and is not intended to be used without consultation from accounting and financial professionals. Allan Madan and Madan Chartered Accountant will not be held liable for any problems that arise from the usage of the information provided on this page.