How to Prepare Financial Statements

Allan Madan, CPA, CA

In this article called, “How to Prepare Financial Statements”, I am going to walk you through, step by step, how to prepare financial statements for your business or corporation.

Get Yourself Organized:

The first step in how to prepare your financial statements for a corporation is to get yourself organized. You can do this in three easy to follow sub-steps.

- Locate and sort all of your expense receipts by month. I have a habit of putting the expense receipts, by month, either in a folder or in an envelope, for easy storage and location afterward.

- Print all bank and credit card statements and sort them by month.

- Attach all receipts to the related credit card or bank statement. This makes it easy to identify how a particular expense was paid and when it was paid.

Prepare Your Expense Sheet:

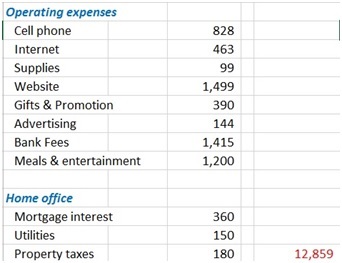

The next step in preparing your business’s financial statements involves preparing the expenses spreadsheet. In the example I have given, I have used the business of an IT contractor/independent consultant. He has registered his corporation for HST and is collecting sales tax from customers. Notice in the spreadsheet that I have subdivided the expenses into three main categories. As your business is unique, your categories may be different from mine.

My categories are:

- Car

- Operating expenses, and

- Home office

I have further subdivided these categories by expense item. It is best practice to prepare this spreadsheet on a monthly basis as doing so can save you a lot in time, money, and effort. For home office expenses, I have only included the deductible portion of the spreadsheet. This percentage is equal to the size of the office relative to the size of the home. For example, my IT contractor’s den (to learn more about home office deductions, visit our resource on what can independent contractors deduct?) is 10% of the total size of his home. Therefore, he is only able to deduct 10% of home office expenses.

Let us look at a particular item on the spreadsheet, gas (highlighted in blue). The IT contractor spent a total of $2,627 on gas for his car. He paid for it by:

- VISA – $1,748

- Business bank account – $879

- Cash – $0

In the spreadsheet, there are subtotals at the bottom. The total amount spent by the IT contractor was $13,906.

Special Accounts:

The third step is to calculate the balances of the special accounts.

The first account we want to look at is HST payable. The IT contractor has HST payable to the Canada Revenue Agency of $11,301. We calculate HST payable as the total HST collected less the HST paid in the year. HST paid during the year is in respect of the business purchases shown in the expenses spreadsheet.

Income Taxes Payable

Next, we are going to look at the income tax payable. This has a total of $8,600. Income tax payable is equal to the income tax expense $13,600, less tax installments made by the contractor (which totals $5,000). You can either obtain your income tax expense from your accountant or calculate this amount using corporate tax return preparation software. For more information on corporate tax return preparation, please visit our resource Corporate Tax Return- Canada,

Accounts Receivable

Accounts Receivable is the next special account. Accounts receivable represents the total invoices issued during the year, less cash collected. The corporation has accounts receivable of $10,000.

Accounts Payable

Next, we have accounts payable. The corporation has unpaid invoices representing $3,256 dating back to 2012. This is the amount owing to vendors or suppliers.

Shareholder Drawings

The last special account is shareholder drawings (aka dividends paid). The IT contractor withdrew $73,796 from the corporation’s business checking account, but only contributed $4,000. Therefore, the net drawings or dividends paid during are $69,796. The net drawings are taxable to him.

Calculate Tax Depreciation:

The fourth step in business financial statement preparation involves calculating depreciation. For tax purposes, the CRA calls depreciation “capital cost allowance”. This represents the decline in the value of assets during the year. My client has three tangible assets, which I have shown on his spreadsheet under “expenses”:

- Desk – 20% depreciation rate

- Computer – 55% depreciation rate

- Software – 100% depreciation rate

You can obtain the depreciation rate for various asset types from the CRA website. In the year that you acquire them, you can only claim half the purchase price of the asset for depreciation. Here, the desk depreciation (or capital cost allowance) is only $70. We calculate this by multiplying the rate of 20% into #350. The consultant can claim a total of $352 for capital cost allowance on these three assets.

Income Statement:

The fifth step in corporation financial statement preparation is preparing the income statement. This represents the amount of profit earned during the year. In this case, we get a total of $73,541. To calculate profits, we take sales and subtract expenses and income taxes. If you don’t know what an income statement is, please visit Understanding The Income Statement.

Revenues

Revenues are $100,000, and they represent invoices issued during the year. Note that these do not necessarily represent cash collected, which the company can acquire later.

Depreciation Expense

I have linked the depreciation expense to the depreciation tab, and have shown it earlier by way of a formula.

Operating & Other Expenses

I have linked other expenses to the earlier spreadsheet. Observe that none of these includes HST, and that they do not include the tangible asset purchases.

Balance Sheet:

The sixth step in business financial statement preparation is setting up the balance sheet. This is arguably the most difficult statement to prepare, and it consists of three separate areas. These are assets, liabilities, and equity. If you are unfamiliar with balance sheets, please visit this resource on Balance Sheets.

Assets

The assets section (which totals $26,902) is equivalent to the sums of liabilities and equity added together. If you add up the total values for liabilities and equity and they are not equal to the total assets, you have made a miscalculation.

- We take Cash from the year-end bank statement.

- We link accounts receivable to the special accounts tab.

- We link physical (capital) assets to the depreciation tab.

- Accumulated amortization represents the depreciation taken since inception. In this case, the accumulated amortization is the same as the depreciation expense for the year. This is because it is the first year of the company’s operation.

Liabilities

We also get the liabilities from the special accounts tab.

Equity

Equity is a formula that represents the cash and assets retained in the business. It is equal to net income less the dividends. To arrive at this number for our example, we take $73, 541 (net income, taken from the income statement) and subtract $69,796 (dividends paid, taken from the special accounts tab). In doing this, we arrive at an equity amount of $3,745 for this company.

Disclaimer

The information provided on this page is intended to provide general information. The information does not take into account your personal situation and is not intended to be used without consultation from accounting and financial professionals. Allan Madan and Madan Chartered Accountant will not be held liable for any problems that arise from the usage of the information provided on this page.