Tax guide for legal representatives of deceased members.

Allan Madan, CPA, CA

The death of a loved one is often a trying time for family and friends. This could make filing a final tax return for the deceased a daunting, emotional and often even frustrating task for family and friends still coping with the tragic loss. With that being said, this article is meant to ease this task and be your guide for filing taxes for deceased individuals.

The death of a loved one is often a trying time for family and friends. This could make filing a final tax return for the deceased a daunting, emotional and often even frustrating task for family and friends still coping with the tragic loss. With that being said, this article is meant to ease this task and be your guide for filing taxes for deceased individuals.

What Happens First?

When an individual dies, the legal representative of his/her estate should swiftly contact the Canada Revenue Agency (CRA), Service Canada, as well as the various institutions and banks in which the deceased held investments, and notify them that the individual has passed away. With this, a copy of the deceased’s death certificate must also be sent to the various institutions. Residents of Quebec must contact Revenue Quebec and Regie des rentes du Quebec.

Who is Considered to be a Legal Representative?

The legal representative (also known as the liquidator or executor) is the person who is either named executor in the deceased’s will, appointed by the court as the administrator of the estate, or is the liquidator for an estate in Quebec.

What are the Responsibilities of the Legal Representative

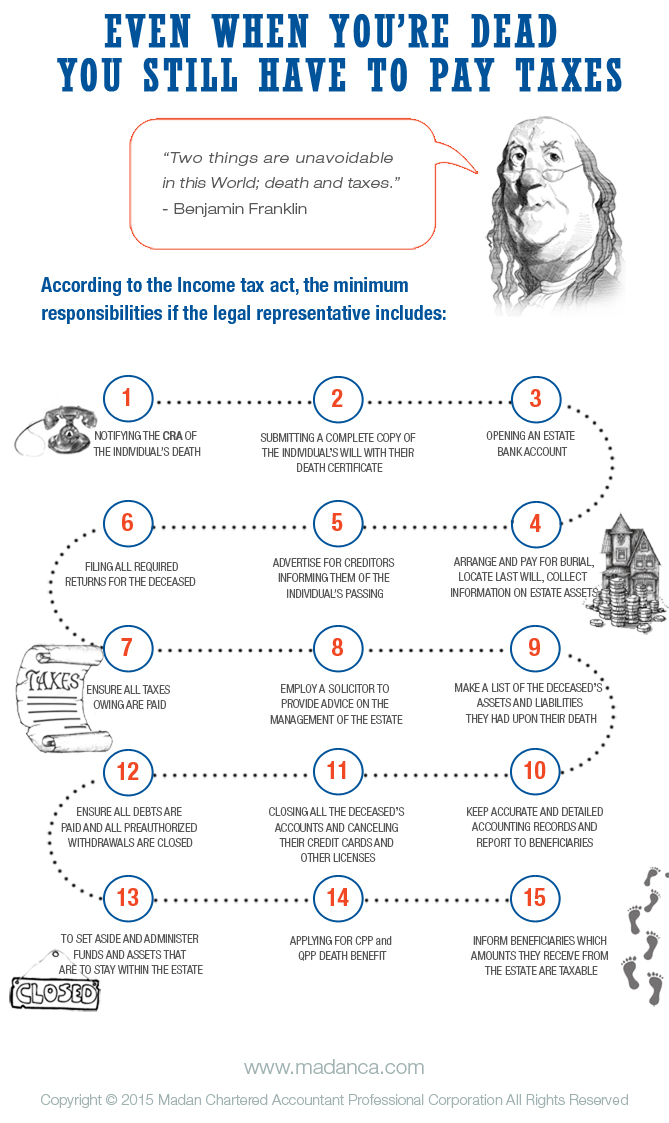

According to the Income Tax Act, the minimum responsibilities of the legal representative include:

- notifying the CRA of the individual’s death

- submitting a complete copy of the individual’s will with their death certificate to the various agencies, banks and investment firms the deceased was involved with

- opening an estate bank account

- arrange and pay for burial, locate last will, collect information on estate assets

- advertise for creditors informing them of the individual’s passing

- filing all required returns for the deceased (i.e. prior, current and trust returns if applicable)

- ensure all taxes owing are paid

- employ a solicitor to provide advice on the management of the estate

- make a list of the deceased’s assets and liabilities they had upon their death

- keep accurate and detailed accounting records and report to beneficiaries for all actions involving administering the estate

- closing all the deceased’s accounts and cancelling their credit cards, health insurance and other licenses

- ensure all debts are paid and all preauthorized withdrawals are closed

- to set aside and administer funds and assets that are to stay within the estate

- applying for Canadian Pension Plan (CPP) death benefit/Quebec Pension Plan (QPP) death benefit

- Inform beneficiaries which amounts they receive from estate are taxable

- If necessary, obtain a clearance certificate to certify that all amounts owing to the CRA and Revenue Quebec are paid

The legal representative for the deceased may also need information from the deceased person’s tax records which they can get from the CRA.

If you wish to appoint an authorized representative to deal with the CRA or Revenue Quebec on estate matters, the legal representative must complete any of the following applicable forms and attach it with a certified copy of the will and death certificate:

- Form T1013, Authorizing or Canceling a Representative

- Form RC 59, Business Consent Form

- Form MR-69-V, Power Attorney, Authorization to Communicate Information or Revocation

The legal representative should also ensure that certain types of CRA payments received by the deceased are stopped or transferred to a survivor, if applicable. Some examples of these payments include:

- The Goods and Services/Harmonizing sales tax credit (GST/HST Tax Credit

- The Working Income Tax Benefit (WITB) advance payments, Canada Child Tax Benefit (CCTB) and/or Universal Child Care Benefit (UCCB)

- If the deceased is a child, then the CCTB and/or UCCB and/or GST/HST credit payments paid

Is the Estate Legal Representative/Executor/Liquidator Subject to Compensation?

The legal representative/executor/liquidator of the estate does receive a fee for services performed. This fee must be fair and reasonable and is often legislated by the province. An executor is allowed to charge any value up to a maximum of 5%, unless specified in the will. Any inheritance to the legal representative in the will however does not replace the fee, as the fee may be charged on top of the inheritance. These fees are intended to cover the cost of any expenses incurred by the representative in performing their duties and responsibilities.

Deceased Still Received GST/HST Credit Payments After Date of Death, What Do We Do?

GST/HST credit payments are generally issued on the fifth day of the month in July, October, January, and April. If the deceased was receiving GST/HST credit payments, it is possible that the CRA may still send out a payment after their date of death. This may just signify that the CRA was unaware of the individual’s passing. In this case, the GST/HST payment would have to be returned to the CRA.

What Must be Done with the Canada Child Tax Benefit (CCTB) and/or Universal Child Care Benefit (UCCB) Payments?

What Must be Done with the Canada Child Tax Benefit (CCTB) and/or Universal Child Care Benefit (UCCB) Payments?

If the deceased person was receiving these child benefit payments and the surviving spouse/common-law partner is the child’s parent, then the CRA will usually transfer these payments to the spouse/common-law partner. The surviving spouse/common-law partner could also request the CRA to recalculate the payments so that they exclude the deceased person’s net income (complete the form Request for Canada Revenue Agency to update record). If a non-parent is now primarily responsible for the child, they would have to request child benefit payments by submitting a Canada Child Benefits Application (form RC66). However, if the deceased is an eligible child the UCCB and CCTB payments stop the month after the child’s date of death and the CRA must be notified of this date.

What Happens if the Deceased was Paying Tax by Installments?

If this was the case for the deceased, then no further instalment payments need to be made as of the date of his/her death. However, installments that were due before the date of death still have to be paid if they are outstanding.

When is the Final Tax Return and Any Balances Owing Due?

The due dates for a deceased’s final return are as follows:

|

Period when Death Occurred |

Filling Due Date |

Due Date for Balance Owing |

|

January 1 – October 31 |

April 30 of the following year |

April 30 of the following year |

|

November 1 – December 31 |

6 months after the date of death |

6 months after the date of death |

However, if the deceased was carrying on a business, the due dates are as follows:

|

Period when Death Occurred |

Filling Due Date |

Due Date for Balance Owing |

|

January 1 – October 31 |

June 15 of the following year |

April 30 of the following year |

|

November 1 – December 15 |

June 15 of the following year |

6 months after the date of death |

|

December 16 – December 31 |

6 months after the date of death |

6 months after the date of death |

If the final return is filed late and there is a balance owing, then a late-filing penalty of 5% of the balance owing will be charged. If the balance owing is not paid by the due date then interest will start to accumulate the day after the balance due date on the unpaid amount at a rate of 1% of the balance owing for a maximum of 12 months. For more information on how to file a final tax return, please refer to our guide on how to prepare a final tax return for a deceased person in Canada.

How do I Know if the Will is Valid?

In Canada, the most common type of will is the conventional will and it is recognized in all provinces. To be valid the will must:

- Be in writing

- Be signed by the testator (person for whom the will was made) or by some other person under the presence and direction of the testator

- Be signed in the presence of two or more witnesses

What is a Probate?

Probate is set by the court and it essentially certifies that the will is valid and that the legal representative/liquidator/executor has been given the authority to administer the estate for the deceased. This is a way for banks and other financial institutions to ensure that all payments and transfers reach the appropriate party.

What is a Probate Fee and How is it Calculated?

A probate fee is a state administrative tax that must be paid. Probate fees are calculated based on the value of a person’s estate at their time of death and is paid out of the estate assets. These fees vary between provinces and may involve additional legal and administrative costs. An estate is valued depending on the provincial legislation set in place for estate valuation.

Can I Avoid Probate?

Probate can be avoided. The way to do this is to have as many assets as possible pass directly to the beneficiaries without it becoming part of the estate. This includes assets that are jointly owned (i.e. Bank accounts and real estate), assets with named beneficiaries, and gifted personal property (i.e. art work, jewellery, household items etc.)

What Happens if an Individual Dies Without a Will?

If the deceased does not have a will he/she is deemed an intestate. In this case, the Surrogate Court appoints an individual to administer and distribute the estate according to the laws of intestacy applicable to the province where the deceased’s residence is located. The responsibility of administering the estate is usually given to the surviving spouse, child, grandchild, great grandchildren, parents or siblings (in that order). If relatives of the deceased do not want to assume responsibility for the deceased’s estate then they can choose to appoint a trust company as administrator and if the deceased has no living relatives, then the estate becomes property of the crown.

What Happens if the Taxpayer Dies and is in Debt?

There are instances where the taxpayer dies and has insufficient assets to cover all their debts. In this circumstance, the laws of the province where the deceased lived determine which creditors are paid first. Usually funeral and estate administration costs are paid first and the amount owing to the CRA may not have priority over other debts. It is advised that the legal representative of the estate seek legal advice before settling any debts.

Clearance Certificates, How Does it Work?

Before distributing the estate to the beneficiaries, the Income Tax Act requires that the legal representative of the estate acquire a clearance certificate from the CRA. Failure to do so will cause the legal representative to be personally liable for any amount the deceased owes. A clearance certificate basically verifies that all amounts for which the deceased is liable have been paid. If there is a trust, then a separate clearance certificate is needed for that trust.

A clearance certificate will only be issued by the CRA if all of the following are done:

- A system of distribution by a certain chosen date is established by the trustee before the date of the request for the clearance certificate

- Tax payable is calculated as if the distribution occured on the chosen date

- A final tax return is filed for the tax year ending on the chosen date and any taxes, interest and penalties payable out of the estate or trust are paid

- A request, along with a statement that will show the completion of the actual transfer of all estate/trust property, is submitted soon after the receipt of the clearance certificate

Once the clearance certificate is issued, the CRA considers the chosen date as the actual date of distribution for tax purposes. It also regards the estate or trust legal representative as holding the properties for the beneficiaries since that date. The income earned by the estate is then reported by the beneficiaries.

Disclaimer

The information provided on this page is intended to provide general information. The information does not take into account your personal situation and is not intended to be used without consultation from accounting and financial professionals. Allan Madan and Madan Chartered Accountant will not be held liable for any problems that arise from the usage of the information provided on this page.

What Must be Done with the Canada Child Tax Benefit (CCTB) and/or Universal Child Care Benefit (UCCB) Payments?

What Must be Done with the Canada Child Tax Benefit (CCTB) and/or Universal Child Care Benefit (UCCB) Payments?