GIC versus GIC … What’s the difference? Time and money!

WEALTH MANAGEMENT

Confused? You would not be the first person to mix up

these two GIC investment vehicles: guaranteed

investment certificates and guaranteed interest

contracts. Although their acronym is the same, the

differences between these GICs could have material

implications for your money, especially when it comes to

transferring wealth to the next generation.

Individuals often find themselves holding a large portion of

their wealth in non-registered investments. This may have

been a result of an inheritance, shrewd saving, recent

downsizing to a condo or the sale of a business. Whatever the

scenario, the risk to the non-registered money if you pass

away is that your estate and this money will be subject to

probate – along with the delays and fees that come with it.

The perils of probate

Let’s first review this key concept: Probate is the legal process where a judge reviews the deceased’s will for validity and authenticity, and appoints the executor of the estate. It comes with a cost that is levied to the estate.

Each province has its own set of probate fees. For example, in Ontario on an estate worth $200,000, the probate costs would be about $2,250, or close to 1.1% of the estate’s value.

Moreover, in Ontario the probate process will delay the release of estate funds by six to nine months. In the meantime, while your estate’s funds are tied up in the courts, your surviving loved ones may be required to pay the cost for certain final expenses, such as funeral and burial costs, and the additional professional service fees that accompany the administration of the deceased’s estate, including accounting, legal and executor fees. In the end, for a $200,000 estate, these costs may subtract another $3,900: for a combined estate cost of $6,150, or close to 3% of your estate.

The GIC that protects more of your assets

So, why does this matter to your non-registered GIC portfolio? Well, if you would like to ensure a smooth, cost-effective transfer of your wealth to the next generation, then choosing the right type of GIC is important.

Although both bank and insurance GICs operate in much the same manner while an individual is alive, it is the treatment of the GICs within the estate that shows the important difference between the two.

If you hold an insurance GIC, it will help protect your non-registered assets from these influences, as you can elect a beneficiary to your insurance GIC that allows the non-registered assets to flow directly to them – and bypass probate. Holding a traditional bank GIC will expose your non-registered assets to the probate, potential delay and additional fees discussed above.

More information to help you plan

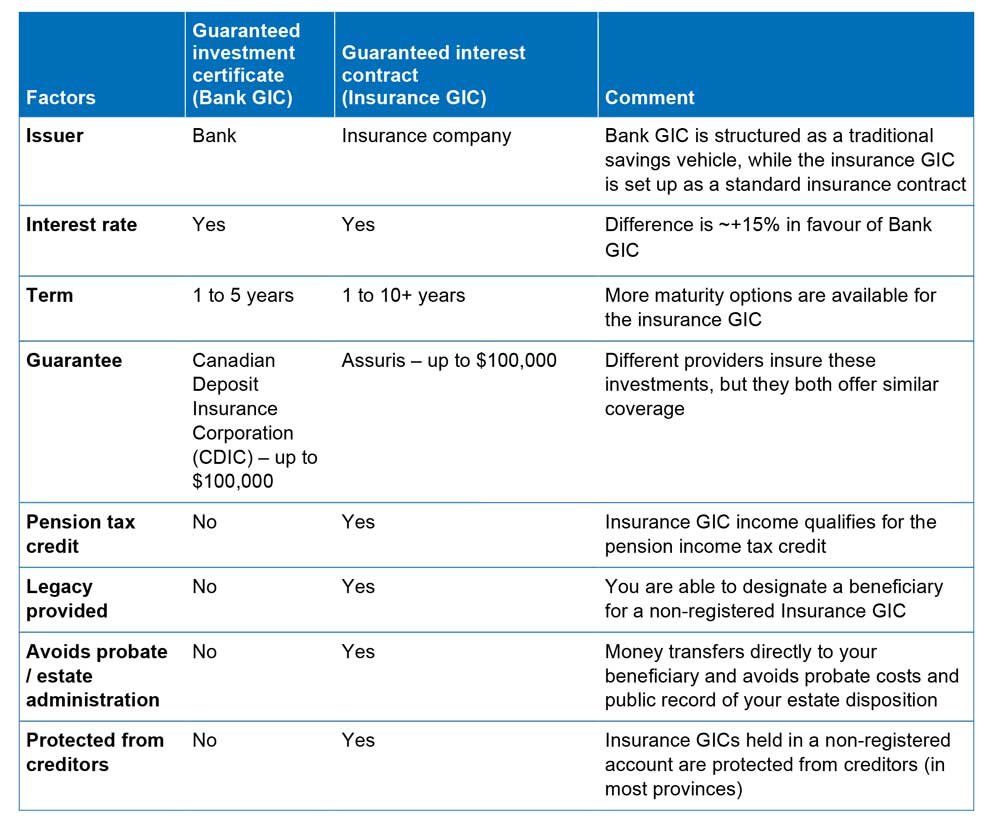

The table below expands on these similarities and differences between the two investment vehicles. Use this information as part of your overall investment planning, for a clearer picture that helps you make a more informed choice to fit your goals.

Disclaimer

The information provided on this page is intended to provide general information. The information does not take into account your personal situation and is not intended to be used without consultation from accounting and financial professionals. Allan Madan and Madan Chartered Accountant will not be held liable for any problems that arise from the usage of the information provided on this page.

SOCIAL CONNECT