Taxation — The Deciding Factor

TAXATION

A six-figure earned income may not have as much

spending power as expected after taxes.

Wages, salaries and all other forms of earned income

have increased dramatically for those with the required

skills who are willing to move to the parts of the country

where such skills are in demand. Indeed, it is not

unusual to see T4s at year end in excess of $100,000.

The satisfaction of earning a six-figure income is

quickly tarnished, however, after the amount of federal

and provincial tax has been calculated.

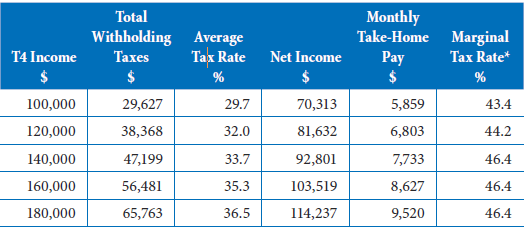

A $160,000 annual salary income, for instance, is

equal to $13,333 per month. Based on 2013 personal

tax calculations, however, a single person living and

working in Ontario, for example, would pay $56,481

in combined deductions from federal and provincial

income tax, Canada Pension Plan (CPP) and Employment

Insurance (EI).

Effect of Deductions

Given these figures, anyone in Ontario who earns

$160,000 is going to take home $103,519 if salaried. On

a monthly basis, this amounts to $8,627, a far cry from

the $13,333 that appears on the payslip. For those who

earn or aspire to earn in the six-figure range, consider

the tax brackets in the following table.

*The marginal tax rate represents the average additional income tax on the next

$20,000 of income.

It is also important to note that, as marginal tax rates

rise with additional income, there are fewer disposable

dollars left until the maximum marginal rate is reached.

Base spending decisions on disposable

income not gross income.

Gross Income vs. Disposable Income

The realization that gross income must not be construed

as disposable income should be factored into

any spending decisions. Financial decisions should be

calculated on the basis of take-home, i.e., not gross,

income. The following questions should guide any

spending and saving decisions:

- How much are my monthly mortgage payments

and utility bills? - How much does it cost per month to service my

student loans or other debts? - If mortgage rates increase will I be able to meet the

additional cash-flow drain? - What is the price of mortgage insurance?

- How much are my property taxes?

- How much do I spend on rental accommodations,

condominium or common-cost fees? - How much do I need to put aside to accumulate

the 20% down payment on a home? - How much do I spend per month on food, clothing,

repairs and maintenance, entertainment and

other leisure activities? - Should I purchase an expensive vehicle with payments

spread over 84 months? - What is the minimum after-tax dollar requirement

to support my current lifestyle in the event I lose

my job? - How much do I need to put aside to cover a shortterm

layoff? - If I need to borrow for an emergency, will I be able

to pay down the line of credit? - In the event of downsizing, will I be able to quickly

find a new position with the same pay scale? - Is it worth moving to take a new job that pays more?

- In the event I am ill, what is the cost of insurance

to cover the cost of staying in my home? - Can I afford to open an RRSP? What is my contribution

limit? Can I afford to contribute? - What is the cost of medical and dental insurance?

- What is the cost of going to and from the job site?

- Will I be able to help my parents if the need arises?

- Will increased earnings offset increases in the cost

of living? - How long will I continue to earn six figures?

Budget Strategically

“I’ve been rich and I’ve been poor. Believe me, rich is

better.”

This pithy remark, often attributed to Sophie Tucker,

Mae West and others is certainly true, regardless of

who said it first. Earning more is better than earning

less. But the principal factor in determining the

amount of money available for lifestyle expenditure

remains taxation. Those who already have six-figure

incomes should carefully analyze the long-term

impacts of a high debt load, future increases in the cost

of living, and the risk of layoff in order to determine

the best means of managing after-tax income wisely.

Disclaimer

The information provided on this page is intended to provide general information. The information does not take into account your personal situation and is not intended to be used without consultation from accounting and financial professionals. Allan Madan and Madan Chartered Accountant will not be held liable for any problems that arise from the usage of the information provided on this page.

SOCIAL CONNECT