Part 1: How to Prepare a 1040-NR Tax Return for U.S. Rental Properties

Allan Madan, CPA, CA

Are you a Canadian investor in US real estate? If yes, then this video is meant for you. I will show you how to prepare a 1040-NR Tax Return for your US rental property. This video is part one of a two-part series. In part 1, I will cover form 1040-NR and in part 2 I will review schedule E and form 4562.

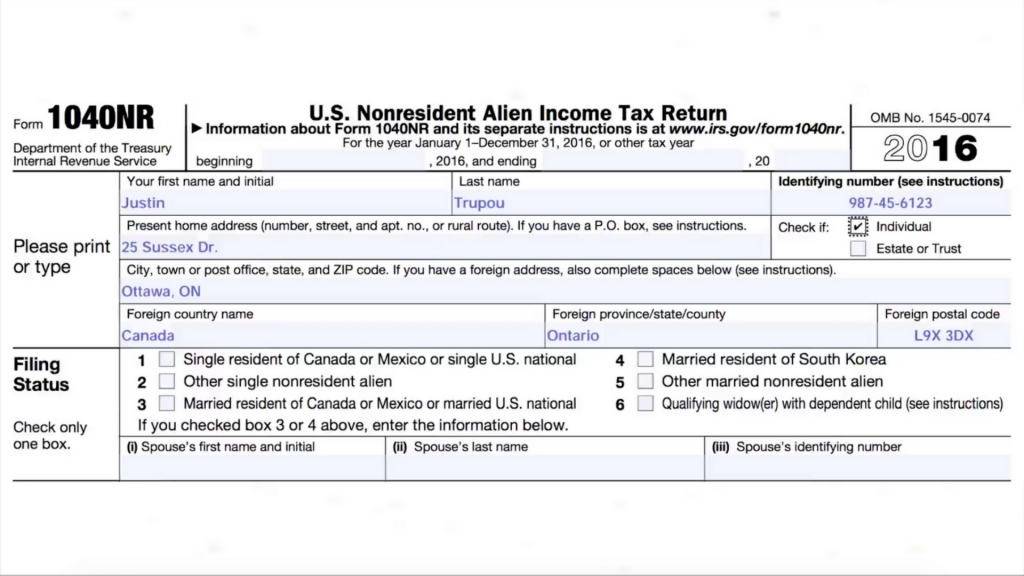

Let’s look at the example of Mr. Justin Trupou, a Canadian resident who lives in Ottawa, Ontario. He is married to a Canadian, with one dependent child who is 17 years old. He is the sole owner of a rental property in Orlando, Florida.

Step 1 – Complete the Identification Area of form 1040-NR

Enter your:

- First Name

- Last Name

- Identifying Number

- This is an Individual Tax Identification Number issued by the IRS. If you do not have one, attach form W7 to the 1040-NR return.

- Address information

- Check the corresponding box if it is an individual, estate or trust.

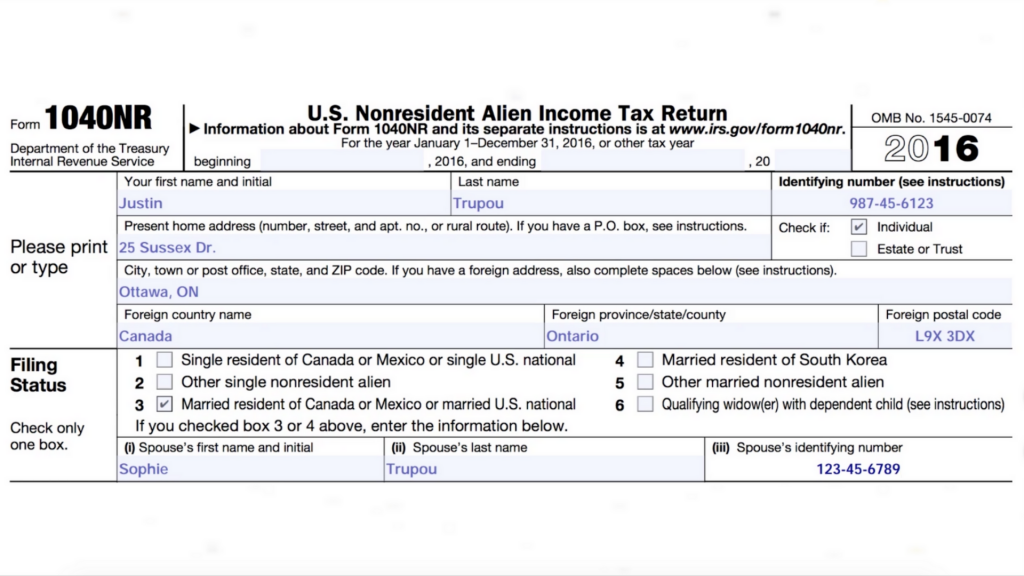

Step 2 – Complete your Filing Status

- If you are married, and live in Canada or Mexico, check box 3. Otherwise, check box 1 for Single resident of Canada or Mexico.

- If married enter your spouse’s first name and last name and Individual Tax Identification Number. If your spouse does not have an ITIN, attach form W7 to your 1040-NR return.

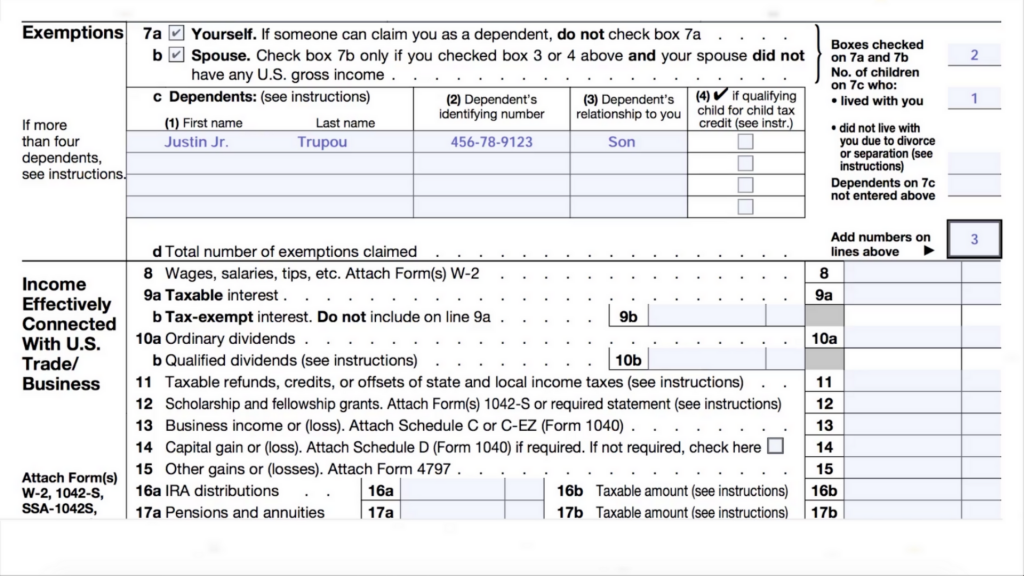

Step 3 – Claim Exemptions

- Enter the number of exemptions you are claiming. You can claim an exemption for yourself, your spouse , and your dependents in the amount of $4,050 each. Each person that you are claiming an exemption for must have an ITIN. Otherwise, you cannot claim them.

- Enter your dependent’s information.

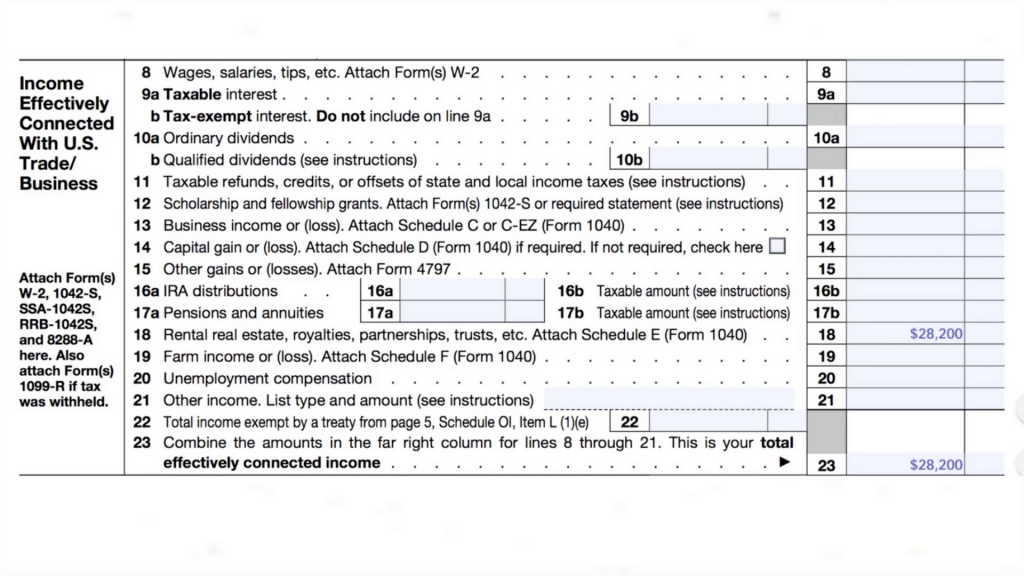

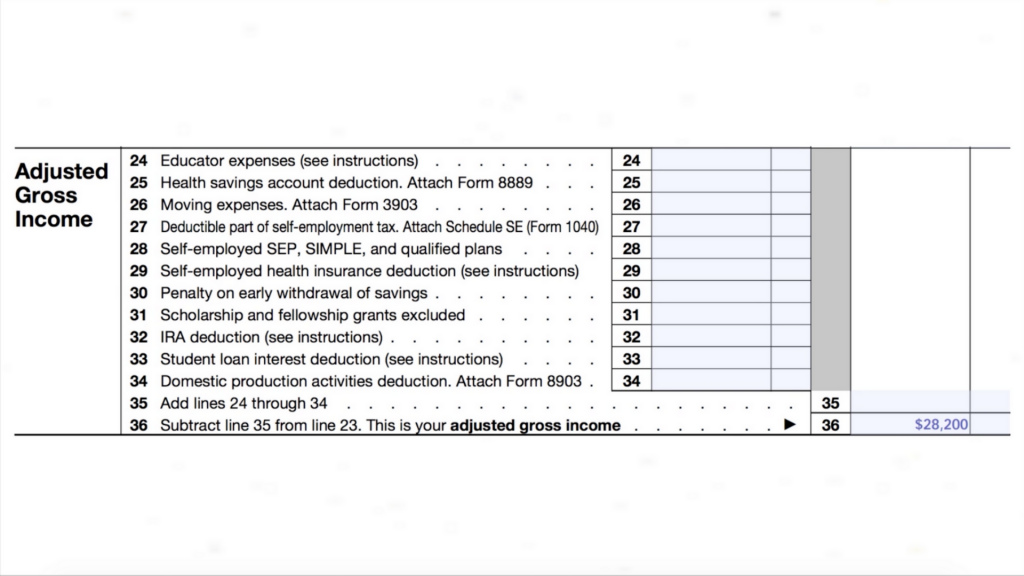

Step 4 – Report Rental Profit

Report the net profit after depreciation from your US rental property on line 18. Assume that Justin Trupou earned a net profit of $28,200. This amount comes from schedule E, which I will show you how to prepare in part 2 of this video series.

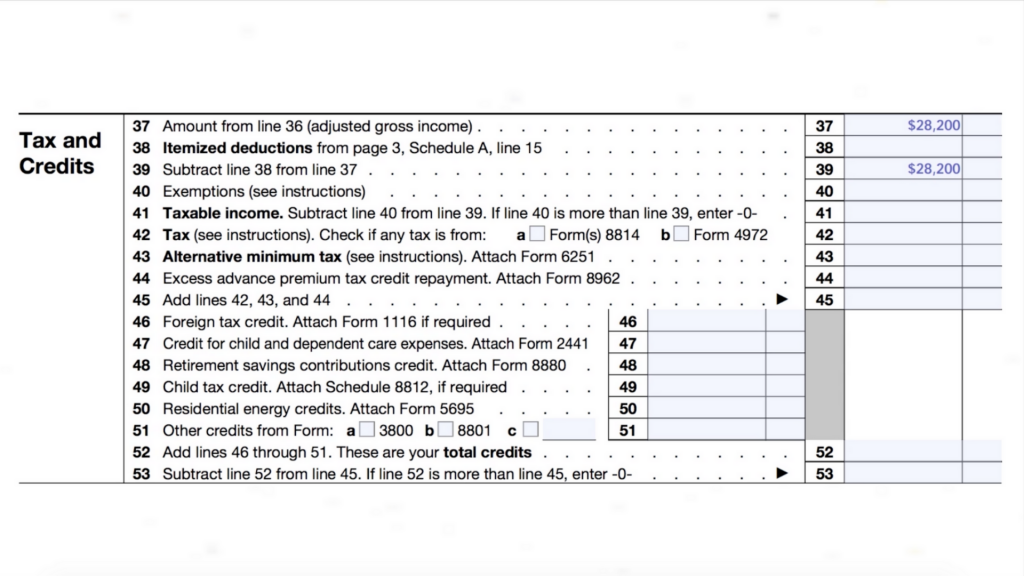

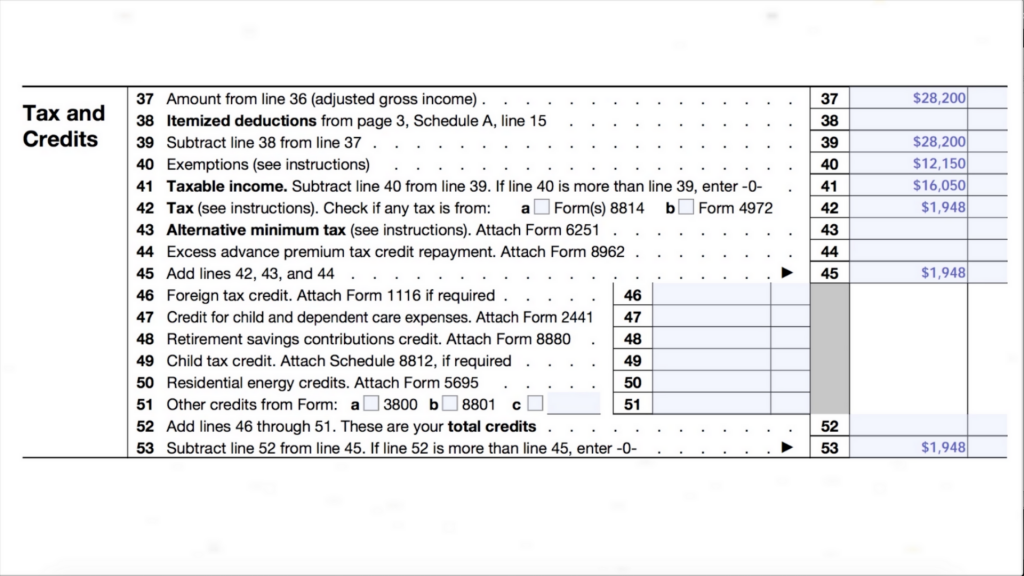

Step 5 – Calculate the Tax and Credits

- Since Justin is claiming exemptions for 3 individuals, including himself, his total exemption amount is $12,150 (i.e. $4,050 x 3), which is entered on line 40.

- Calculate the taxable income, which is the equal to the net rental profit of $28,200 less the exemptions claimed for $12,150. This comes to $16,050 of taxable income, which is entered on line 41.

- Calculate the amount of tax payable on line 42. This should be generated automatically by your tax preparation software.

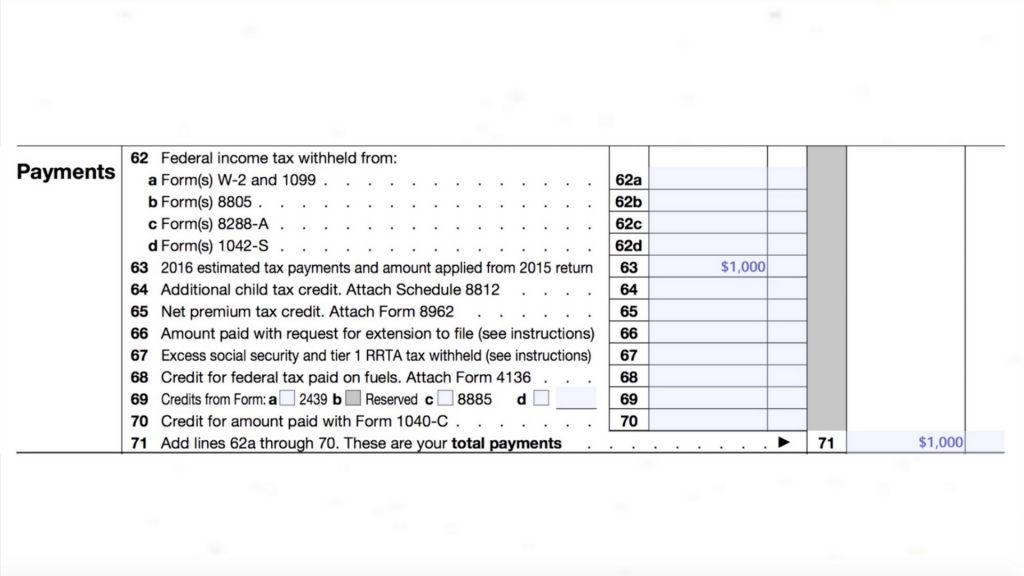

Step 6 – Enter Payments Made

If you made tax installment payments to the IRS during the year, enter the amount paid on line 63. Let’s assume Justin paid $1,000.

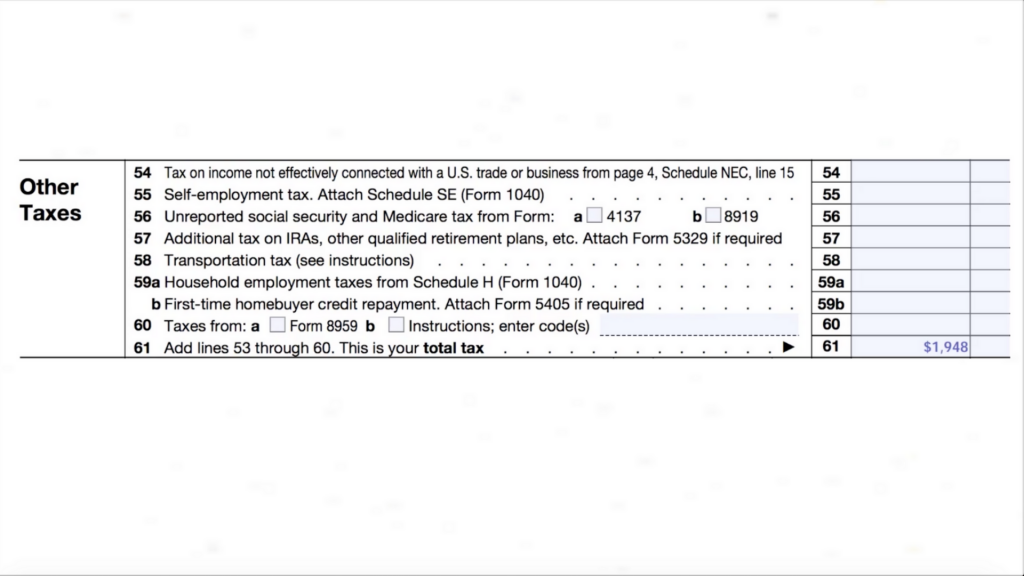

Step 7 – Determine Amount Payable or Refundable

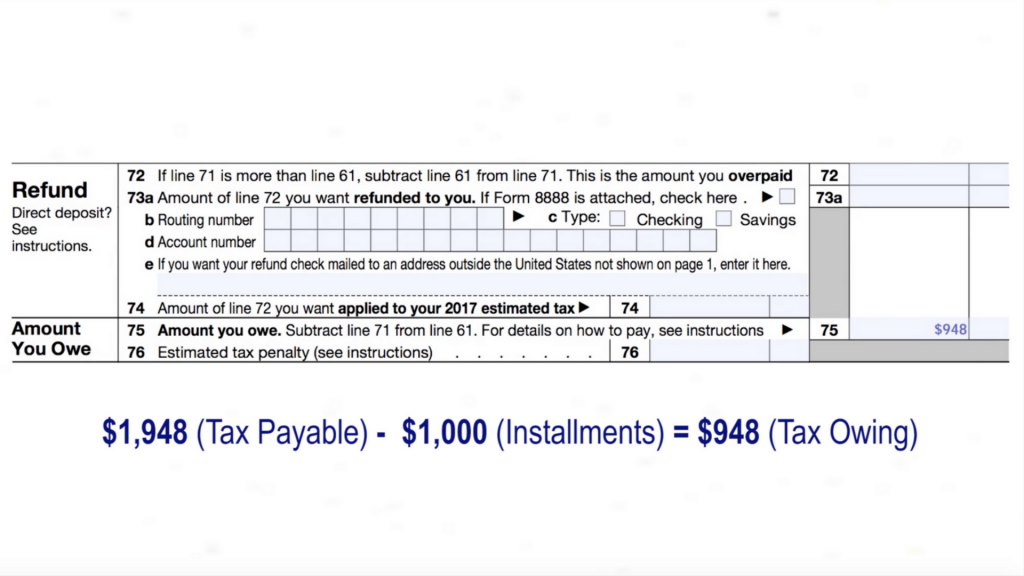

Justin owes tax of $948, which is reported on line 75. The tax owing is equal to the difference between the tax payable (line 42) and the installments paid in the year (line 63).

- Tax Payable $1,948 (Line 42)

- Less: Installments $1,000 (Line 63)

- Amount You Owe $948 (Line 75)

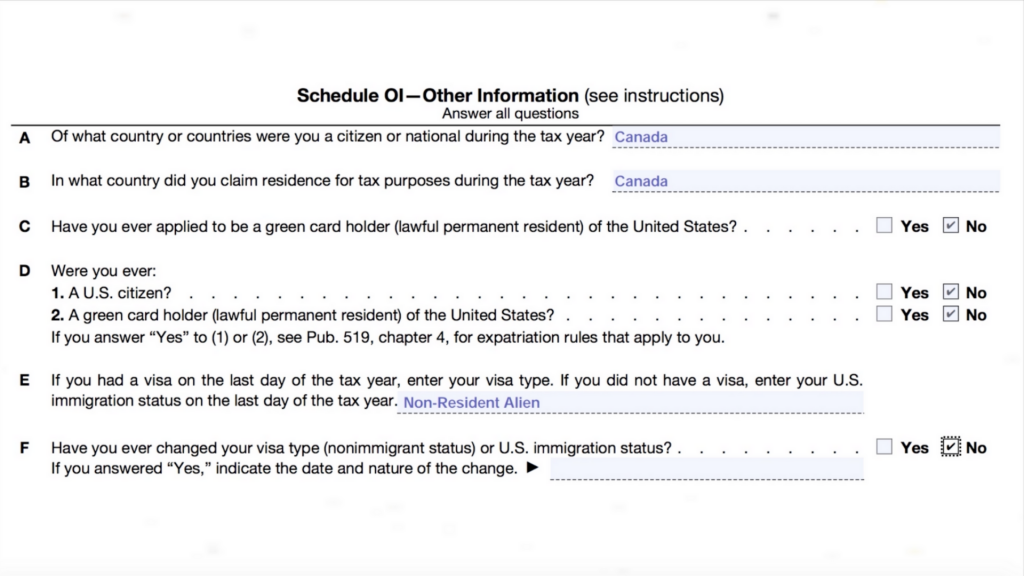

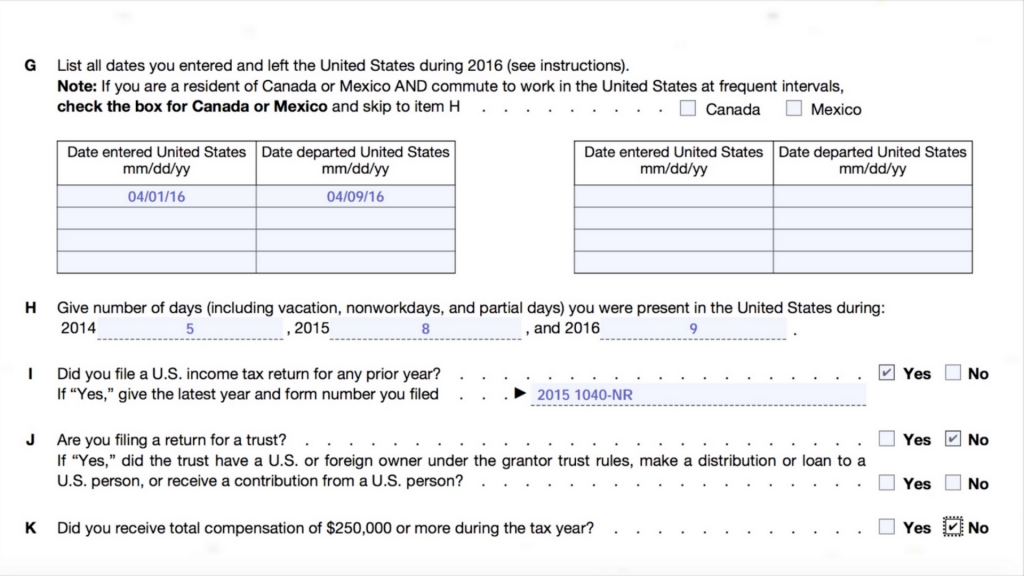

Step 8 – Complete Page 5, Other Information

Lastly, complete page 5 of the form. Please watch while I fill out this information for Justin Trupou.

Please click here to visit part 2.

Disclaimer

The information provided on this page is intended to provide general information. The information does not take into account your personal situation and is not intended to be used without consultation from accounting and financial professionals. Allan Madan and Madan Chartered Accountant will not be held liable for any problems that arise from the usage of the information provided on this page.

SOCIAL CONNECT