Small Business Deductions in Canada

Allan Madan, CPA, CA

Interested in how the small business deduction in Canada can save you money through a special tax rate? If so, we’re here to help!

As an owner of a small business in Canada, you may or may not have heard of the small business deduction available to you. You have worked hard to grow, and already know that making the most of every dollar is crucial to your survival. However, what you may not know is this: “How does this deduction help me save money?”

If you do own and operate your company, then it is very important you read this article. In it, I will show you how you can utilize this great tool to save a lot in taxes and use those savings to bring you towards your goals.

WHAT IS THE SMALL BUSINESS DEDUCTION CANADA?

The small business deduction (SBD) is a credit available to specific kinds of companies in Canada. It is performed on active income and reduces the general corporate taxation percentage from 26.5% to only 15.5%. The limit for this reduction is $500,000 in profit (that is, revenue minus expenses), which represents a significant amount in savings. To stay current on the latest corporation rates, please visit the CRA’s website (Corporation Taxes).

WHICH COMPANIES QUALIFY?

After seeing how much it can save you, I hope I have you interested in this special tax rate. Next, we are going to look at what varieties of Canadian companies qualify for the deduction.

In order to be eligible, your company must be a Canadian Controlled Private Corporation (CCPC). Are you not currently incorporated but are thinking of doing so? Please visit our resource on the subject (Allan Madan’s Personal Tax Tips) to find out more. A CCPC has the following characteristics:

- Incorporated in Canada;

- More than 50% of the voting share capital of the corporation must be owned by Canadian residents;

- Is not listed on a stock exchange.

As the allowance is directed to smaller organizations, your company cannot have a capital size of over $15 million dollars. If your company has a taxable capital of $10 million and $15 million dollars in active income during the previous year, you are still eligible but your limit will be reduced. For more information on CCPC qualification, please visit TurboTax (do I qualify for a small business deduction?).

WHAT ARE THE TYPES OF INCOME THAT APPLY?

Now that you have determined you are a CCPC, the next matter is the types of income that qualify. The type of earnings your company earns must be Active Business Income in order to receive the SBD. This means income earned from a business excluding investment income and capital gains.

HOW DO I TAKE ADVANTAGE OF THIS TOOL?

Now you know what types of corporations and earnings qualify for the small business deduction; the final topic of discussion is how to take full advantage of it. To do this, ask your accountant to prepare Corporate Income Tax Return and claim the small business tax rate on the return. If you would like to do this yourself, please visit our resource (How Can I Prepare an Income Tax return for my Corporation?) Should your corporation earn both investment and active business gains, a separate calculation must be performed on Federal Schedule 7 of the Corporate Income Tax Return to calculate the proper percentage.

Assuming that your corporation makes more than $500,000 in profit, the excess profit above that limit will be levied with a percentage of 26.5%. Therefore, it is best to declare a bonus payable to yourself to reduce the corporation’s profit to $500,000 or less. However, when making the bonus, be sure to pay it within 180 days of your corporation’s year end. If you do not, the bonus will not be tax deductible

GOING FURTHER WITH THE SBD

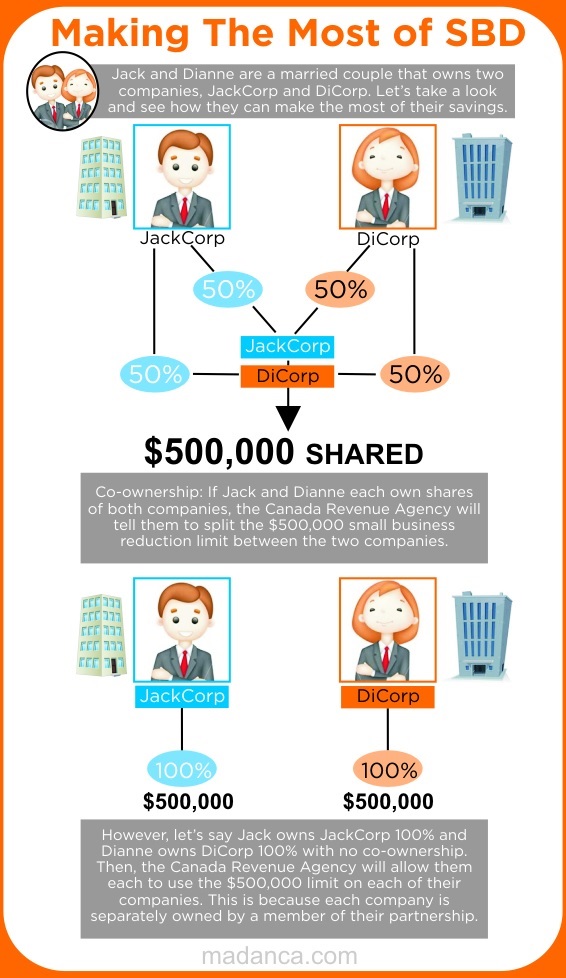

If you are in a partnership, there is an additional way to make the most of your CCPC savings. Let us say that you are a couple that owns two CCPC’s. If you both own one of the companies with no co-ownership (meaning that you do not own shares in your partner’s company and vice-versa), you can allocate $500,000 to each company. If you and your partner own the two companies together, then you only get $500,000 to split between the companies. The Canada Revenue Agency does this to prevent people from owning multiple companies and unfairly receiving a reduction on all of them.

To further illustrate this concept, let’s look at an example. Jack and Dianne are married, and they own two CCPC’s. If Jack owns 100% of his corporation and Diane owns 100% of hers, then they both get to pay a lower rate on up to $500,000 of their business’s active income. However, if Jack owns some of Dianne’s company and vice-versa, the Canada Revenue Agency only gives them $500,000 jointly to split between their companies. The following info-graphic illustrates the concept further.

Another key issue facing business owners in Canada today is whether to pay themselves salary or dividends. Would you like to know more? Please visit our resource (Should I pay myself salary or dividends as a business owner?)

Another thing to consider when opening CCPC’s is the differences in provincial tax rates. Although the federal portion of the corporation tax remains the same throughout Canada, the provincial percentage is different for each province. In Alberta, a CCPC will have its limit taxed at a lower rate than in Ontario (14% vs. Ontario’s 15.5%). This will allow the Albertan CCPC to save more because there are paying less tax. For a full list of provinces and their tax rates on corporations, please visit KPMG’s resource on federal and provincial tax rates.

Disclaimer

The information provided on this page is intended to provide general information. The information does not take into account your personal situation and is not intended to be used without consultation from accounting and financial professionals. Allan Madan and Madan Chartered Accountant will not be held liable for any problems that arise from the usage of the information provided on this page.