Home Personal tax

Tag: Personal tax

Peer-to-Peer Tax Return Filing In Canada

Estate Planning in Canada: Avoiding Unnecessary Taxes for Your Heirs

How to Manage Canadian-Source Income as a Non-Resident | Watch Video

How to Maximize Your Principal Residence Exemption in Canada | Watch Video

Flipping Houses? Here’s How The CRA Classifies Your Profits

5 Tax Tips for High Income Earners In Canada

Changing how you use property? Here’s how to save on taxes

14 Things About Crypto Tax in Canada That Could Save You Thousands

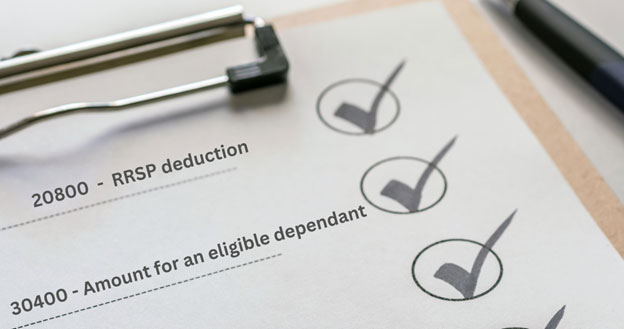

2024 T1 Tax Return: Maximize Your Savings with These Tricks

2024 Canada Tax Changes: Key Updates & Refund Tips Watch Video

The Impact of US Tariffs on Canada’s Economy

How to Maximize Your 2024 Tax Return

Canada Crypto Tax FAQs

How to Maximize Your Principal Residence Exemption

SOCIAL CONNECT