Tax Implications for Canadians Doing Business in China

Allan Madan, CPA, CA

The Chinese market represents a huge opportunity for Canadian businesses looking to expand and increase their sales. With that said, in this short video I will summarize the tax implications for Canadians doing business in China.

Withholding Taxes

Under China’s Corporate Income Tax (CIT) law, payments made to Canadian businesses by a Chinese buyer are subject to a 20% withholding tax. This withholding tax rate is reduced to 10% due to the tax treaty between Canada and China. The types of payments subject to withholding taxes include:

– Dividends and bonuses

– Interest, rents and royalties

– Income from property sales

Let’s use an example:

Assume that a Canadian corporation, Rockstar Canada Inc., receives a royalty from sales made by Chinese companies that sell Rockstar Canada Inc.’s products to customers in China. In 2016, Rockstar Canada Inc. earned $1,000,000 in China from royalties. Under the tax treaty, 10% or $100,000 would be deducted as a withholding tax, leaving $900,000 after-tax for Rockstar Canada Inc.

Permanent Establishment

Are you a Canadian business owner? If so, you may decide, or have already decided to open a physical presence in China by opening an office, a factory, or a branch to gain greater access to the Chinese market. Why does this matter for tax purposes?

Under the Canada-China tax treaty, a Canadian business that has a permanent establishment in China is subject to a 25% China Corporate Income Tax on business profits derived from that permanent establishment. A permanent establishment includes:

1. Office

2. Factory

3. Branch

4. Construction Site

It also includes service based projects in China carried on by employees of a Canadian company where the project lasts 6 months or longer.

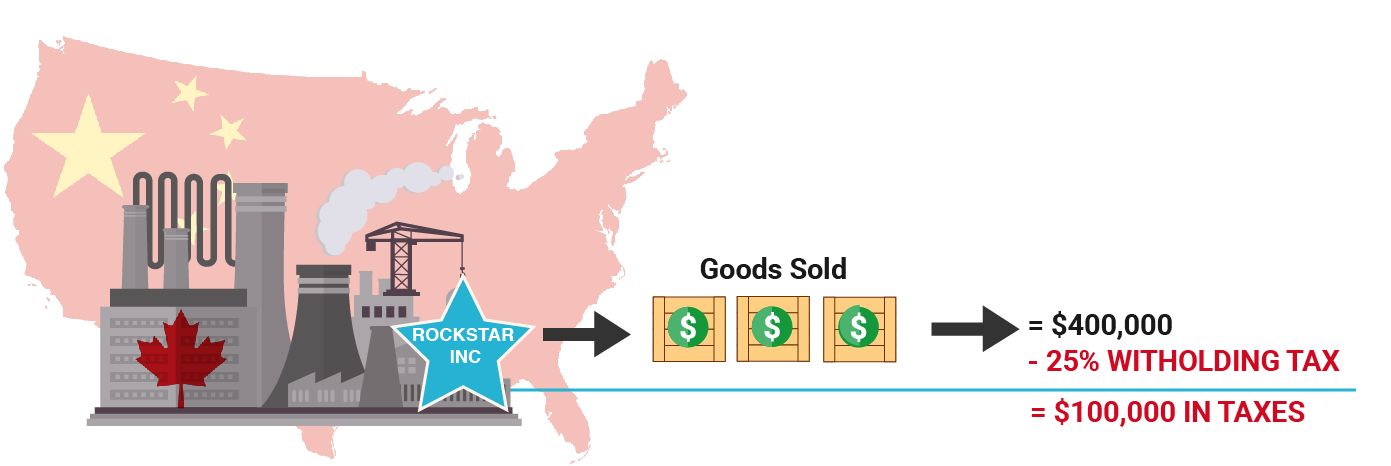

For example, assume that Rockstar Canada Inc. opens a factory in China to manufacture its products. In 2016, the Chinese factory made and sold $400,000 worth of goods. As a result, Rockstar Canada Inc. will be liable for 25% or $100,000 of China Corporate Income Taxes.

Foreign Tax Credits

Canadian businesses are required to pay Canadian income taxes on their worldwide income, this includes income from China. As you can see, a double tax problem could arise because Chinese income is being taxed twice – first by China and then again by Canada. To reduce double taxation Canadian businesses can claim a foreign tax credit for part or all of the Chinese taxes paid.

For example, assume that RockStar Canada Inc. has a Canadian corporate tax rate of 19%. Further, assume that it earns income in China from royalties that are subject to 10% withholding taxes.

In theory, the 10% withholding taxes deducted should be credited against the 19% Canadian corporate income taxes that RockStar Canada Inc. pays on its royalty income, resulting in a net Canadian tax rate of 9%.

Disclaimer

The information provided on this page is intended to provide general information. The information does not take into account your personal situation and is not intended to be used without consultation from accounting and financial professionals. Allan Madan and Madan Chartered Accountant will not be held liable for any problems that arise from the usage of the information provided on this page.

SOCIAL CONNECT