How to Prepare a Rental Form

Allan Madan, CPA, CA

Find out how you can prepare a Statement of Real Estate Rental Form T776 as part of your personal tax filing. This is meant for investors that own rental properties in Canada and would like to file their tax returns independently.

Rental Form T776 called the Statement of Real Estate Rentals must be completed for each rental property that you own in Canada. Form T776 should be attached with your annual personal tax filing. Follow these 10 easy steps to prepare the Statement of Real Estate Rentals.

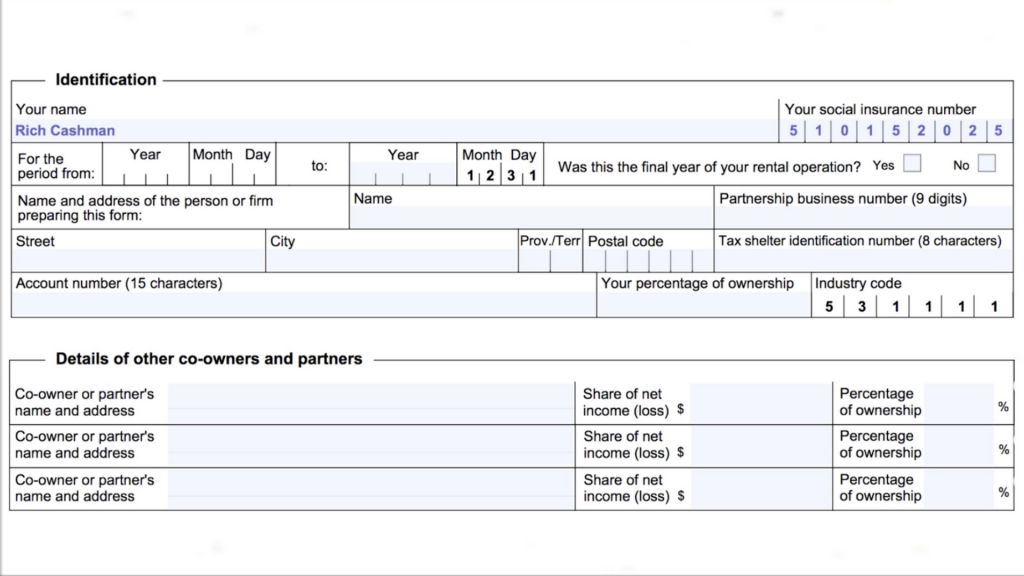

Step 1:

Enter your name and social insurance number at the top of the form.

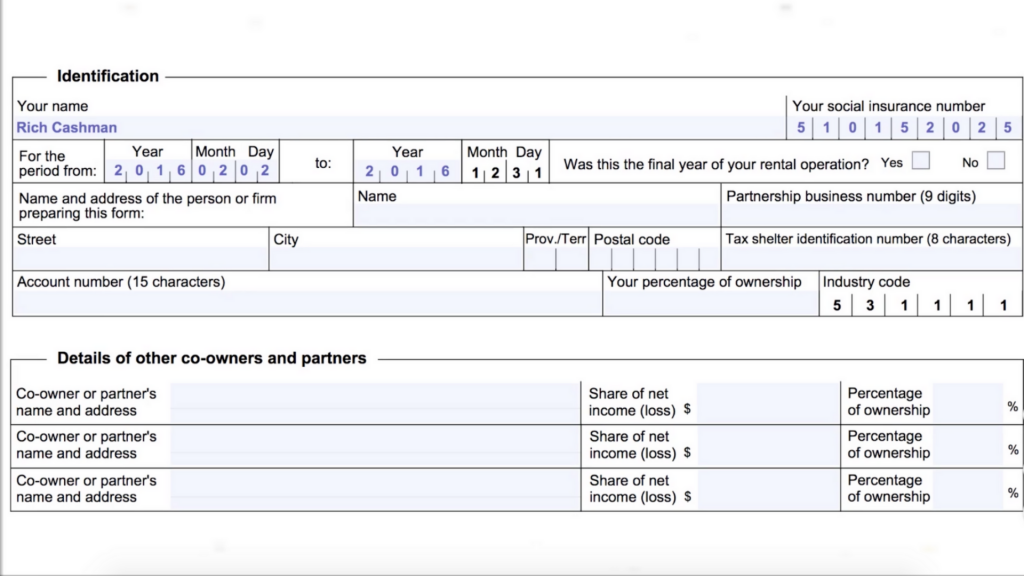

Step 2:

Enter the start date, January 1 and the end date, December 31. If you acquired the property during the current tax year (e.g. 2016) then enter the date of acquisition as the start date. Let’s assume that the purchase date was February 2, 2016.

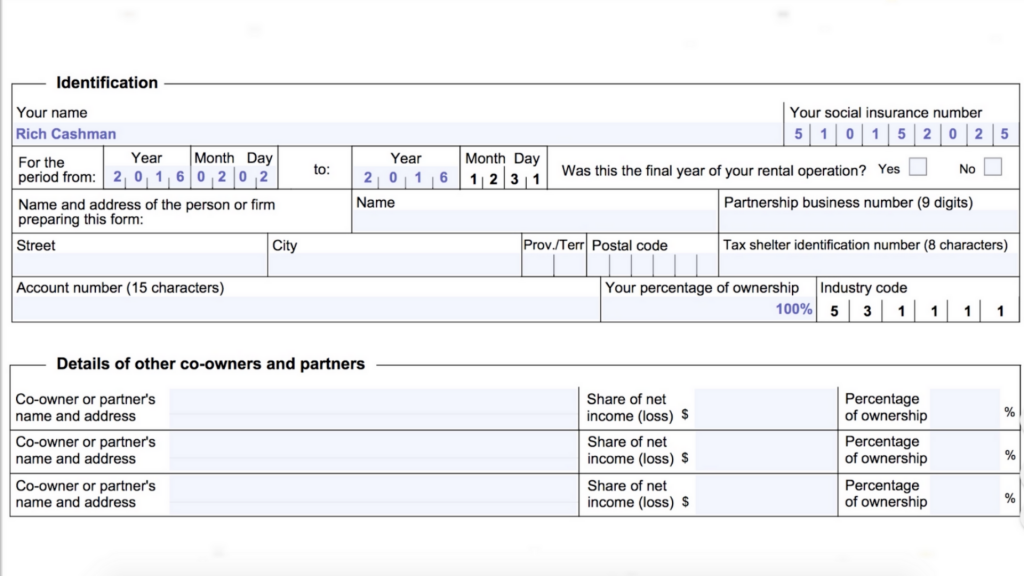

Step 3:

Enter your % of the ownership of the rental property. Let’s assume that you are the sole owner, and therefore own 100%. If there are other owners in addition to you, enter their details below.

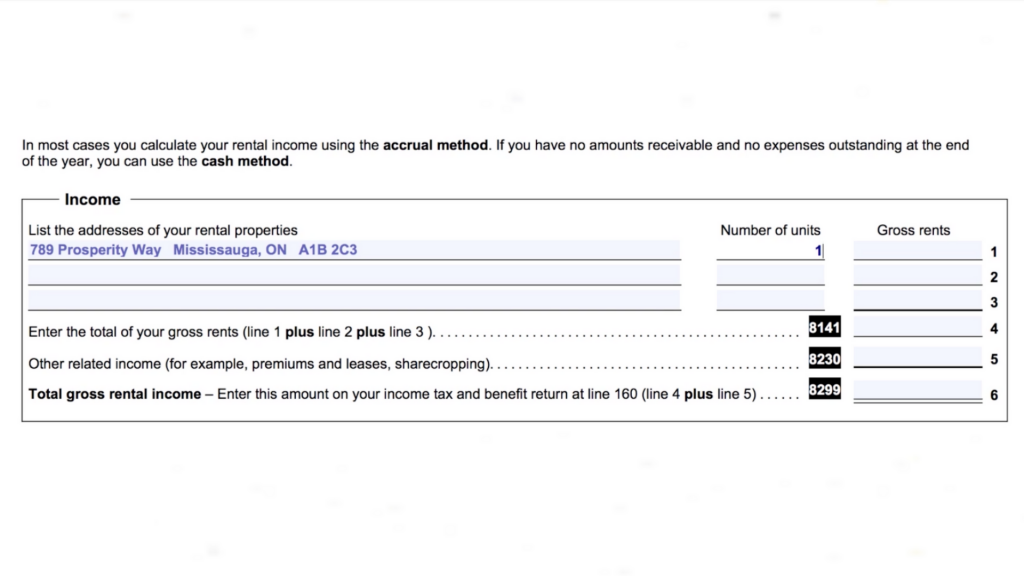

Step 4:

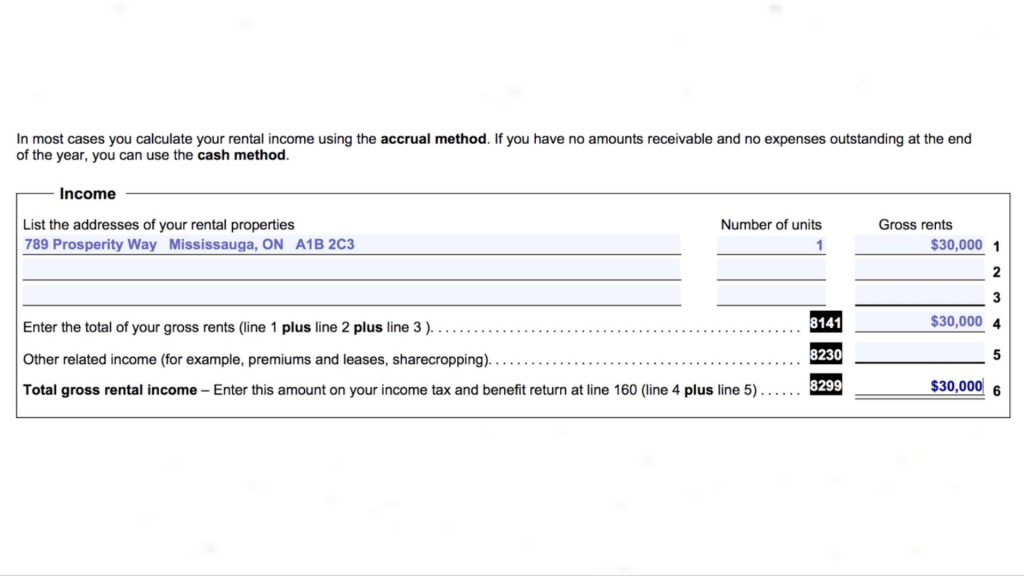

Enter the address of the property and the number of units. In this example, let’s assume that the rental property is a condo and therefore only 1 unit.

Step 5:

Enter the gross rental income earned in the current year. This is the total of rents you charged to your tenants. Assume that the gross rents are $30,000 in this example.

Step 6:

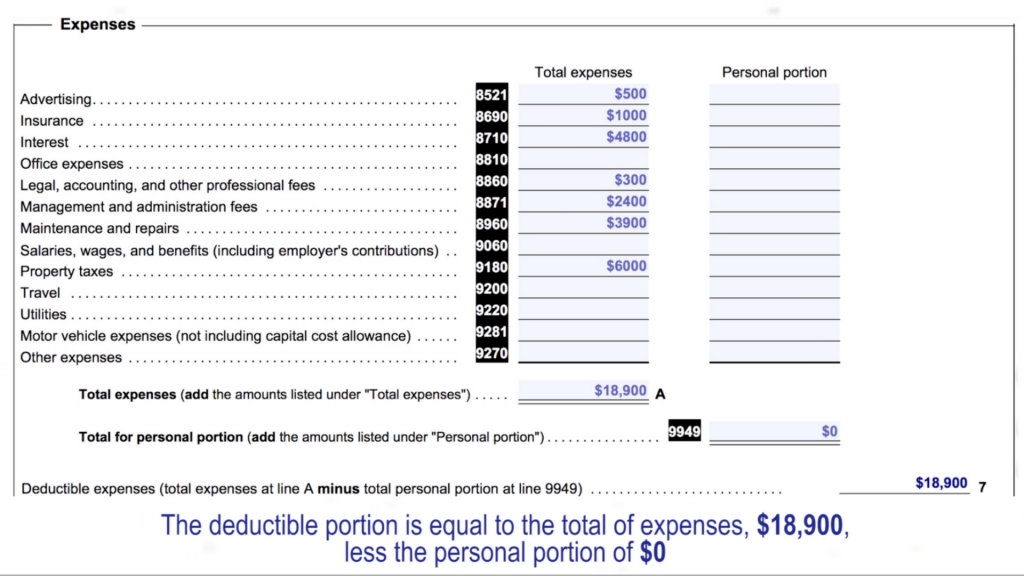

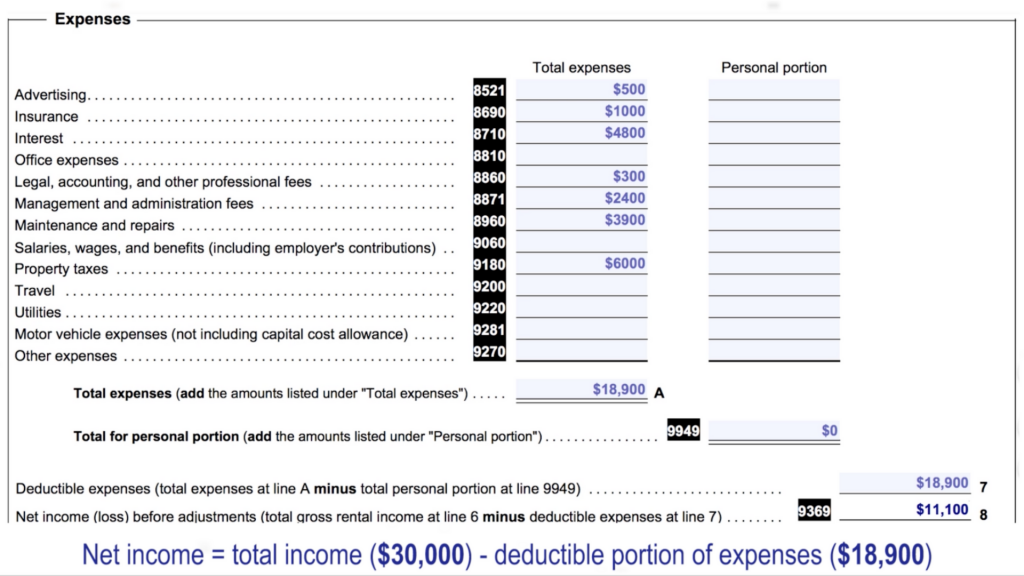

Enter the expenses incurred in the current year. Then enter the total of these expenses which comes to $18,900 in this example. If the entire property is rented out, and none of it is kept for your personal use, then enter $0 for the personal portion. The deductible portion is equal to the total of the expenses, $18,900, less the personal portion of $0.

Step 7:

Calculate the net income, which is the difference between the total income on line 6 of $30,000 and the deductible portion of the expenses on line 7 of $18,900. In this example, the net income is $11,100.

Step 8:

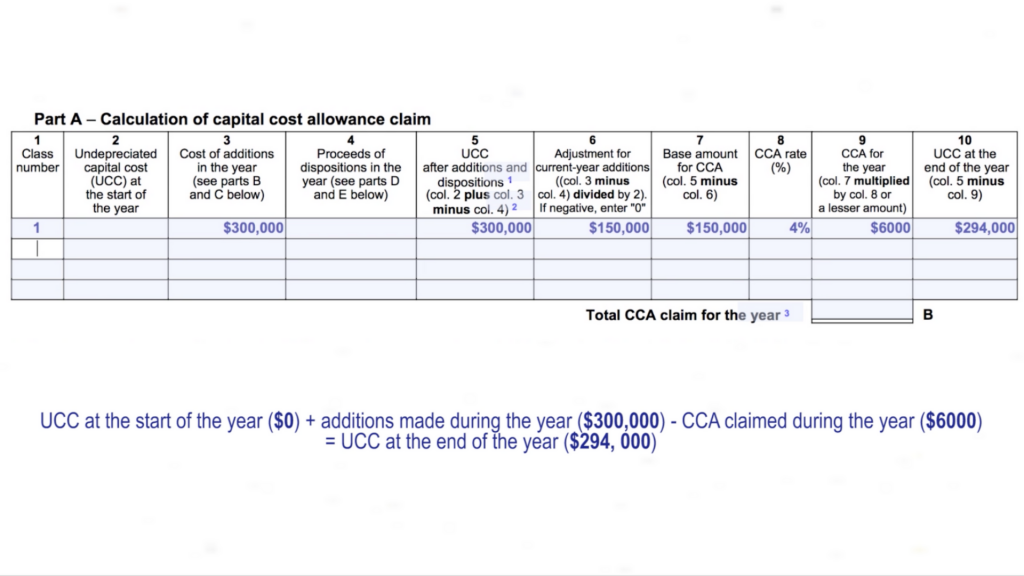

Calculate the capital cost allowance, which is also known as tax depreciation. CCA is a tax-deductible expense. In this example, assume that you purchased the rental condo on February 2, 2016, for $300,000.

- In column 1, enter CCA Class #1

- In column 3, enter $300,000 which is the total of the additions for the year. Enter the same amount in column 5.

- In column 6, enter $150,000 which is equal to one-half of the purchase price of $300,000. In the year of purchase, you can only claim one-half of the CCA ordinarily allowed in the year. Enter the same amount in column 7.

- Column 9 is equal to the CCA rate of 4% multiplied by the base amount for CCA in column 7 for $150,000. (4% x $150,000). This comes to $6,000 in our example.

- In column 10, enter the UCC at the end of the year. This is the balance remaining to depreciate in future years and is calculated as follows:

-

How to Prepare a Rental Form Step 8

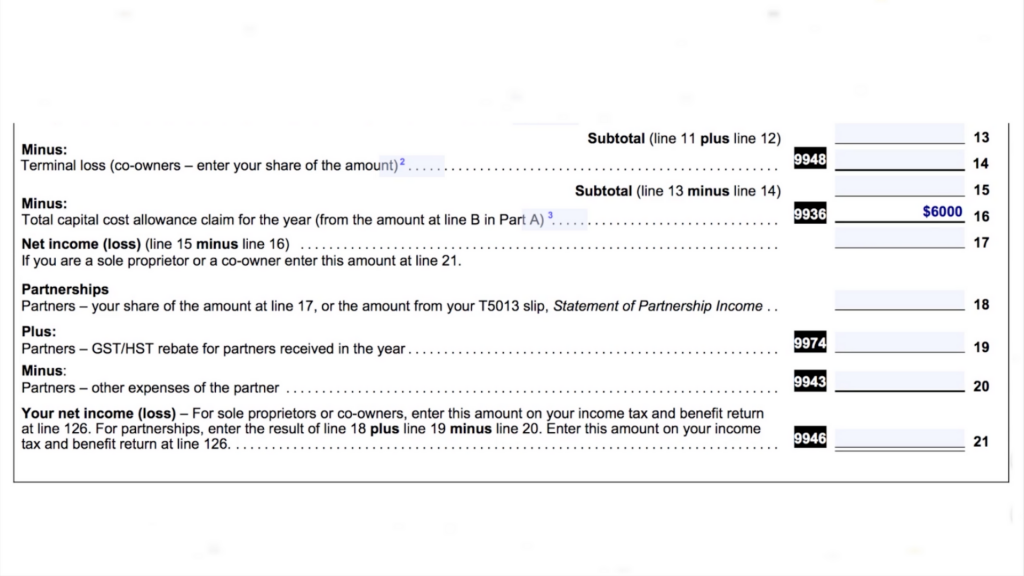

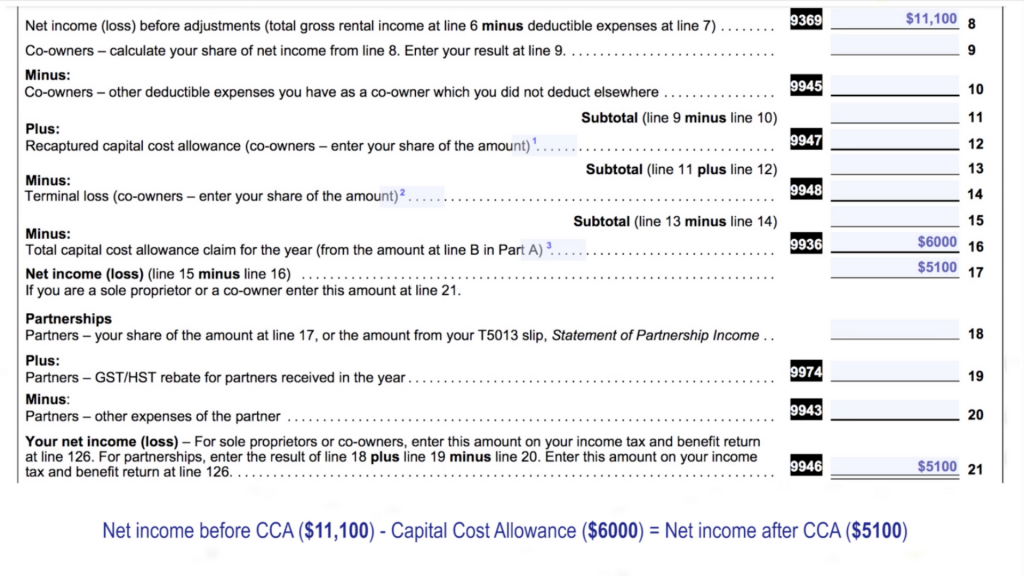

Step 9:

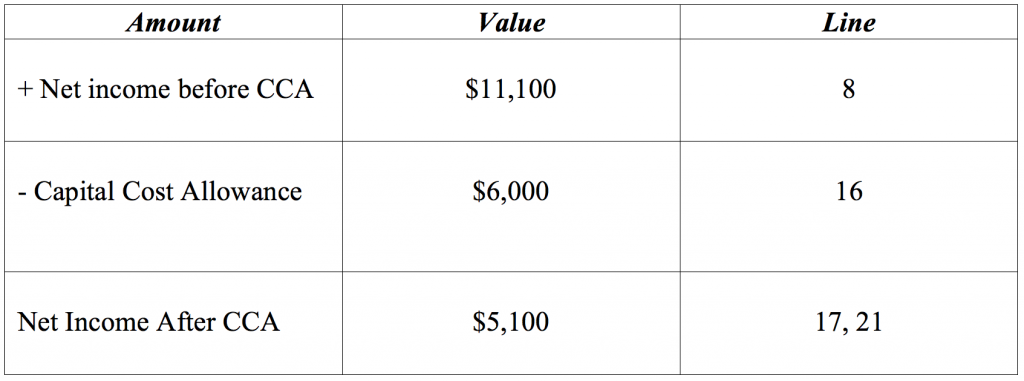

Enter the Capital Cost Allowance of $6,000, which we calculated in the previous step, on line 16.

Step 10:

Enter the Net Income after Capital Cost Allowance on line 17. This is equal to $5,100 in our example:

You will pay personal income taxes at your marginal rate on the Net Income after CCA. In other words, the net income after CCA is added to your total taxable income.

Disclaimer

The information provided on this page is intended to provide general information. The information does not take into account your personal situation and is not intended to be used without consultation from accounting and financial professionals. Allan Madan and Madan Chartered Accountant will not be held liable for any problems that arise from the usage of the information provided on this page.

SOCIAL CONNECT