Selling a U.S. vacation property/ Know the tax implications

Allan Madan, CPA, CA

Imagine, sipping a steaming cup of coffee while looking out onto your beachfront property. Imagine, the sun washing over your face in the dessert heat. Many Canadians did not have to as they flocked to buy vacation properties in the U.S when the Canadian Dollar was at an approximate par with the US dollar. However as the Canadian dollar weakens, some Canadians are choosing to sell their vacation properties and lock in their gains. As a result, many sellers are running into tax implications they did not prepare for.

As of February 16, 2016, a higher withholding tax is applied to property sales. Combined with the Canadian Income Tax, the return on vacation properties is not as profitable as Canadian sellers originally thought. However, there are some strategies that can reduce these tax implications.

How Does Withholding tax work?

When you sell your vacation property, the IRS requires the purchaser to withhold 15% (as of February 16, 2016) of the total proceeds.

For Example: If your property sold for $40,000 USD, the purchaser must withhold $6,000 USD. You can claim this amount as an installment payment credit when you file your US tax return. If you do not wish to pay the 15% withholding tax, you can estimate the actual tax and obtain a withholding tax certificate from the IRS.

In order to apply for a withholding tax certificate, Form 8288 – B must be filed before the closing date. A Tax identification number is required for the form. If you do not have a tax identification number, you must complete form W-7, and send it along with form 8288-B.

File your US tax return

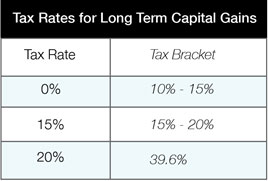

After selling your vacation property in the US, you will need to report any amount of the selling price that exceeds the original cost – or capital gain – to the IRS. A non-resident US income Tax Return is required to be filed as well. You can do this by filling out form 1040NR. Note that the capital gains tax from the sale of your property in the US is calculated based on your tax bracket.

The above rates are for Long Term Capital Gains. A long term capital gain arises on the sale of a property that has been owned for longer than 1 year.

For example:

Five years ago, you purchased your vacation property for $90,000 USD and have now sold it for $200,000 USD, would make you fall under the 23%-35% tax bracket. Your capital gain from the sale of the property would be $110,000 USD. The capital gains tax is 15% and therefore you would pay $16,500 ($110,000 USD x 15%) in taxes from your profit.

Tip: The withholding tax can be applied as an installment payment credit on your return.

Do you need to pay Canadian Income tax?

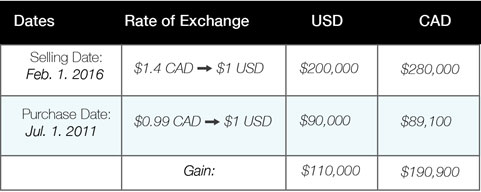

As a Canadian resident, you will need to pay income tax on your worldwide income. The capital gain made from the sale of your US property, must be expressed in Canadian dollars using the exchange rate at the time sale. Your capital gain can vary drastically depending on the dollar rate.

For example, let’s compare the capital gain in American dollars versus Canadian dollars with the exchange rate effect. Remember that the property in this example was purchased in 2011 when the Canadian dollar was on par.

As you can see from the chart above, a gain of $110,000 USD is in fact a gain of $190,900 in Canadian dollars!

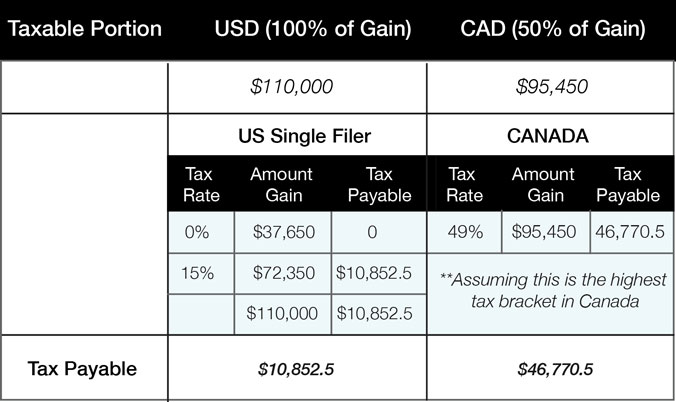

A capital gain is only half taxable in Canada, meanwhile fully taxable in the U.S. In the U.S, if your gain is $37,650 or less, it is 0% taxable. If your gain is higher, the first $37,650 is not taxed, and the difference is taxed at 15% if you are a single filer for long term capital gains.

How to Reduce your Canadian Income Tax?

You don’t want to end up paying capital gains tax twice, on both your Canadian and US income tax return on the same gain. To avoid this, claim a Foreign Tax Credit (FTC) to prevent double taxation.

Net Tax Payable – NTP: Tax Owing

Before the application of foreign tax credits on your Canadian tax return your Canadian taxes payable, in this example, is $46,770.50 Canadian dollars (see chart above). However, the foreign tax credit is equal to the American taxes payable of $10,852.50 USD, or $15,193.50 Canadian dollars.

NTP after FTC:

As you can see, after applying a foreign tax credit of $15,193.50, the net tax payable in Canada is $31,577.

Tip: You can also claim a principal residence exemption to reduce the taxes paid from the sale of your property if the main purpose of it was not to generate revenue. By designating certain years, you can bring down the taxes owing from your property’s profit to $0 in Canada.

What is the consequence if you rent out our vacation property?

You may not want to sell your vacation property and choose to rent it out and generate some revenue instead. If you choose to do this, your tenant will withhold 30% of the total rent and submit it to the IRS.

How to avoid withholding tax

You can elect to have your income treated as income generated by a US business and avoid the withholding tax. After you become a business, you can also deduct expenses related to your rental property such as insurance, maintenance costs and property tax.

After completing the election you will need to report your rental income on the annual US income tax return, from 1040NR. In addition to the US income tax, you will also need to claim your rental income on your Canadian income tax return. A foreign tax credit, equaling to the approximate amount of the US tax paid can be claimed when you file your Canadian Income Tax Return.

Disclaimer

The information provided on this page is intended to provide general information. The information does not take into account your personal situation and is not intended to be used without consultation from accounting and financial professionals. Allan Madan and Madan Chartered Accountant will not be held liable for any problems that arise from the usage of the information provided on this page.