Benefits of incorporating a Holding Company in Canada

Creating a holding company in Canada provides numerous advantages for business owners. Below are some key benefits to consider when deciding whether to form a holding company.

1. Creditor Proofing

One significant advantage of a holding company in Canada is the ability to implement a creditor-proofing plan. This strategy allows business owners to reduce risk and protect assets from potential claims. By transferring assets to a holding company, you can protect them from creditor actions. However, it’s crucial to ensure that your business can meet its debts before making such transfers, as actions perceived as attempts to evade creditors may be legally challenged.

Cash held by the operating company is one of the most valuable assets. A key part of the creditor-proofing process involves transferring cash profits to the holding company through dividends. The holding company can then claim a tax deduction under Section 112 of the Canadian Income Tax Act, as it is ‘connected’ to the subsidiary company. Regular dividend payments from the operating company to the holding company are advisable.

If the operating company requires capital, it can borrow from the holding company on a tax-free basis. To protect the loan amount from potential creditors, a general securities agreement should be prepared to secure the loan against the operating company’s assets, similar to a secured mortgage.

2. Transferring Assets to Holding Companies in Canada

Transferring assets from an operating company to a holding company in Canada can protect those assets from the operating company’s inherent risks. For instance, if you own a Canadian corporation manufacturing medical supplies—a field fraught with risk due to the potential for product defects—consider having the expensive manufacturing equipment owned by the holding company. This way, if a lawsuit arises against the operating company, the holding company’s assets remain unaffected.

3. Income Splitting with Multiple Shareholders

Holding companies in Canada can facilitate income splitting among family shareholders, which can lower the overall tax burden and is a strategic option for family-run businesses. However, implementing income splitting has become more complex due to the CRA’s Tax on Split Income (TOSI) rules introduced in 2019. These rules impose a higher tax rate (up to 53%) on dividends paid to family members who do not contribute to the business. There are exceptions to these rules, which are discussed in my article about TOSI

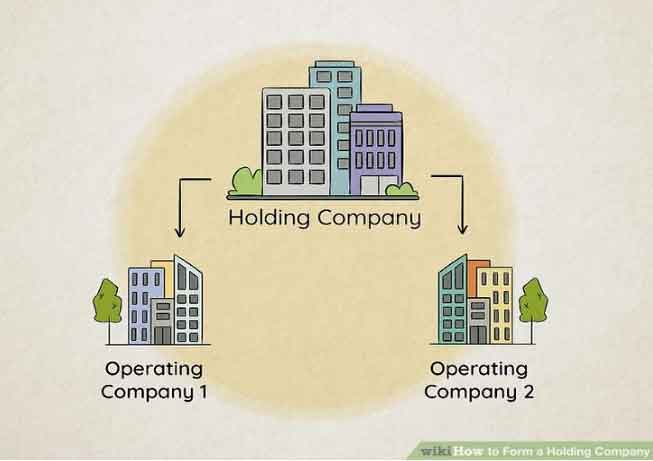

4. Acting as a Parent for a Group of Companies

A holding company in Canada can own multiple subsidiary companies, improving organization and management across various business ventures. For example, a holding company could own both an operating business and a real estate company, streamlining financial operations such as rent payments and profit distributions. This structure promotes operational efficiency and simplifies transactions among different business units.

How to Incorporate Holding Companies in Canada

Now that you understand the benefits of holding companies in Canada, how do you create one? It’s advisable to hire a professional accounting firm to assist with incorporation, whether at the provincial or federal level.

If you are a shareholder of an existing incorporated company, you can transfer your shares to a holding company using the rollover provisions in the Canadian Income Tax Act. Specifically, Section 85 allows you to transfer your shares at a deemed selling price equal to their cost amount (e.g., $100). This means capital gains tax will not apply to the transfer. Without these rollover provisions, shares must be transferred at their fair market value.

Conclusion

Establishing a holding company in Canada can be a strategic move for business owners seeking to optimize asset protection, tax efficiency, and operational management. However, it’s essential to consider the complexities and legal implications involved. Consulting with financial

and legal advisors can help ensure that this structure aligns with your overall business objectives.

SOCIAL CONNECT