Tax rules for small businesses in Canada for 2018.

Allan Madan, CPA, CA

Do you own an incorporated small business? Learn about the new changes made by the government to small business taxation, which you should be aware of and how they can impact you.

1. INCREASE IN DIVIDEND TAX

The government will increase the tax on dividends paid to family members that are shareholders of a small business corporation, effective January 1, 2018.

For example, assume that Mrs. Nancy Johnson and Mr. Kevin Johnson are shareholders in a medical professional corporation. Nancy is the sole doctor and works in the corporation, while her husband is a non-active shareholder. Every year, the corporation pays Nancy and Kevin a dividend of $100,000 each in respect of their shareholdings.

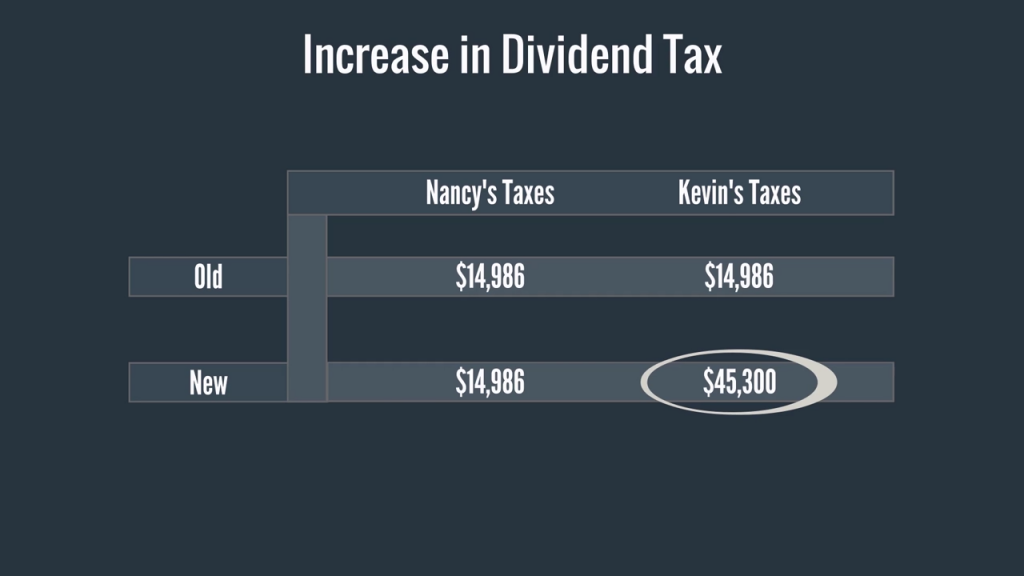

Under the previous rules, Nancy and Kevin each paid tax at regular tax rates on the dividends they received in the year. Under the new rules, the dividends paid to Kevin are taxed at the highest marginal rate. This is because Kevin does not work in the medical practice, and he has not made any major financial investment in the practice.

As a result of the new rules, Kevin’s personal tax will increase from $14,986 to $45,300 on $100,000 of dividend income.

As you can see, the government does not want you to save tax anymore by paying dividends to family members.

2. FAMILY TRUSTS

With the new rules, the government has stopped the practice of multiplying the lifetime capital gains exemption with multiple family members through the use of a family trust. The new rules are effective on January 1, 2018.

Under the old tax regime, beneficiaries of a trust that owned shares of a small business corporation could each claim the lifetime capital gains exemption.

For example, assume that Uncle Bob runs a successful cheese-making factory. Uncle Bob is very generous and has made his spouse, Aunt Bobette, and three children Tiny, Big, and Sloppy beneficiaries of his Family Trust. His Family Trust is the sole owner of Cheesery Inc.

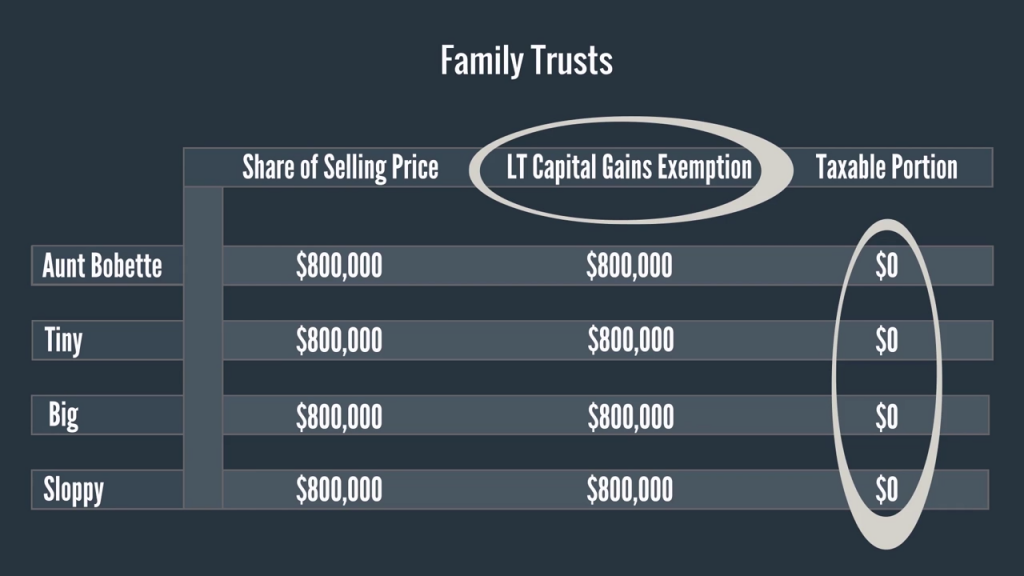

Assume that Uncle Bob receives an offer from the Big Cheese Man Inc. to purchase his company, Cheesery Inc., for $3,200,000. Uncle Bob accepts the offer, and no tax is payable on the sale because each beneficiary of the trust claimed the lifetime capital gains exemption on the sale of the shares.

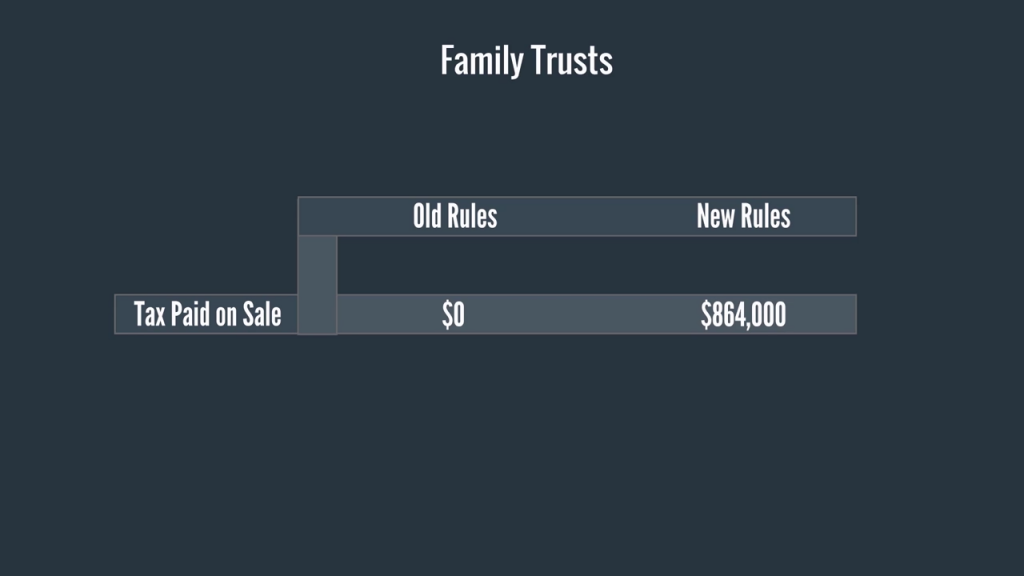

As you can see from the chart, the lifetime capital gains exemption was allowed for each beneficiary and so no tax was paid on the sale. The government has stopped this tax-planning tool under new rules by preventing beneficiaries of a family trust from claiming the lifetime capital gains exemption. If Uncle Bob had sold his company under the new rules, the total tax paid by all of the beneficiaries in respect of the sale would be $864,000.

3. TAX ON INVESTMENT INCOME

The government is proposing to increase the tax paid by small business corporations on the investment income that it earns, including interest, rents, royalties, and dividends.

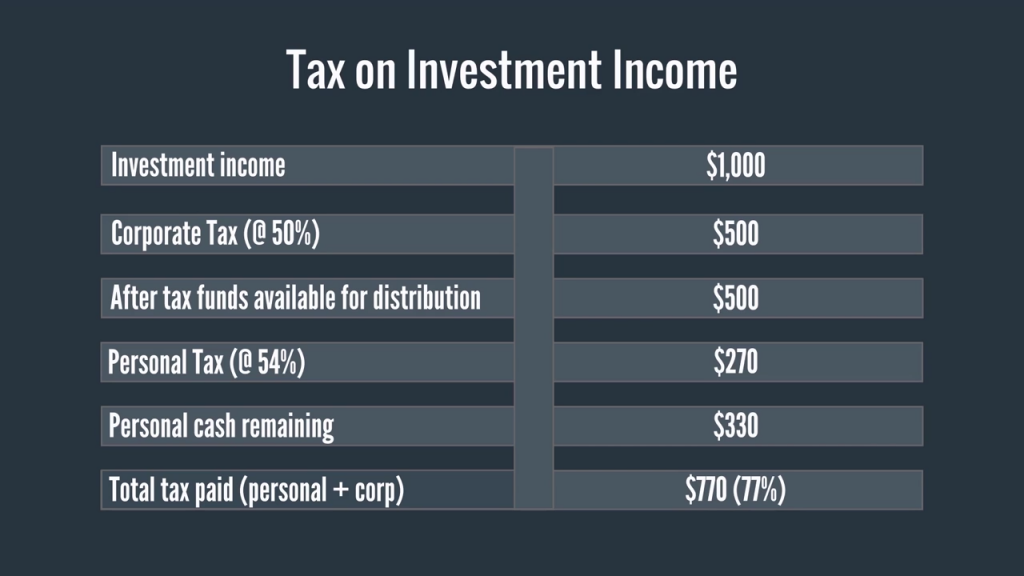

If the proposals are put into law, then the tax rate on investment income earned by a corporation would increase to effectively 50%, without any tax relief. In addition, when the investment income is distributed by the corporation to its shareholders, the shareholders would pay personal tax on the dividends received at a rate of 54%. The combined corporate tax rate and personal tax rate on investment income distributed is approximately 77%.

Please speak with your local MP to prevent this proposal from being enacted.

Disclaimer

The information provided on this page is intended to provide general information. The information does not take into account your personal situation and is not intended to be used without consultation from accounting and financial professionals. Allan Madan and Madan Chartered Accountant will not be held liable for any problems that arise from the usage of the information provided on this page.