Preparing business taxes for self-employed individuals.

Allan Madan, CPA, CA

Find out how to complete form T2125, the Statement of Business Activities Part 2 in 3 easy steps. This is meant for self-employed individuals who would like to complete their tax return independently on specific sections, including home-office expenses, vehicle expenses, and Capital Cost Allowance.

Part 2 – How to Prepare Business Taxes for Self-Employed Individuals

How to complete form T2125, Statement of Business Activities Part 2 in 3 easy steps. Specifically, we will review the sections of this form related to home office expenses, capital cost allowance and vehicle expenses. This is the final part of a 2 part series.

1. Home Office Expenses

If you work from your home office and meet certain conditions, you can deduct home office expenses from your business income. Specifically, you have to meet only one of these two conditions.

a) Your home office is your principal office. This means you spend more than 50% of your working time from your home office;

OR

b) You regularly meet clients in your home office.

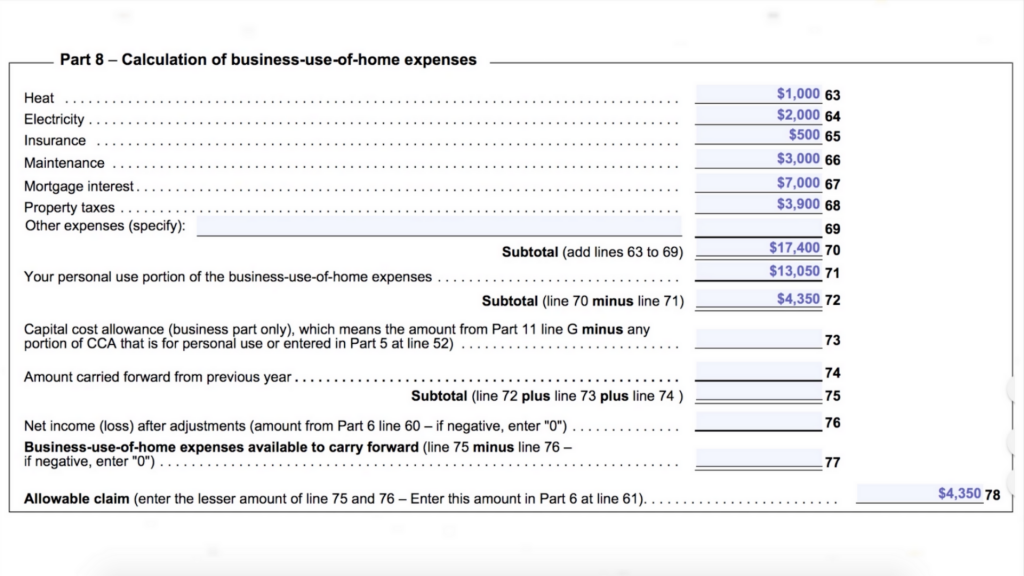

Let’s take the example of a sole proprietor, Ms. Oscar, who makes gold and red award envelopes from home. This is her only office and she spends 50% of her time working from home. She has the following home expenses, which are entered in part 8 of form T2125:

- Gas for heating her home of $1,000

- Electricity bills of $2,000

- Insurance of $500

- Maintenance of $3,000

- Mortgage interest of $7,000

- Property taxes of $3,900

- Her total home office expenses on line 70 are $17,400

The total square footage of Ms. Oscar’s home office is 500 and the total square footage of her home is 2,000. That means 75% of her entire home is used for personal purposes. This is calculated as follows:

Size of home: 2,000

Less: Office space (500)

Personal portion: 1,500 square feet

1,500 square feet is 75% of the total size of her home that is used for personal purposes (1,500 / 2,000).

If we multiply her total home office expenses of $17,400 by 75% we get $13,050. Enter $13,050 as “Your personal use portion of the business use of home expenses” on line 71. The difference (on line 72 and 78) of $4,350 represents the tax deduction Ms. Oscar can claim for her home office expenses.

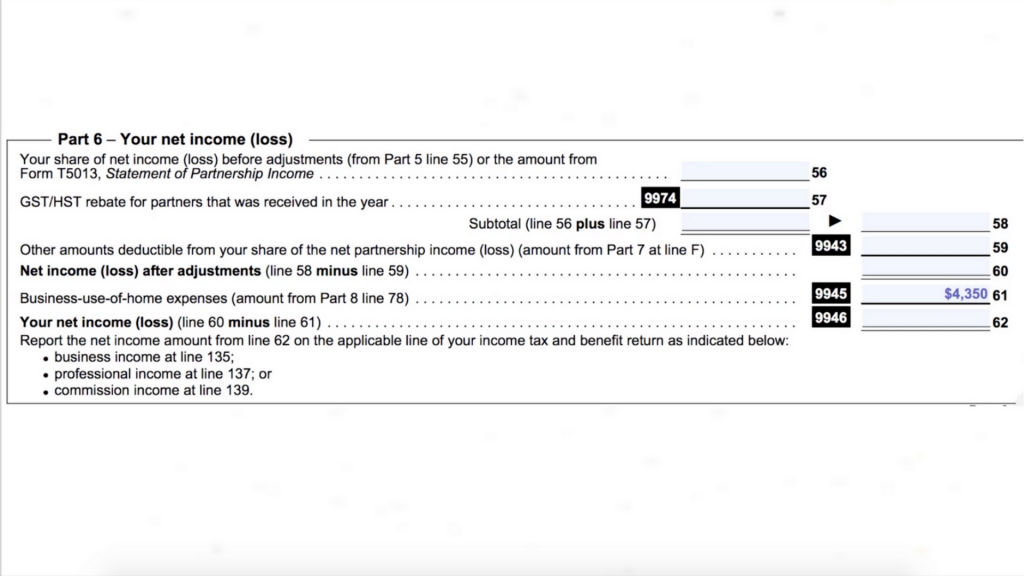

As a final step, enter the home office deduction of $4,350 on Part 6, line 61.

2. Capital Cost Allowance

Capital cost allowance is also known as depreciation of your business assets. CCA is a tax deduction. Let’s continue with the example of Ms. Oscar:

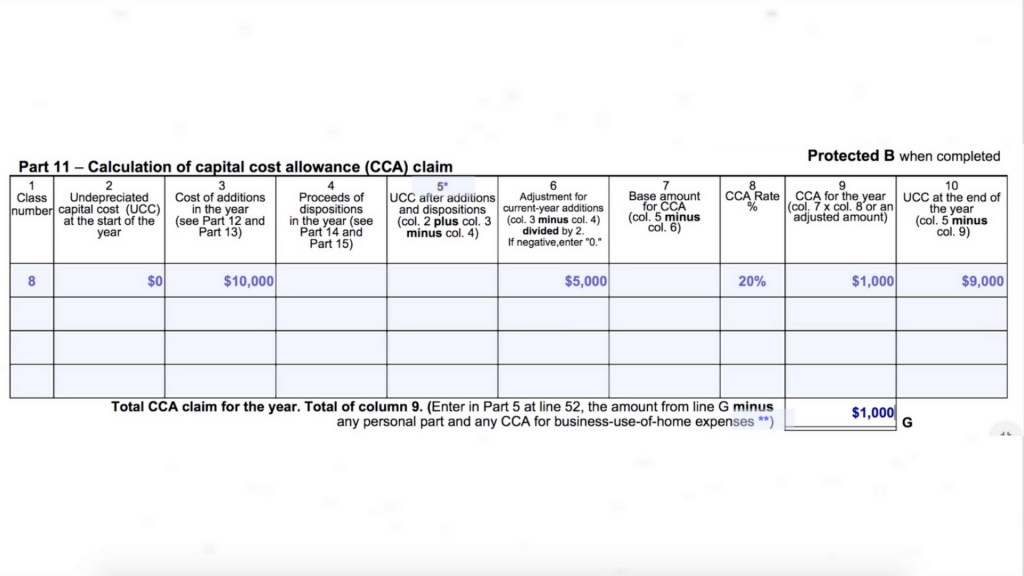

Ms. Oscar purchased an envelope machine from PWK for $10,000 during the current year. This is the first machine that she ever purchased. Ms. Oscar should enter the details on Part 11 as follows:

- Enter Class 8 for machinery and equipment in Column 1

- In column 2 enter $0

- In column 3 enter $10,000 for the machinery purchased

- In column 6 enter one-half of the amount for machinery purchased in the year, or $5,000. In the year of acquisition, only half of the CCA ordinarily allowed can be deducted.

- Enter the CCA rate of 20% for machinery in column 8

- Enter the amount of capital cost allowance in column 9, which is calculated as 20% of $5,000. This comes to $1,000. In other words, $1,000 of CCA can be deducted from income.

- Enter the remaining balance to be depreciated of $9,000 ($10,000 less $1,000) in column 10.

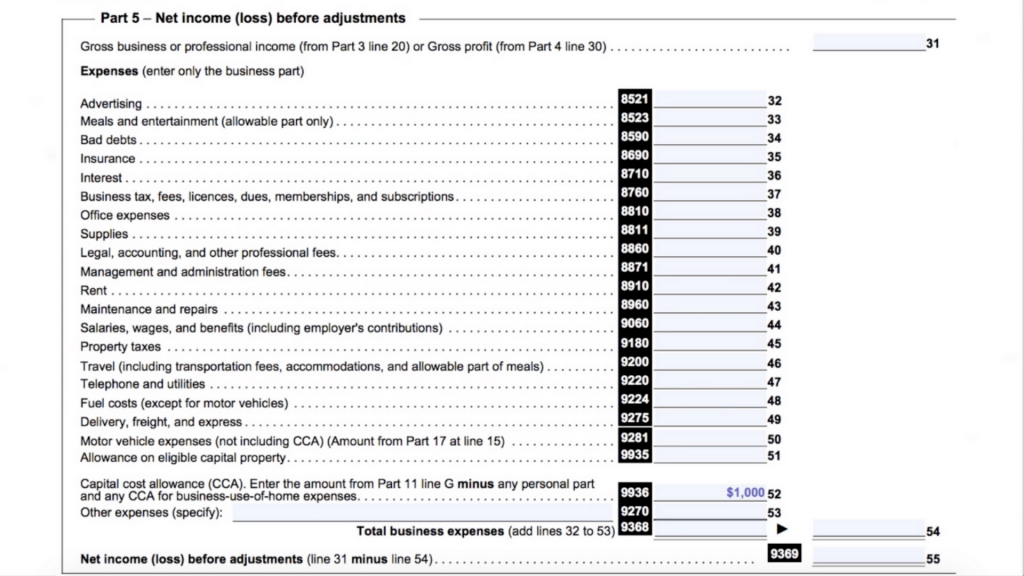

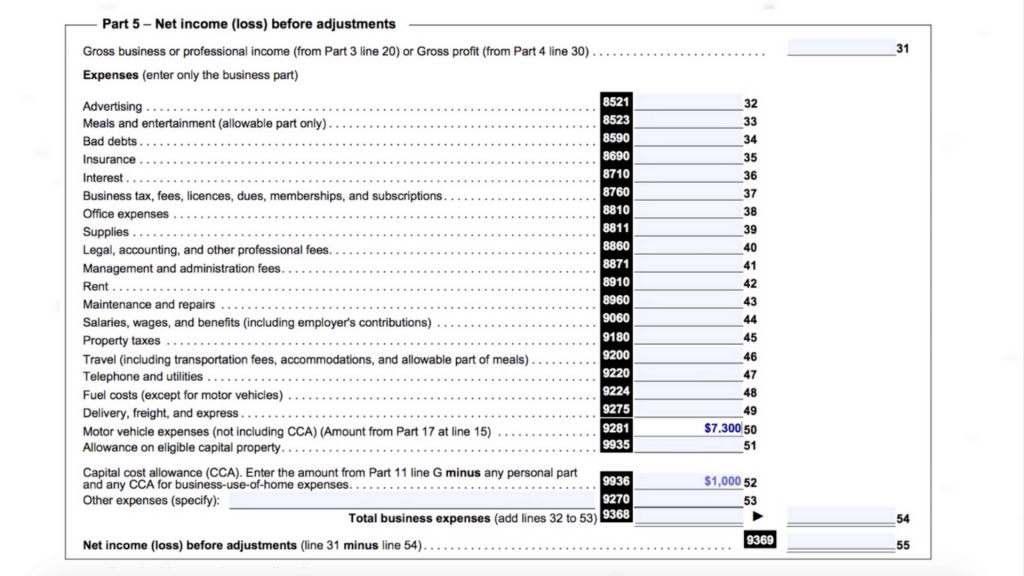

- The final step is to enter the total CCA of $1,000 on line 52.

3. Vehicle expenses

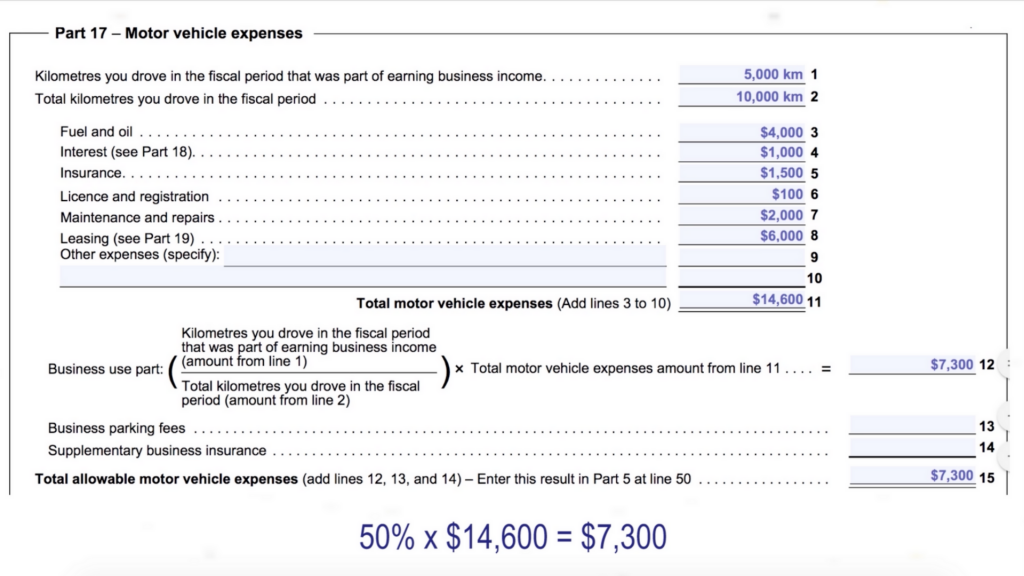

Vehicle expenses can be claimed so long as you use your vehicle for business purposes. Continue with the example of Ms. Oscar. She regularly drives to her customers on Tollywood Blvd and her vehicle expenses for the year are as follows, which she enters in Part 17 of form T2125:

- Fuel and Oil $4,000

- Interest on her car loan $1,000

- Insurance $1,500

- License and registration $100

- Maintenance and repairs $2,000

- Lease payments $6,000

Her total vehicle expenses for the year come to $14,600 (line 11). Furthermore, Ms. Oscar drove 5,000 km (line 1) for business purposes and 10,000 km (line 2) in total for the year. In other words, she drove 50% of the time for business reasons (5,000 km / 10,000 km). Therefore her deductible vehicle expenses are 50% of her total expenses of $14,600, which comes to $7,300 (50% x $14,600). This amount is entered on lines 12 and 15.

As a final step, enter the deductible portion of $7,300 in Part 5, line 50.

See Part 1 For the First 6 Steps for Form T2125, the Statement of Business Activities. For self-employed individuals who would like to complete their tax return independently.

Disclaimer

The information provided on this page is intended to provide general information. The information does not take into account your personal situation and is not intended to be used without consultation from accounting and financial professionals. Allan Madan and Madan Chartered Accountant will not be held liable for any problems that arise from the usage of the information provided on this page.