Preparing Corporation Income Tax Returns in Canada

Allan Madan, CPA, CA

If you need to prepare your corporation income tax return and plan to do so by yourself, check out the Step-by-step instructions provided in this article, making the corporate tax return preparation process pain-free. If you are self employed and looking for a guide on how to complete your personal income tax return, check out How to Complete Form T2125 for a Sole Proprietor.

Who Has to File a Return?

In Canada if you own a resident corporation in Canada then you are required to prepare a corporate income tax return(T2). When you fill out your first corporate retusrn you must declare a year end for your corporation. A benefit to incorporating is you can choose any date in the year to be your company’s year end. In Canada a corporation can file their return up to 6 months after its year end. However taxes must be paid within 3 months of the year end so many corporations elect to file at the same time.

Get Organized

Getting yourself organized is the first step in preparing a corporate tax return in Canada. Filling out your T2 corporate income tax form will require many supporting documentation. Before beginning you should make sure the following is done:

1) Find and organize your expense receipts by month

2) Print and sort all bank and credit card statements by month

3) Attach receipts to corresponding monthly bank or credit card statement

By completing these three steps you will ensure all documentation you expect to claim on your return is accounted. In case of a review by CRA you will also know where to find the supporting documentation as they will request proof for the claim in question.

Some other information you will need to know are:

- Business number of your corporation

- The address of your corporation’s head office

- Address where your corporation’s books and records are kept

- The fiscal year end of your company

Whether filing on your own or with an accountant, proper documentation and information before hand can save you time and money with your corporate tax return.

Financial Statements

Before starting the preparation of your Canadian corporation income tax return, you will require the Income Statement and Balance Sheet of your company.

Let’s use Tech Consulting Company Inc. (TCCI), a fictitious company, as an example.

Income statement for 2016

- Sales: $200,000,

- Expenses: $84,000 (including $2,000 for meals and entertainment)

- Profit: $116,000.

TCCI is a profitable company!

Balance Sheet as of December 31, 2016 (year-end)

- Assets: $149,100 (cash and accounts receivable)

- Liabilities: $13,000 (accounts payable and GST payable)

- Equity: $136,100 (net assets retained in the corporation)

Important to note when filling out your financial statements in schedule 100 and 125 you will be required to provide the General Index of Financial information (GIFI) numbers. This is how the CRA keeps track of different accounts. These numbers will be listed at the bottom of your schedule and will have corresponding accounts listed next to them.

Where do I find corporate tax forms and schedules?

Where do you get the schedules and forms for the preparation of a corporate tax return? They can be obtained from the Canada Revenue Agency’s (CRA’s) website.

On the homepage of the CRA’s website, enter ‘T2 returns and schedules’ in the search field and then click on ‘search.’

By clicking on T2 Returns and schedules, you will see a listing of all of the corporate tax forms and schedules that you could ever possibly need for the preparation of your company’s income tax return. You should only select the forms and schedules that are applicable.

Know the basic corporation tax forms and schedules

The most commonly used schedules for the preparation of a corporation income tax return for a business in Canada are:

- Schedule 100: Balance Sheet Summary

- Schedule 125: Income Statement Summary

- Schedule 50: Shareholder Information

- Schedule 8: Capital Cost Allowance

- Schedule 1: Net Income for Tax Purposes

- Schedule 3: Dividend Received, Taxable Dividend Paid, and Part IV Tax Calculation

- Schedule 11: Transactions with Shareholders, Officers or Employees

- Schedule 24: First time Filer after Incorporation, Amalgamation or Wind-up of Subsidiary into a Parent

- Schedule 200: T2 Corporation Income Tax Return

Schedule 100 – Balance Statement Summary

Schedule 100 is a summary of the company’s balance sheet. Enter the total assets, total liabilities, and equity on this schedule. Make sure that you are recording the proper GIFI number with its matching account. If you have cash on hand account its GIFI number would be 1001.

Schedule 125 – Income Sheet Summary

Schedule 125 is a summary of the company’s income statement. Enter the total sales, operating expenses and net income on this schedule. This is where having a copy of your company’s income statement will come in handy. Similar to the balance sheet you will also have to provide the GIFI number. They will be listed at the bottom of the schedule with its corresponding account.

Wave Accounting is a free software designed for small business owners who want to maintain their own financial statements. By connecting your bank account to Wave, transactions will be automatically created for your business. All that is required is for you to categorize each transaction.

Schedule 50 – Shareholder Information

Input the name of each shareholder, their social insurance number, type of shares owned (common or preferred), and % of shares owned.

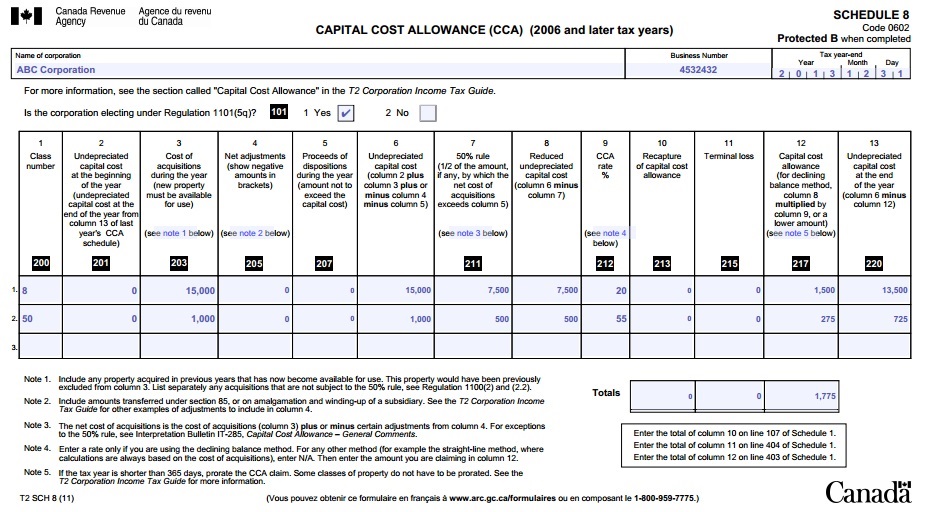

Schedule 8 – Capital Cost Allowance

Capital Cost Allowance (CCA), which is a tax deduction, represents the wear and tear of the company’s physical assets.

During the year, TCCI purchased furniture for $15,000 and computers for $1,000. These amounts should be entered in column 3 of schedule 8.

In column 12, capital cost allowance is calculated based on the depreciation rates shown in column 9 – 20% for furniture and 55% for computers.

Computers have a special capital cost allowance rate of 100% if they were purchased before February 2011. All other assets are subject to the ‘half year rule’, meaning that only half of the capital cost allowance that would otherwise be allowed, can be claimed in the year of acquisition.

As the chart above illustrates, the capital cost allowance rate for furniture is 10% in the year of acquisition instead of 20% (i.e. $1,500 of capital cost allowance on $15,000 of furniture purchases). The computer, since it was purchased during 2016 would also qualify for the half year rule. It would be amortized at a CCA rate of 27.5% (i.e. $275 of the capital cost allowance on the $1,000 computer purchase)

Schedule 1 – Net Income for Tax Purposes

On Schedule 1 you will calculate net income for tax purposes:

In the example used above, TCCI has net income for accounting purposes of $116,000, as per its income statement. This amount should be entered on line A (amount calculated on line 9999 from Schedule 125) of Schedule 1.

TCCI incurred $2,000 of meals and entertainment expenses during the year. Therefore, $1,000 of meals and entertainment expenses (half of which are non-deductible) are added back on line 121 of Schedule 1.

The capital cost allowance of $1,775 [calculated on Schedule 8] should be deducted on line 403 of Schedule 1.

After all of the add backs and deductions, the net income for tax purposes of TCCI is $115,225.

Other examples of non-deductible expenses that should be added back on Schedule 1 are:

- Golf dues

- Life insurance premiums

- Personal expenses, such as business clothing, or personal meals

- Sports clubs memberships

Schedule 3 – Dividends Paid to Shareholders & Dividends Received

Dividends paid by a corporation to a shareholder must be reported on box 500 of Schedule 3. Dividends are a common way of paying owner-managers, as opposed to salary. For more on whether to pay your self dividend or salaries read more from our article.

Dividends received by Canadian corporations and foreign corporations are also entered on this schedule through parts 1 and 2.

Note that dividends received from Canadian corporations are generally tax-free, meaning that the recipient corporation does not have to pay corporate income tax on those dividends. This is also true for foreign corporations owned by a Canadian corporation.

However, if your corporation owns less than 10% of the stock of a corporation from which it receives a dividend, then a special tax, known as Part 4 tax, will apply. Part 4 tax is equal to 33.33% of the dividend received.

For example, assume that your corporation owns 1000 Apple Shares and 3000 Google shares. Further assume that your corporation received a dividend of $20,000 in respect of its Google and Apple shareholdings.

Since your corporation’s ownership interest in the capital stock of Apple and Google is less than 10%, then Part 4 tax of $6,666.67 will apply.

Tip: Part 4 tax is refundable to your corporation. The refund is triggered when your corporation pays you a dividend. The refund rate is $1 of Part 4 tax for every $3 of dividends paid to you. Therefore, consider paying yourself a dividend in order for your corporation to receive a tax refund.

Schedule 11 – Transactions with Shareholders, Officers or Employees

This schedule is used to report transactions between the owner and his/her company. Examples of common transactions reported on Schedule 11 are:

1. Shareholder loans made to the corporation

2. Shareholder loans received from the corporation

3. Assets transferred by the shareholder to the corporation

4. A ‘Section 85 Rollover’ – complex transaction relating to asset transfers

Things you can expect to fill out on Schedule 11 are the relationship of the transaction, amount of the transaction, reimbursement, and whether section 85 applies to the asset transfer. For more information on Section 85 visit our article on Converting a Sole Proprietorship to a Corporation.

Schedule 24: First Year Filing Income Tax

If this is your first year filing your corporate income tax return you are required to complete Schedule 24, First Time Filer after Incorporation. Schedule 24 is to be completed after an incorporation, amalgamation or wind-up of a subsidiary into a parent.

Part 1: New Corporation

If you have incorporated your business in the 2016 tax year then you are required to complete part one of this schedule.

Part 1 requires the following information:

- Name of new corporation

- Business Number

- Fiscal year-end

- And type of operation (crown corporation, credit union, Insurance company, etc)

Part 2: Amalgamations

This section is only if you have amalgamated two or more corporations during the current tax year. If this section applies to you then you must name all previous corporations and their business numbers. This must be filed in the first year after the amalgamation.

Part 3: Winding Up a Corporation

If this is your first time filing after winding up a subsidiary corporation you must fill out part three. A wind up is when a business sells all of its assets with intention to pay off all creditors so it can dissolve its business. In this section you must name all subsidiary corporations that were wound up as well as their business number, start date of wind-up and end date of wind-up.

Schedule 200 – T2 Corporation Income Tax Return

Schedule 200, the T2 corporation income tax return, is an eight page form. The following information should be entered on this schedule:

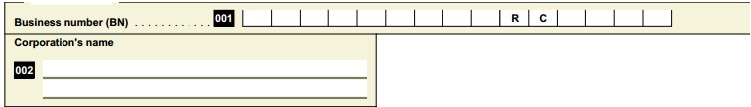

- On the first page of Schedule 200, the corporation’s legal name and business number are reported.

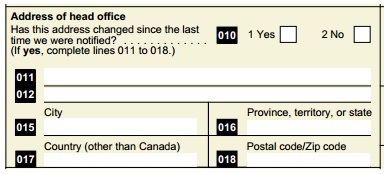

- On boxes 11 to18 of page 1, the address of corporation’s head office is reported.

- You do not need to enter the mailing address or the location of the books and records if they are the same as the head office’s address.

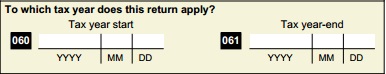

- The taxation year (e.g. January 1, 2016 to December 31, 2016) should be entered on boxes 60 and 61 of page 1.

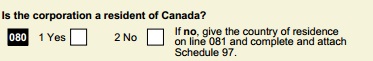

- On box 80, yes should be checked if your corporation is a resident of Canada.

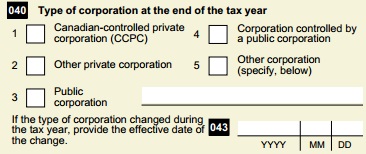

- On box 40, check one of the boxes for the type of corporation. Most small businesses in Canada should check box 1 for Canadian Controlled Private Corporation.

- On page two of Schedule 200, check the schedules that apply (see basic forms and tax schedules above)

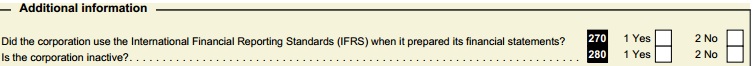

- On page three ‘Additional Information’, you should check ‘no’ to IFRS, check ‘no’ to inactive.

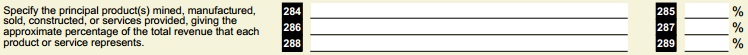

- On box 284 of page 3, the description of the services or goods sold by the corporation must be entered.

- The rest of schedule 200 [pages 4 to 8] is used to calculate tax. TCCI (which is a Canadian controlled private corporation) is entitled to the small business deduction for $19,465 (i.e. net income for tax purposes multiplied by 17%)

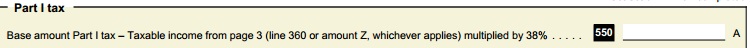

- The base amount of Part I tax for TCCI is $43,510 and this amount is entered on box 550. The base amount of Part I tax is calculated by multiplying net income for tax purposes by 38%.

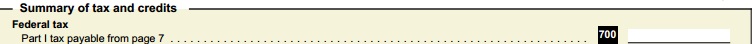

- After the reduction for the small business deduction and the federal tax abatement from the base amount of Part I tax, TCCI has Part I tax payable of $12,595 (box 700)

- On the last page of Schedule 200 (page 8), the provincial tax from Schedule 5 is entered on box 760. TCCI has provincial and territorial tax payable of $5,721.

- TCCI has a total balance owing (federal Part 1 tax payable for $12,595 plus provincial and territorial tax payable for $5,721) of $18,316.

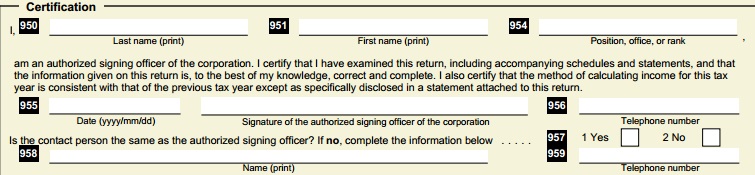

- On the very bottom of page 8 the corporation’s name, address, and telephone number, are reported. You must sign and date the corporation income tax return in the same area.

Additionally, if your corporation has engaged in any work related to research & development, you may be eligible for the lucrative SR&ED tax credit. To find out more, please consult our article on tax credits for technology companies in Waterloo. You can also refer to your video above on How to Prepare Corporation Income Tax Return or watch it on Youtube.

Disclaimer

The information provided on this page is intended to provide general information. The information does not take into account your personal situation and is not intended to be used without consultation from accounting and financial professionals. Allan Madan and Madan Chartered Accountant will not be held liable for any problems that arise from the usage of the information provided on this page.