An Accountant’s Tips for Cross Border Real Estate Investing

Allan Madan, CPA, CA

Investing in U.S. real estate offers a wealth of opportunities, from generating passive income to building long-term wealth. However, for Canadian investors, understanding the tax implications and choosing the right investment structure is critical. By strategically planning your investments with the help of a cross border accountant, you can navigate these complexities and make informed decisions.

This article explores key strategies, investment types, and cross border structural options for Canadians venturing into U.S. real estate, as recommended by a professional accountant.

Types of Real Estate Investments

Before diving into cross border real estate in the U.S., determine which investment strategy aligns best with your goals, skills, and resources. The three common approaches are rentals, flipping, and wholesaling.

Rentals

Purchasing a property to rent out is a strategy that generates passive income by allowing tenants to pay rent regularly while you retain ownership of the asset. This approach is ideal for accumulating wealth over time, especially when you outsource property management to reduce the ongoing effort required to maintain the rental. While rental properties provide stable, long-term returns, they require a significant upfront capital investment, which can be a barrier for some investors.

Flipping

Flipping involves acquiring properties, renovating them to add value, and selling them within a short timeframe, typically within a year, to generate a profit. This method offers the potential for higher profits compared to other investment types but requires a more significant level of hands-on involvement throughout the process. Flipping is the most capital-intensive real estate investment approach, demanding substantial upfront financial resources to cover purchase and renovation costs.

Wholesaling (Assignment Sales)

Wholesaling involves identifying underpriced properties, securing purchase agreements, and selling the rights to these agreements to another buyer in exchange for a fee. This investment strategy requires minimal upfront capital, making it an accessible option for those just starting in real estate investing. Success in wholesaling relies heavily on strong negotiation and networking skills to identify deals and connect with interested buyers effectively.

Consulting a cross border accountant can ensure your income is taxed efficiently on both sides of the border and that your deals are accurately reported and tax-efficient.

Choosing the Right Cross-Border Investment Structure

Selecting the right investment structure is crucial to limit liability, avoid double taxation, and optimize tax efficiency. Below are the most common options that our head accountant recommends when setting up a business to start investing in cross border real estate opportunities.

Sole Proprietorship

A sole proprietorship would be used if you chose to buy U.S. real estate in your own name. This structure is best for beginner investors, single-property rental investors, or wholesalers. The advantages are that setting up a sole proprietorship is a simple process with minimal costs, there is only one tax return to file for non-residents of the U.S., and this structure avoids double taxation since Canadian taxes are reduced by claiming foreign tax credits.

The disadvantage with this structure is that there is no liability protection, meaning that a tenant or contractor can sue you for damages. Considering that US citizens are typically more litigious than Canadians, this is a very important consideration. Any injury during renovation or during the tenant’s stay can be problematic, which is why we never recommend this structure for investors that plan to flip properties. Alternatively, you can purchase liability insurance to mitigate this, but there are also other structures that could be more beneficial depending on your situation.

Limited Partnership (LP)

A Limited Partnership (LP) would be set up in the United States and is ideal for investors who are pooling resources or managing rental properties.

The benefits of LPs are that the partners enjoy liability protection, meaning their risk is limited to the amount they have invested. LPs are also recognized as flow-through entities by both the IRS and the CRA, ensuring that income is only taxed once and avoiding double taxation. Lastly, they provide flexibility in profit distribution among partners, which can be tailored to individual arrangements.

The disadvantage is that a general partner is required to assume unlimited liability for the partnership’s obligations, although this risk can be mitigated by forming an LLC to fulfill this role.

The complex nature of the structure requires professional setup and involves additional compliance obligations.

Let’s look at an example of how a limited partnership would manage its taxes.

Wendy and Shelley are sisters that form a limited partnership to buy an apartment building in the U.S. Both sisters are Canadian tax residents and non-residents of the U.S. In this example, each sister invests $50K and owns 50% of the business, and they generate $100K in net profit for the year.

Wendy and Shelley will pay tax on their global income based on their Canadian marginal tax rates, and U.S. taxes based on the graduated tax rates.

Wendy’s Taxes:

| Profit | $50,000 | |

| U.S. Graduated Rate (15%) | $7,500 | |

| Canadian Marginal Rate (53%) | $26,500 | |

| Foreign Tax Credit | -$7,500 | |

| Total Tax Liability | $19,000 |

Shelley’s Taxes:

| Profit | $50,000 | |

| U.S. Graduated Rate (15%) | $7,500 | |

| Canadian Marginal Rate (35%) | $17,500 | |

| Foreign Tax Credit | -$7,500 | |

| Total Tax Liability | $10,000 |

Wendy and Shelley will get a K1 slip, known as a “partnership income slip” which they will then use to file a 1040NR form with the IRS (Internal Revenue Service). Proper reporting allows them to use the U.S. tax as a foreign tax credit and therefore avoid double taxation.

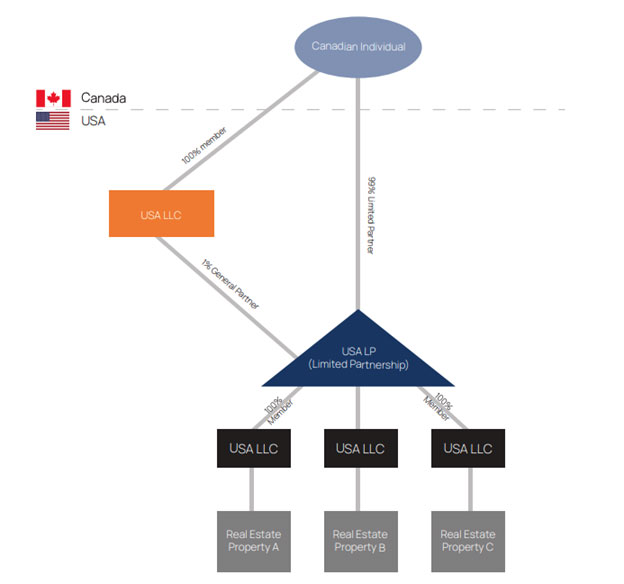

One nuance of the Limited Partnership is that by law, this arrangement requires a general partner. This person is responsible for decision making on behalf of the partnership and is the person or entity that assumes all risk in liability over and above the LP’s investment. Because of this (essentially unlimited liability), we recommend forming a U.S. LLC (Limited Liability Company) that owns 1% of the partnership. In this situation, the LLC is technically double-taxed, but only by 1% of the profits. See how this arrangement works in the diagram below.

Corporation

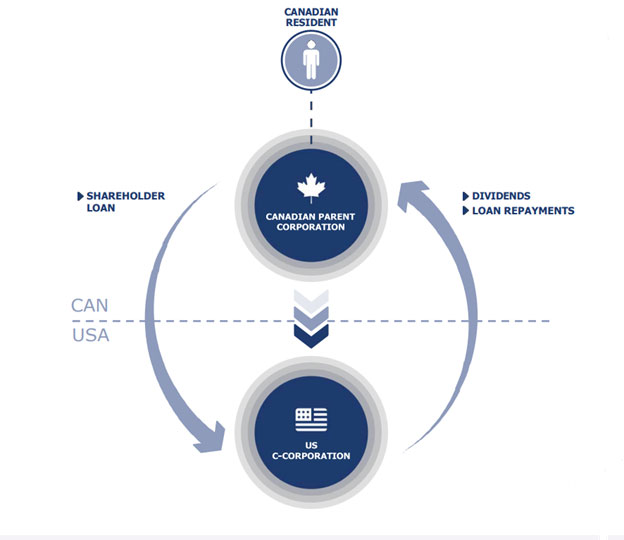

Lastly, the corporate structure we recommend for Canadians investing in cross border flipping or wholesaling is a US C-Corporation for its benefits of liability protection and scalability. We don’t recommend this structure for rental investors. Note that the shares of the US C-corporation should be owned by a Canadian holding corporation.

The pros are that a corporate structure allows for the deferral of personal income tax by retaining profits within the corporation. It also enables the accumulation of capital within the business, which can be reinvested into future deals and opportunities. When structured properly, it is not subject to double taxation, ensuring tax efficiency.

Meanwhile, this setup incurs higher costs, both for initial establishment and ongoing compliance, as it requires filing corporate tax returns in both the U.S. and Canada.

Let’s say Carrie’s U.S. C-corporation made a $100,000 profit from a house flip. Her U.S. C-corporation will pay a U.S. federal corporate income tax of $21,000 based on a 21% U.S. corporate tax rate. If the funds remain in the C-Corp, there is no further tax and that money can be used to buy another property or wholesale deal. Alternatively, if Carrie plans to bring money back into Canada, she will have to take the following steps:

| Step # | Description | Amount of Tax | Calculation |

| Step 1 | Pay 21% U.S. federal tax corporate tax on the $100K profit | $21,000 | $100,000 x 21% |

| Step 2 | Pay a 5% withholding tax to the IRS on the dividend distribution of $79,000 | $3,950 | $79,000 x 5% |

| Step 3 | The Canadian holding company receives a net payment of $75,050 | $0 | $79,000 – $3,950 |

| Step 4 | The Canadian holding company claims a 100% tax deduction for the entire amount of the dividend received | $0 | $75,050 – $75,050 |

| Step 5 | Carrie reports an ‘eligible dividend’ of $75,050 on personal tax return. If she has no other source of income, she will pay $2,000 of personal tax | $2,000 | Based on eligible dividend tax rates |

| TOTAL TAX BURDEN | $26,950 |

Common Tax Pitfalls for Canadians

Canadian real estate investors venturing into cross border markets must be aware of several tax pitfalls. First, avoid using U.S. LLCs for real estate investments, as the Canada Revenue Agency (CRA) does not recognize them as flow-through entities, which can result in double taxation.

Additionally, it’s essential to understand the implications of Tax on Split Income (TOSI), particularly when income splitting with family members. Investors should also be mindful of the litigious nature of U.S. practices, especially when engaging in rental or flipping strategies, as liability risks are higher. Lastly, Canadian investors cannot access the U.S. 1031 Exchange tax-deferral mechanism, so it’s crucial to plan exit strategies carefully to minimize tax burdens.

Benefits of Working With a Cross Border Accountant

Navigating U.S. tax laws as a Canadian investor can be overwhelming, but the guidance of a cross border accountant ensures compliance and maximized savings. We can help set up the optimal business structure, avoid double taxation through proper reporting, and leverage tax treaties and credits to reduce the overall tax burden.

Starting Your U.S. Real Estate Journey

New investors should weigh their budget, risk tolerance, and long-term goals before selecting an investment type and structure. For most beginners, starting with a sole proprietorship or limited partnership provides simplicity, liability protection, and tax advantages. As your portfolio grows, corporate structures may offer more scalability and tax deferral options.

By making informed decisions and seeking advice from a cross border accountant, Canadian investors can turn U.S. real estate into a profitable and tax-efficient venture.

Disclaimer

The information provided on this page is intended to provide general information. The information does not take into account your personal situation and is not intended to be used without consultation from accounting and financial professionals. Allan Madan and Madan Chartered Accountant will not be held liable for any problems that arise from the usage of the information provided on this page.