Canadian Tax Strategy Using Barbados & St. Lucia

Allan Madan, CPA, CA

In today’s global environment of tax transparency and regulatory alignment, entrepreneurs and consultants must structure their businesses with care. The goal is to achieve legitimate tax efficiency while maintaining full compliance with local and international laws. A proven strategy that meets this objective involves using a dual-jurisdiction structure incorporating entities in Barbados and St. Lucia.

This article explains the rationale, legal mechanics, and benefits of a Barbados–St. Lucia corporate setup. We will also walk through a hypothetical case study of a Canadian citizen who successfully executed this plan after relocating to Barbados.

Why Barbados and St. Lucia?

Barbados is widely respected for its stable legal system, extensive tax treaty network, and its commitment to OECD-aligned substance rules. The jurisdiction offers a competitive corporate tax rate between 1% and 5%, depending on global revenue. It also provides personal residency options, such as the Special Entry and Reside Permit (SERP) for high-net-worth individuals and the 12-Month Welcome Stamp for remote workers.

St. Lucia complements this strategy by offering a flexible corporate environment for holding companies. LLCs in St. Lucia that do not earn local income are exempt from tax and reporting. These entities can act as pass-throughs in many jurisdictions, providing operational simplicity and privacy for beneficial owners. When used together, these jurisdictions enable efficient cross-border structures for professionals, investors, and digital entrepreneurs.

How the Structure Works

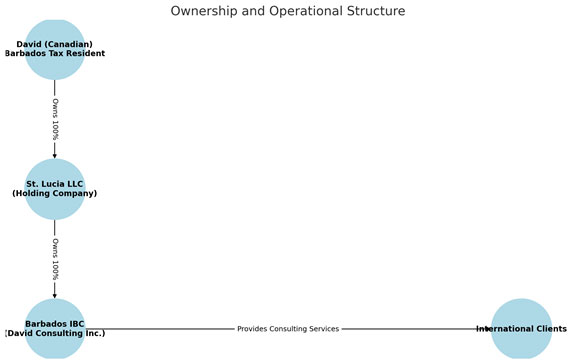

The typical structure involves two entities working in tandem. The Barbados IBC is the operating company that invoices clients, signs contracts, and runs day-to-day activities. It is subject to Barbados corporate tax, with rates starting at 1%. To qualify for this rate, the IBC must satisfy substance rules including local directorship, a registered office, and real business activity on the island.

The St. Lucia LLC acts as a holding company. It owns 100% of the shares of the Barbados IBC and serves as a conduit for dividends. St. Lucia imposes no tax on foreign-sourced income and has no filing requirements for such companies. Distributions from the St. Lucia LLC to the beneficial owner—if structured properly—can be received tax-free by a non-domiciled resident of Barbados.

Case Study (Hypothetical): Canadian Consultant Relocates to Barbados

Disclaimer: The following case study is a hypothetical scenario created for illustrative purposes only. It does not reflect the circumstances of a real client, and should not be construed as legal, tax, or financial advice.

David, a 38-year-old Canadian citizen, earns $300,000 per year providing virtual consulting services to clients in the U.S., U.K., and Singapore. In this fictional scenario, David decides in 2024 to relocate to Barbados to reduce his global tax burden while maintaining full legal compliance.

He is single with no spouse or dependents and takes all necessary steps to sever his Canadian tax residency—disposing of his home, canceling provincial health coverage, closing non-essential Canadian accounts, and filing a departure tax return. CRA recognizes his non-resident status.

In Barbados, David incorporates David Consulting Inc. as a Barbados IBC with the help of SG Global Consulting. The company becomes his sponsoring employer for a work permit, which allows him to legally work and reside on the island. He draws a modest local salary of BBD 80,000 (~CAD 54,000), which satisfies Barbados tax residency rules and is taxed at approximately 20% under the local personal tax regime.

To optimize the flow of retained earnings, a St. Lucia LLC is established as a holding company. It owns 100% of the Barbados IBC. David, in turn, owns the St. Lucia LLC directly (or optionally through a discretionary trust). The IBC earns $300,000 in gross income, deducts David’s salary and expenses, and pays tax at 1.5% on net profits. Dividends are then distributed to the St. Lucia LLC, which pays no tax. From there, David receives dividends personally. As a non-domiciled resident of Barbados, these foreign-sourced dividends are exempt from Barbadian tax as long as they are not remitted to a Barbados account.

SG Global Consulting (Barbados) Inc. played a key role in helping David implement this hypothetical structure effectively. Their services included incorporating the Barbados IBC, arranging for a resident director, registering a physical office, and preparing the local employment agreement needed to sponsor David’s work permit. They also facilitated the creation of the St. Lucia LLC and provided ongoing compliance support to meet Barbados’ economic substance requirements.

Clients seeking similar support can reach SG Global Consulting at:

SG Global Consulting (Barbados) Inc.

🌐 www.sggc.bb

✉ Gilles Gosselin, M.B.A., LL.M – gg@sggc.bb

✉ Rebecca Durant, LLB (Hons.), Attorney-at-Law – rmd@sggc.bb

Ownership and Operational Structure

Summary of Tax Treatment

| Income Component | Jurisdiction | Tax Treatment |

| Salary (BBD 80,000) | Barbados | Taxed at ~20% personal rates |

| IBC profit (after expenses) | Barbados | Taxed at 1.5% corporate rate |

| Dividend to St. Lucia LLC | St. Lucia | Not taxed |

| Dividend to David (non-domicile) | Barbados | Tax-free if not remitted |

| Canadian tax | Canada | Not applicable (David is a non-resident) |

Compliance Considerations

This structure is fully compliant when implemented correctly. The Barbados IBC must meet economic substance requirements, such as having a local director, physical office, and tax filings. All intercompany charges between the IBC and the LLC should be arm’s length and documented. Canadian Controlled Foreign Corporation (CFC) rules and the General Anti-Avoidance Rule (GAAR) must be considered for former Canadian residents. Lastly, care should be taken to manage the repatriation of funds and avoid triggering Canadian or Barbadian tax unnecessarily.

Final Thoughts from Allan Madan, CPA

The Barbados–St. Lucia strategy is not a one-size-fits-all structure. But for the right client—such as consultants, SaaS founders, digital entrepreneurs, and investors—it can be a powerful vehicle for global tax optimization, asset protection, and international growth. With professional guidance, this structure can be executed in a compliant and sustainable way.

If you’re thinking about international expansion, leaving Canada permanently, or streamlining your global tax profile, contact me for a consultation. Let’s explore whether this structure fits your long-term vision.

Footnote

This article contains a fictional case study for illustrative purposes only. It does not describe a real individual or client of Madan Chartered Accountant. Readers should seek personalized advice before acting on any tax planning strategies discussed.

Disclaimer

The information provided on this page is intended to provide general information. The information does not take into account your personal situation and is not intended to be used without consultation from accounting and financial professionals. Allan Madan and Madan Chartered Accountant will not be held liable for any problems that arise from the usage of the information provided on this page.