Filing Your T1? Don’t Miss These 2024 Tax Return Updates

Allan Madan, CPA, CA

As tax season approaches, it’s essential to stay informed about the changes and updates that may impact your 2024 tax return. From federal tax brackets and RRSP contribution limits to automobile deductions and updates to capital gains inclusion rates, this article breaks down the key changes and their implications for individuals and in some cases, sole proprietors.

Understanding these updates will not only help you prepare your taxes more accurately but also allow you to maximize your potential savings and deductions.

Federal Tax Rates for 2024 Tax Return

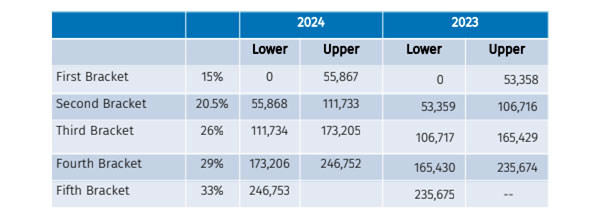

The federal tax rates on income have been adjusted for 2024 using an indexation factor of 4.7%, reflecting inflation adjustments made by the government. The chart below compares the upper and lower limits for each tax bracket in 2023 to 2024.

For those filing their 2024 T1 tax return this April 2025, it’s important to know about these changes to accurately calculate your taxes payable. It’s also important to note that income is marginally taxed, meaning that the first $55,867 you earn is taxed at 15%, then income over that up until $111,733 is taxed at 20.5%, and so on.

For example, if you earned $115,000 in 2024, your federal income tax calculation would look like this on your 2024 return:

| Bracket | Tax Rate | Tax Payable |

| $0 to $55,867 | 15% | $8,380.05 |

| $55,868 to $111,733 | 20.5% | $11,452.53 |

| $111,734 to $115,000 | 26% | $849.42 |

| Total: 20,682 |

The total federal income tax payable on $115,000 of taxable income is $20,682.

The expanded brackets may allow for a lower effective tax rate if your income has not significantly increased. Provincial rates have changed as well.

Capital Gains Deduction for 2024 Tax Return

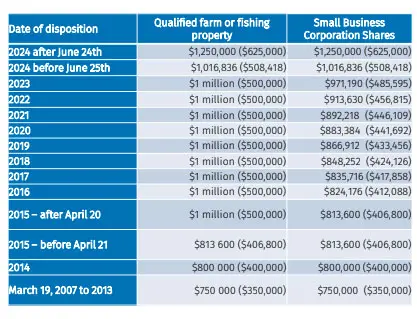

The chart below highlights the changes in the capital gains deduction available for both Qualified Farm or Fishing Property and Small Business Corporation Shares in Canada over time.

The deduction amounts vary based on the date of disposition of the assets, reflecting legislative updates and changes to tax laws made on June 24th, 2024. For sales after June 24, 2024, the lifetime capital gains deduction has increased to $1,250,000, whereas sales before June 25, 2024 had a lower deduction, capped at $1,016,836. If you’ve sold shares in 2024 or are planning to in the near future, ensuring accurate reporting of capital gains and claiming the correct deduction is critical.

Automobile Deduction Limits for 2024 Tax Return

Automobile deductions are tax provisions that allow individuals and businesses to claim certain vehicle-related expenses incurred to perform employment or business-related duties. Eligible expenses include vehicle capital costs, leasing costs, fuel, insurance, maintenance, and operating costs.

However, these deductions are subject to annual limits set by the government to prevent excessive claims. The rules differ based on whether you own, lease, or use a company-provided vehicle.

It’s also important to note that employees hoping to get a tax deduction for vehicle expenses will need to fill in form T2200 – Declaration of Conditions of Employment – and have it signed by their employer before submitting it to the CRA.

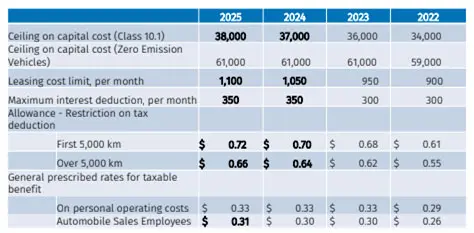

The chart below outlines the Automobile Deduction Limits for tax purposes over the years 2022–2025. These changes affect the maximum amounts deductible and prescribed rates for taxable benefits, crucial for individuals and businesses to track when filing taxes.

Key Definitions:

- Ceiling on Capital Cost: The ceiling on capital cost is the maximum value that can be depreciated for tax purposes when purchasing a passenger vehicle for business or employment use. It sets a limit on how much of the vehicle’s purchase price is eligible for depreciation (or capital cost allowance, CCA). This deduction is available to sole proprietors and employees who have purchased a vehicle for their business or to carry out their duties of employment.

- Class 10.1 Vehicles: Regular, gas-powered vehicles having a purchase price of $38,000 or higher (as of 2025). Only 30% of the purchase price (up to $38,000) can be written off as depreciation each year.

- Zero-Emission Vehicles: The ceiling for zero-emission vehicles purchased in 2024/2025 is $61,000. 75% can be written off as depreciation in the year the vehicle is purchased and 30% in each subsequent year.

- Leasing Cost Limit: The maximum monthly lease amount deductible from income for vehicles leased in 2025 is $1,100.

- Maximum Interest Deduction: The maximum interest deductible for a financed vehicle.

- Vehicle Allowance: It allows an employee or small business owner to receive a tax-free monthly allowance at the rates above based on the amount they travelled for work. Learn more about car allowances in our article, Understanding Car Allowances.

If you’ve incurred vehicle-related expenses in 2024, make sure you apply the correct limits and allowances. Zero-emission vehicles, in particular, have unique tax advantages to consider. Consult a tax advisor if these rates apply to your situation to maximize allowable deductions!

Enhanced Basic Personal Amount

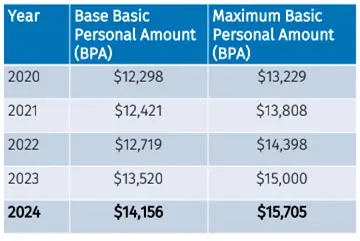

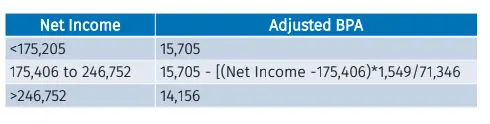

The Basic Personal Amount (BPA) is a non-refundable tax credit that all Canadian taxpayers can claim on their income tax return. It represents a portion of your income that is exempt from federal income tax. The Enhanced BPA is an incrementally increasing adjustment to this amount, introduced by the federal government in 2020 to provide greater tax relief for middle-income earners. The enhancement changes gradually over time and is tied to your net income. The rates and adjustments are noted in the charts below.

The base BPA applies to all taxpayers, regardless of income, however, taxpayers with higher incomes (above the threshold) are only eligible for the base BPA of $14,156 in 2024. The BPA directly reduces the amount of federal income tax owed, and targets low- and middle-income Canadians, providing progressive tax relief.

CPP Rates

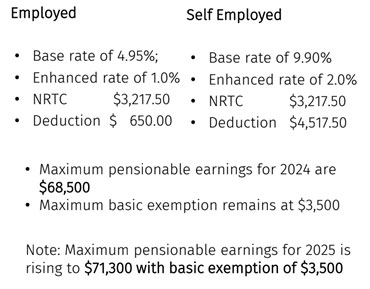

The CPP (Canada Pension Plan) rates refer to the contribution rates that employers, employees, and self-employed individuals in Canada are required to pay into the Canada Pension Plan. The CPP is a public retirement benefit program that provides pension income and disability benefits to individuals when they retire, become disabled, or die.

The image below outlines the rates for employees and self-employed people for 2024.

Employees and employers each contribute a percentage of the employee’s earnings to the CPP. For self-employed individuals, they pay both the employee and employer portions. The maximum basic exemption is $3,500 – meaning that anyone earning under $3,500 will not make CPP contributions. The maximum pensionable earnings for 2024 is $68,500. This means earnings over $68,500 do not require CPP contributions.

Additionally, the CPP enhancement was established in 2019 and was designed to increase the amount of money that retirees receive. The enhancement has created a second earnings ceiling called the Year’s Additional Maximum Pensionable Earnings (YAMPE). The YAMPE for 2024 is $73,200.

How it works is that employees and employers contribute an additional 4% on earnings between the Year’s Maximum Pensionable Earnings (YMPE) and the YAMPE, and those that are self-employed contribute an additional 8%.

Here is an example calculation:

| Self Employed Income | $75,000 | |

| Base Premium 9.9%*(68,500-3,500) | $6,435 | |

| CPP Enhancement 2%*(68,500-3,500) | $1,300 | |

| CPP Enhancement 8% (73,200-68,500) | $376 | |

| Total CPP Premiums | $8,111 |

RRSP Limits

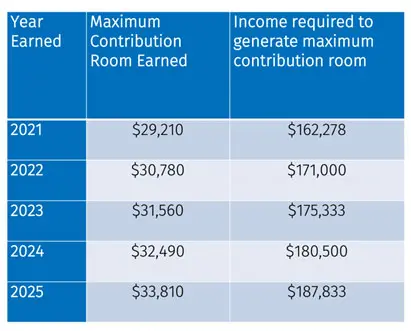

RRSP limits refer to the maximum amount of money you can contribute to your Registered Retirement Savings Plan (RRSP) each year and claim a tax deduction for the amount contributed. RRSPs are tax-advantaged savings accounts designed to help Canadians save for retirement by allowing contributions to grow tax-free until they are withdrawn. Your RRSP contribution is tax deductible and is reported on your 2024 T1 tax return. The chart below shows maximum contribution limits from 2021 to 2025.

The RRSP contribution limit is based on 18% of your earned income from the previous year, up to a maximum dollar limit set by the Canada Revenue Agency (CRA). The maximum dollar limit in 2024 is $31,560 (i.e. $175,333 x 18%). For example, if you earned $100,000 in 2023, you could contribute up to $18,000 to your RRSP in 2024.

Any unused contribution room from prior years is carried forward indefinitely, increasing your allowable contributions for the current year. However, contributions exceeding your limit by more than $2,000 are subject to a 1% monthly penalty tax until the over-contributed amount is withdrawn or adjusted.

TFSA Contribution Limits

The Tax-Free Savings Account (TFSA) contribution limit is the maximum amount you can contribute to your TFSA in a given year. TFSAs are savings and investment accounts that allow your contributions to grow tax-free, and you can withdraw funds without being taxed on the growth or the withdrawals. Each year, the Canadian government sets a specific dollar amount as the annual contribution limit. In 2024 and 2025, the limit is $7,000.

The total available contribution room includes unused contribution room from previous years, the current year’s contributions, and room restored from withdrawals in the previous year. Additionally, if you do not use your full contribution room in any given year, it carries forward indefinitely.

Proposed Changes to Capital Gains Inclusion Rate

Along with other changes made with Canada’s 2024 Budget, the capital gains inclusion rate has also been updated. The capital gains inclusion rate determines the percentage of a realized capital gain that must be included in your taxable income for a given year. For over 20 years, this rate was 50%, however for any capital gain realized on or after June 25th, 2024, the capital gains inclusion rate has increased to two-thirds (⅔). Read more about the 2024 capital gains tax changes in this article.

Employee Stock Option Deduction

The employee stock option deduction in Canada is a tax benefit that provides favorable tax treatment for employees who receive stock options as part of their compensation. The 2024 changes are related to the proposed amendments to the inclusion rate; the stock option deduction will be reduced from 1⁄2 of the benefit to 1/3 for securities disposed of after June 24, 2024.

How it works is that the stock option benefit is priced at the fair market value of the stock on the date of exercise or purchase in excess of the purchase price. For example, let’s say Shreya has the option to purchase 1,000 shares of stock in their company at $1/share. When Shreya purchases the stock, it is trading at $10/share. This would mean Shreya has a benefit of $9,000:

| Trading Price | $10 | |

| Purchase Price | $1 | |

| Benefit Amount/Share | $9 | |

| Benefit for 1,000 shares | $9,000 | |

| Deduction Before June 24 (50%) | $4,500 | |

| Deduction After June 24 (33%) | $2,970 |

Form Changes

You’ll also notice that there have been some changes to the T1 tax return forms for 2024. There are dozens of updates, but we’ll list some of the most commonly used ones here:

- Form T2200: The Home Office Expense Deduction

- There have been some clarifications to make this form easier to fill out.

- Section 67.7: Limitations on Expenses Related to Short Term Rentals

- This applies to Airbnb, VRBO and similar properties. One of the main changes is that if there is a city by-law preventing you from hosting a short term rental, the CRA won’t accept expenses for it.

- Refer to form T777 to see the formula for expenses and complete the calculation.

- FHSA: First Home Savings Account

- There have been significant changes to the form, all of which you can find on the CRA website. One important thing to note is that you now need to report contributions to the FHSA on Schedule 15 of your 2024 tax return.

Final Thoughts

There have been several adjustments to rates, deductions, and limits that will impact your 2024 tax return. If you’re feeling overwhelmed by all of these changes, reach out to our team and someone will be happy to help you navigate your 2024 tax return and make the most of available tax benefits.

Disclaimer

The information provided on this page is intended to provide general information. The information does not take into account your personal situation and is not intended to be used without consultation from accounting and financial professionals. Allan Madan and Madan Chartered Accountant will not be held liable for any problems that arise from the usage of the information provided on this page.