How Can I Reduce My Taxes in Canada?

Allan Madan, CPA, CA

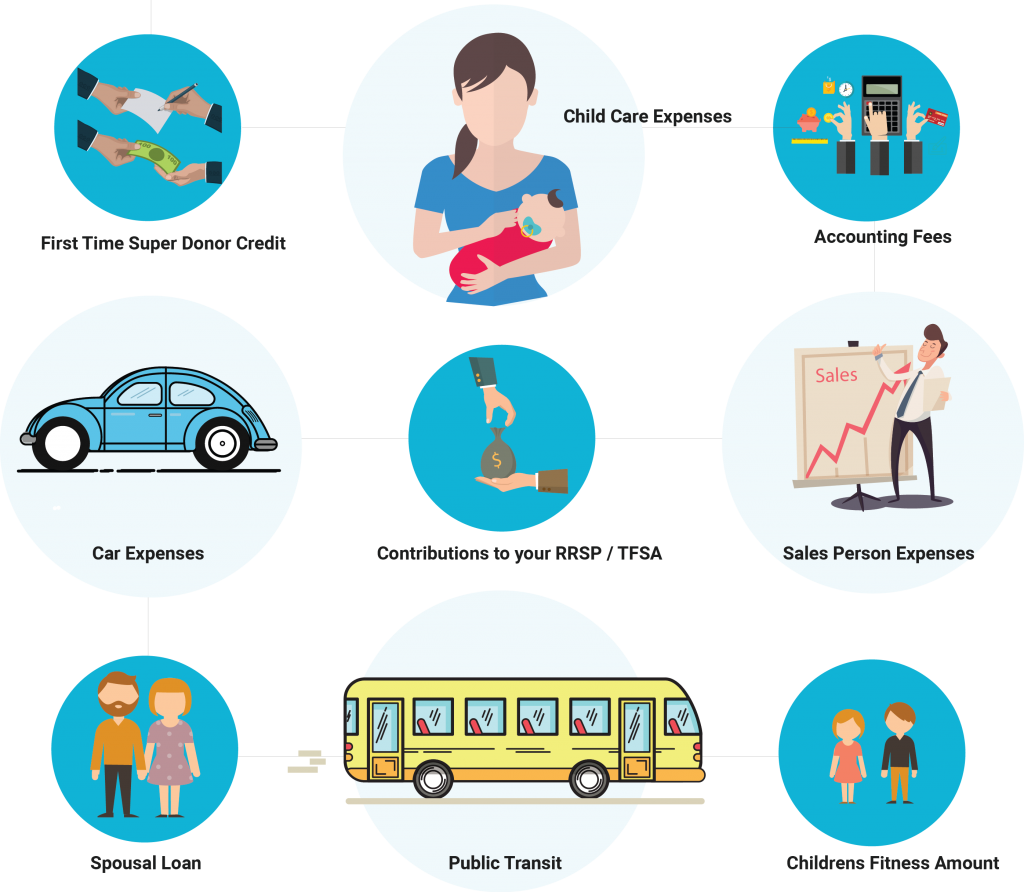

You may not be able to avoid your taxes, but you can take advantage of tax tips that will help you lower your tax bill on th April 30th, the due date for personal tax returns in Canada. Learn how to reduce income taxes every year by applying these 10 tax tips.

1. First time donor super credit

This super credit is only available between the years of 2013-2017.

A first time donor will be allowed to deduct 40% of donations $200 and under and 54% for donations over $200 without exceeding the maximum of $1000. To qualify as a first-time donor, you or your spouse must not have claimed the charitable donation tax credit in any of the previous 5 tax years.

For more information visit the CRA website to see how this super credit can reduce your taxes.

2. Childcare expenses

Childcare expenses include, but are not limited to, fees paid to a babysitter or nanny, daycare fees, costs for an after school program, PLASP fees, etc. They are deductible by the lower-income spouse, even if the higher income spouse paid for the childcare costs.

The maximum amount of childcare expenses that can be claimed is $11,000 for each child Born in 2015 or earlier and $8,000 for each child born in 2009 or later.

3. Accounting fees

You can minimize your taxes in Canada, by deducting fees paid to your accountant for preparing your individual income tax return. The accounting fees paid may be deducted from investment income, rental income, or business income reported on your tax return.

In all other cases, accounting fees are non-deductible.

4. Salespersons expenses

As a salesperson, you can deduct any reasonable expense that you incurred for the purpose of earning commission income.

To support your expense deductions, you must complete form T2200, Declaration of Conditions of Employment, and be required to pay for expenses related to your sales activities, as a condition of your employment.

5. Car expenses

Deducting car expenses is another answer to “How can I decrease my Canadian taxes?”

If you are required to use your personal car to carry out your employment duties, you can deduct expenses related to your car or vehicle. However, you must have a completed form T2200, Declaration of Conditions of Employment, and be required by your employment contract to use your personal automobile.

Only the business use portion of your car expenses can be deducted on your personal income tax return, which includes:

- Insurance

- Repairs and maintenance

- Lease costs (to a maximum of $800 + taxes)

- Capital cost allowance (i.e. tax depreciation, at a rate of 30% per year)

- 407 charges

- Parking fees

For information on whether it’s better to lease or buy a car for tax reasons, see Toronto Accountant Discusses Leasing vs. Buying Car

6. RRSP

Contributions made to an RRSP are deductible from your income. The maximum amount that you can contribute to an RRSP for 2016 is $25,370.

The 2016 RRSP contribution limit is calculated as follows: (18% x 2016 earned income, plus any unused RRSP contribution room from prior years).

Any income earned inside an RRSP is tax free. However withdrawals from an RRSP are taxable to you.

If you’d like to know whether a TFSA or RRSP is better for you, see TFSA vs RRSP – Chartered Accountant Toronto Discusses Pros and Cons

7. TFSA

To reduce your taxes in Canada, consider contributing to a tax free savings account (TFSA). A TFSA is an account in which any investment income earned is not subject to income tax. Unlike an RRSP, withdrawals from a TFSA are not taxable.

Stocks, bonds, mutual funds, and high-interest savings accounts can all be held inside a TFSA.

In addition, the maximum annual contribution limit to a TFSA is $5,500 (2016).

Note that contributions made to a TFSA are non-deductible.

For further information on TFSA’s, see the Canada Revenue Agency’s website and also read TFSA vs RRSP – Chartered Accountant Toronto Discusses Pros and Cons

8. Spousal loan

Another way to lessen your tax bill is by making a loan to your spouse at the Canada Revenue Agency’s prescribed rate of interest, which is currently 1% January 1, 2016.

Your spouse could invest the loan proceeds in business, high-interest bearing investments, stocks, real estate, etc., and any income generated from those investments would be included in your spouse’s taxable income.

The optimal amount of a spousal loan is equal to the amount that would equalize you and your spouse’s taxable incomes, after taking into account the investment income expected to be generated on the investments made from the loan proceeds.

Making a spousal loan to a spouse who is in a lower income tax bracket is an excellent income splitting strategy.

9. Children’s Fitness Amount

The children’s fitness tax credit, a.k.a. children’s fitness amount is a tax credit available to Canadian taxpayers who enroll their children in a physical activity program.

The tax credit is calculated as 15% of the amount paid for a physical activity program. The maximum credit that can be claimed is $500 if your child is under 16.

The receipt for your child’s physical activity program should say whether the program qualifies for the children’s fitness tax credit. Note: This credit will no longer be available in 2017.

10. Public transit amount

As a Canadian taxpayer, you can claim a tax credit, known as the public transit tax credit, for amounts spent on monthly or yearly public transit passes. Eligible passes must be for one of the following:

- Busses

- Streetcars

- Subways

- Trains

- Ferries

11. Frequently Asked Questions on “How can I reduce my taxes in Canada?”

A) Question: Can I claim parking fees on my tax return?

Yes, you can claim parking fees on your tax return, under certain circumstances, including:

- You are self-employed and earned business income

- You are an employee and paid for parking to visit a client, supplier, or in connection with your employment duties. Amounts paid for parking at your place of work are nondeductible.

- You earned rental income during the year and were required to pay for parking in connection with your real estate activities

B) Question: Can I deduct interest paid on a loan to purchase stocks or other income-producing investments?

Yes, you can deduct interest paid on a loan to purchase stocks or other income-producing investments. The interest paid should be deducted on Schedule 4 of your personal tax return.

For more information on tax efficient investing, please see How Do I Save Tax in Canada by Accountants in Oakville

C) Question: Can RRSP contributions reduce my income tax bracket?

Yes, RRSP contributions can reduce your income tax bracket. The amount of RRSP contributions that you must make in order to reduce your income tax bracket is equal to Your taxable income before RRSP’s minus the threshold for the next lowest tax bracket.

To find out what the threshold is for each income tax bracket, see What are the income tax rates in Canada for 2016?

D) Question: Which employment expenses can I deduct to reduce my employment income for tax purposes?

There are many employment expenses that you can deduct, as an employee, on your personal income tax return, including:

- Travel expenses (hotels, air fare and meals)

- Car expenses

- Office rent

- Union and professional dues

- Home office expenses

- Cost of supplies (includes cell phone air time and long distance charges)

- Salary paid to an assistant

For more information on deducting employment expenses, see How Do I Save Tax in Canada by Accountants in Oakville?

E) Question: I’m self-employed. How do I reduce my income taxes in Canada?

If you are self employed in Canada, there are many ways to reduce your income taxes in Canada, especially through tax write-off’s. For more information on reducing tax for self employed individuals, see How to save taxes for self employed in Canada?

F) Question: Are there ways to reduce corporate taxes in Canada?

Yes, there are many ways to reduce corporate taxes in Canada. For the best ways to reduce corporate taxes, watch my video How to save corporate taxes in Canada. Also, read my article 10 Best Tax Tips for Business Owners

Disclaimer

The information provided on this page is intended to provide general information. The information does not take into account your personal situation and is not intended to be used without consultation from accounting and financial professionals. Allan Madan and Madan Chartered Accountant will not be held liable for any problems that arise from the usage of the information provided on this page.