How to Prepare a T5 Slip

Allan Madan, CPA, CA

A T5 slip reports dividends paid by a Canadian corporation to its shareholder(s). In order to prepare a T5 slip, you must follow these 8 easy steps below.

What is a T5 Slip?

A T5 slip reports dividends paid by a Canadian corporation to its shareholder(s).

Preparing a T5 Slip

In order to prepare a T5 slip, you must follow these 8 easy steps.

Step 1:

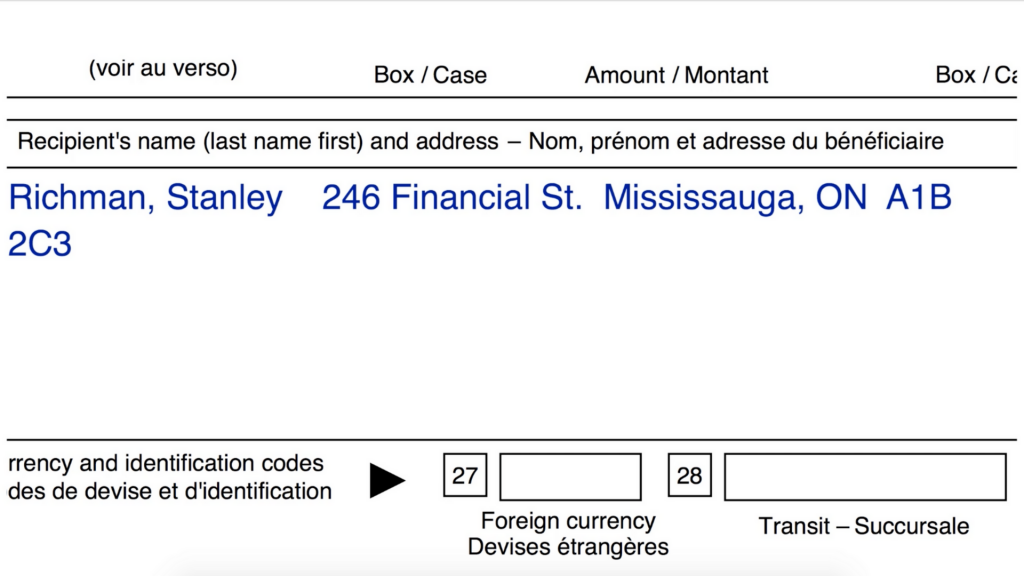

Fill in recipient’s first name, last name, and address. The recipient is the individual receiving the dividend.

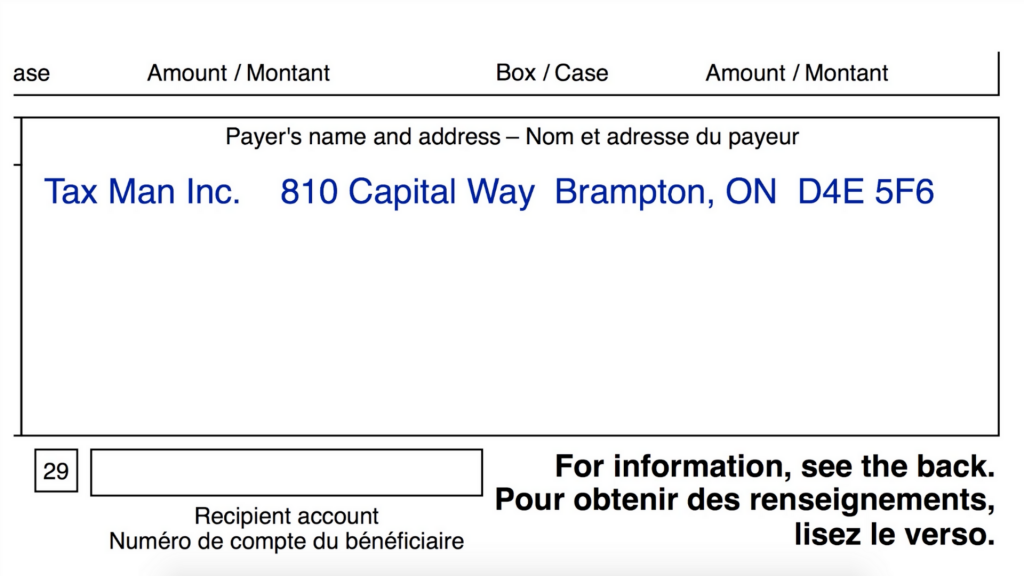

Step 2: Fill in the payer’s name and address. The payer is your corporation.

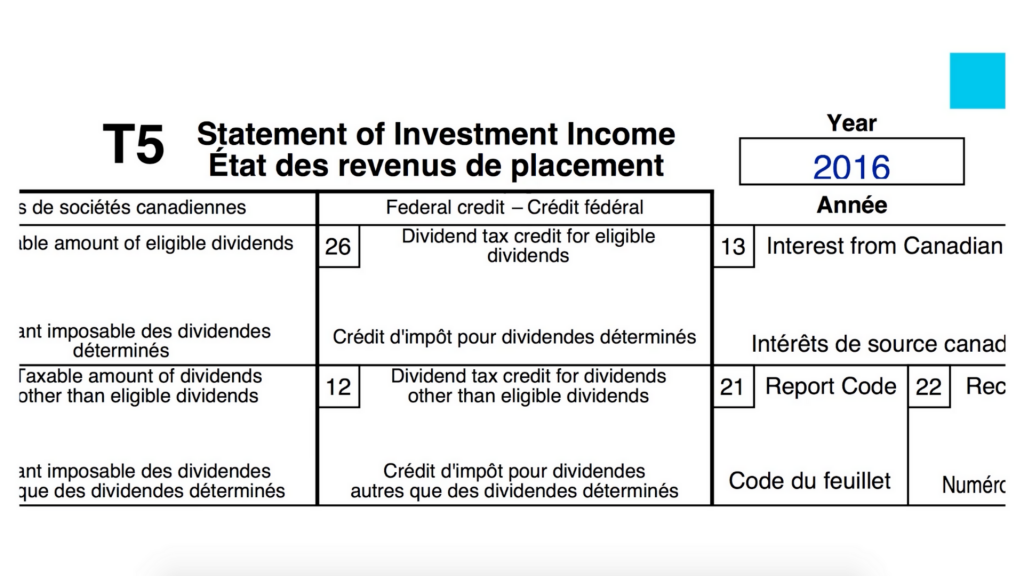

Step 3: Write the year in which the dividend was received, e.g. 2016.

Step 4: Determine if the dividend paid is an eligible dividend or a non-eligible dividend. An eligible dividend is paid from corporate profits in excess of $500,000. Eligible dividends have a preferential or lower tax rate. A non-eligible dividend is paid from corporate profits below $500,000. Most small businesses in Canada pay non-eligible dividends.

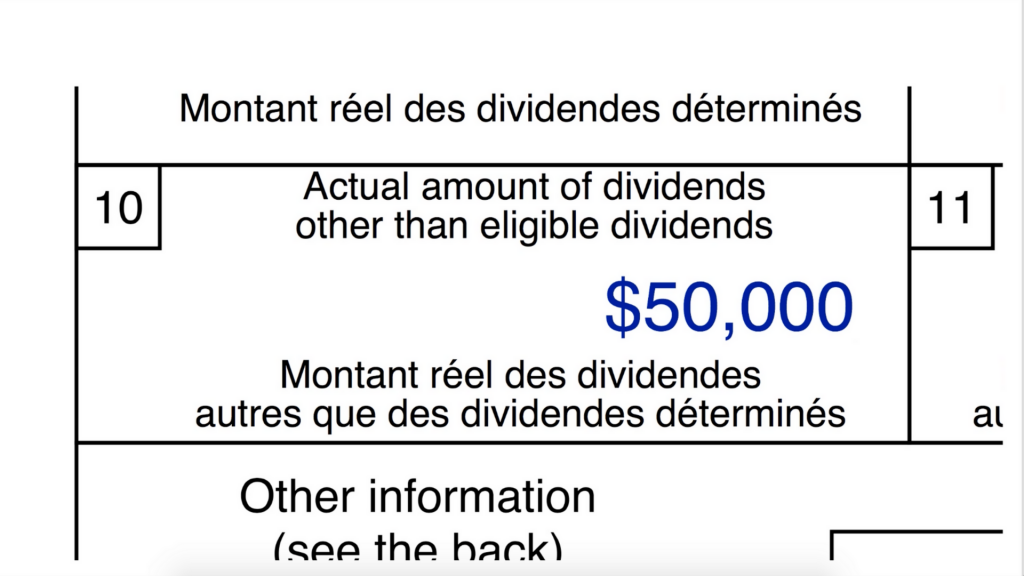

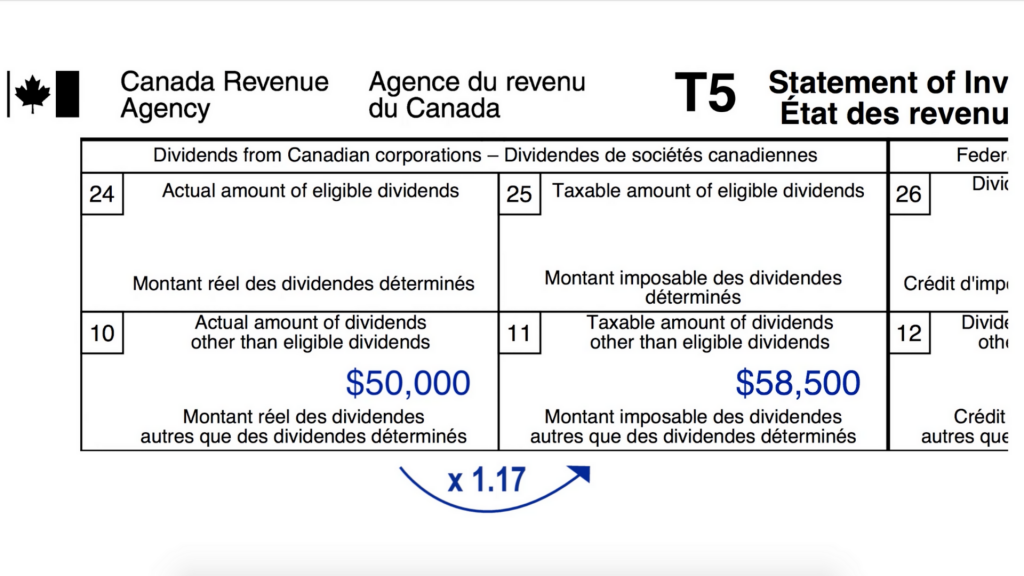

Step 5: Enter a number of dividends that you received in the calendar year (January 1 to December 31) in either box 24 for eligible dividends or box 10 for non-eligible dividends. For this example, assume that you received $50,000 of non-eligible dividends from your corporation in the 2016 calendar year.

Step 6: Enter a number of taxable dividends received in box 11. This is a formula and is calculated as follows: Actual Amount of Dividends (e.g. $50,000) multiplied by a factor of 1.17 is equal to the taxable amount (e.g. $58,500). On your personal tax return, you will include the taxable amount of dividends in your taxable income.

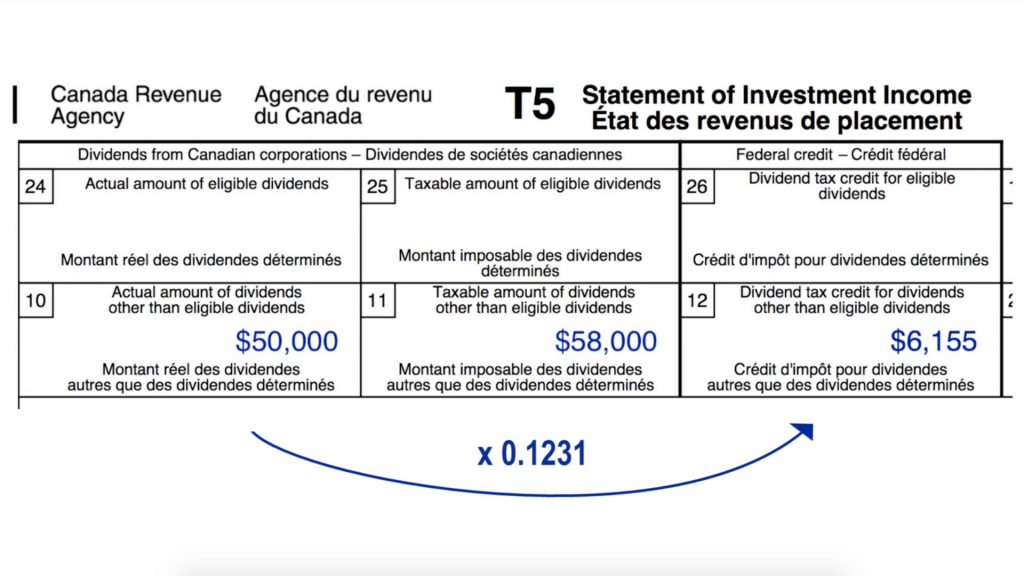

Step 7: Enter the amount of the dividend tax credit in Box 12. This is a formula and is calculated as follows: Actual Amount of Dividends (e.g. $50,000) multiplied by a factor of 0.1231 is equal to the dividend tax credit (e.g. $6,155). You can claim this credit on your personal tax return to reduce your taxes payable for the year.

Step 8: Complete the T5 summary. The T5 summary adds up all of the figures reported on each T5 slip. A corporation may issue multiple T5 slips if it has multiple shareholders. Remember to write the year (e.g. 2016) and your company’s business number on the T5 summary form.

Disclaimer

The information provided on this page is intended to provide general information. The information does not take into account your personal situation and is not intended to be used without consultation from accounting and financial professionals. Allan Madan and Madan Chartered Accountant will not be held liable for any problems that arise from the usage of the information provided on this page.