Transferring Business to Family Member in Canada

Allan Madan, CPA, CA

As a baby-boomer coming close to retirement, you may consider transferring your business to a loved one in the future. Here are a few simple tips to get you started.

Mistakes You Can Make When Transferring a Business

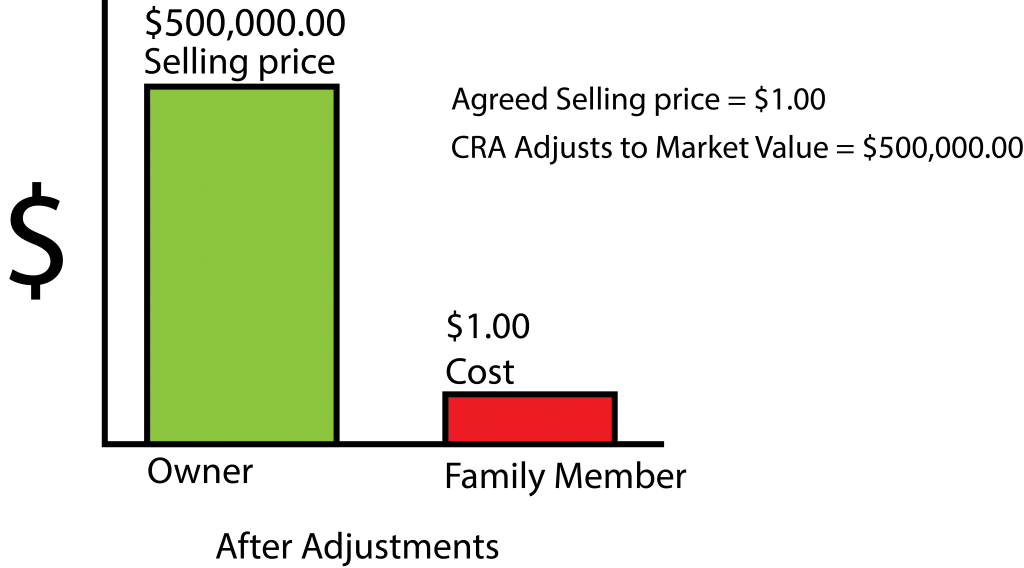

The biggest mistake that business owners make is selling a business to their family members for a nominal value, such as $1. If it were that simple, everyone would do it. However, there are significant, negative consequences for selling your business at $1, when it’s worth a lot more.

For example, let’s assume that your business is worth $500,000 and that you sold it for $1 to your adult child. As a result of selling your business for less than its actual value, the Canada Revenue Agency (CRA) will reassess the selling price to the fair market value of your business.

To determine fair market value of your business, the CRA will evaluate:

Once the CRA has completed their evaluation of your business, they will re-adjust the selling price from $1 to $500,000, and will levy capital gains tax on the sale.

To make matters worse, your adult child will not receive an upward adjustment in the cost of the shares that he/she purchased from you. Essentially, instead of $500,000, the cost of the shares belonging to your adult child will still be $1. If your adult child decides to sell the family business later in life, capital gains tax will be levied again.

Use an Estate Freeze

The correct method to transfer your business to a family member in Canada is to utilize an Estate Freeze.

Using an Estate Freeze will allow you to:

• Transfer your business to family members without incurring any income tax whatsoever;

• Retain control of your business after the transfer; and

• Have a steady stream of retirement income

How to Implement an Estate Freeze

Step 1: Create a Family Trust

A Family Trust is a legal document which states that the shares of your business are to be held by the Family Trust on behalf of your loved ones. The main reason a Family Trust is used in an Estate Freeze is to allow you to retain control over your business, even after you have transferred it to your family members.

For instance, imagine that you sold a multi-million-dollar business to your 19-year-old son without a Family Trust. Your son may say, “Mom and dad, thanks for giving me your company. You no longer have control, so I’m going to buy a Ferrari and squander all of the money.”

Step 2: Cancel your old shares in your company in exchange for new preferred shares

Preferred shares are fixed in value, and are equal to the fair market value of your business immediately before the transfer of your business to your family members. Dividends should be paid on your preferred shareholdings, in order to ensure that you have a steady stream of income during your retirement years.

Step 3: Issue common shares in your company to your newly created Family Trust

This will allow the future growth value of your family business to accrue to your Family Trust.

Conclusion

You must implement an Estate Freeze in order to transfer your business over to a family member in Canada. It will avoid any income tax on the transfer of your business to your loved one and allow you to retain control of your business through the use of a family trust. This will also ensure a steady stream of retirement income for you in the long run.

Disclaimer

The information provided on this page is intended to provide general information. The information does not take into account your personal situation and is not intended to be used without consultation from accounting and financial professionals. Allan Madan and Madan Chartered Accountant will not be held liable for any problems that arise from the usage of the information provided on this page.