Introductory guide to business taxes for the self-employed.

Allan Madan, CPA, CA

Find out how to complete form T2125, the Statement of Business Activities Part 1 in 6 easy steps. This is meant for self-employed individuals who would like to complete their tax return independently on specific sections, including home-office expenses, vehicle expenses, and Capital Cost Allowance.

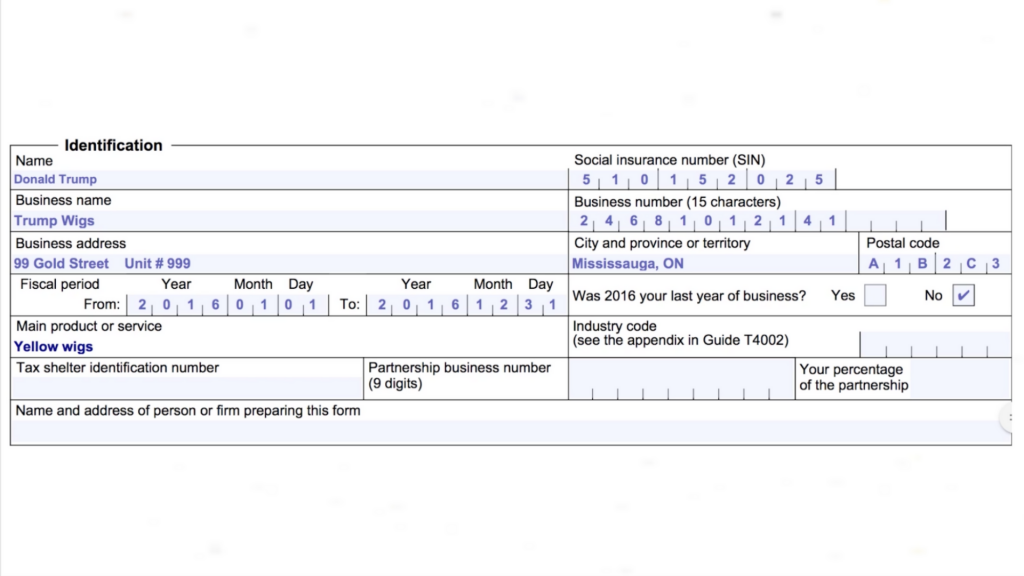

Step 1: Complete the Identification Area. Enter the following information:

- Your name

- Enter your social insurance number.

- The name of your business. If you operated under a name other than your own, write it here.

- If you have a business number issued by the CRA, enter it here.

- Enter the address of the business.

- Enter the start date and end date of the business’s tax year. This is generally from January 1 to December 31. If this is your first business, enter the date on which your business commenced.

- Indicate whether the 2016 year was your first year of business. In this example, I am going to assume that the answer is ‘no.’

- Write a description of the main product or service that you sell. In this example, I’m assuming that Trump Wigs sells yellow wigs.

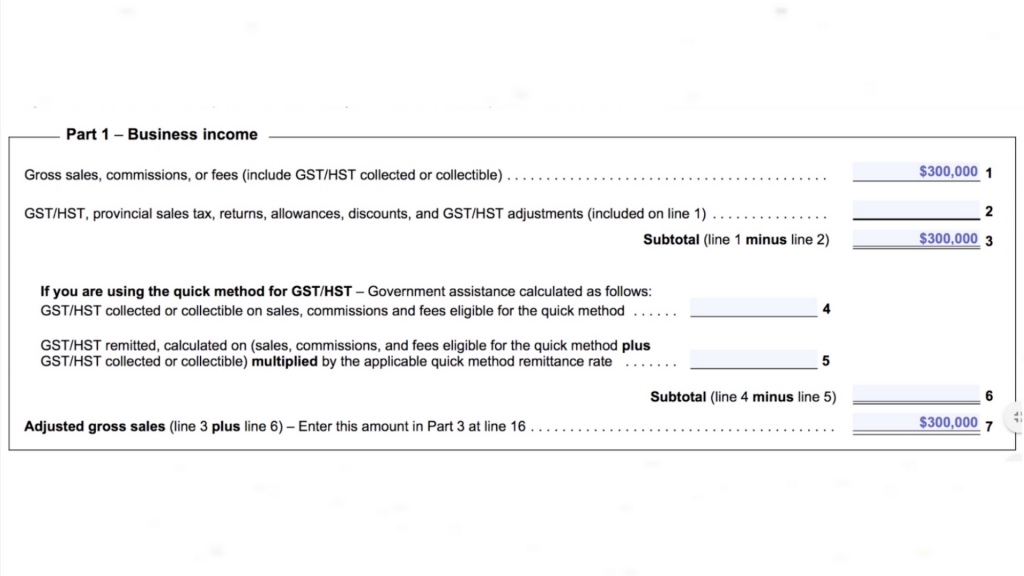

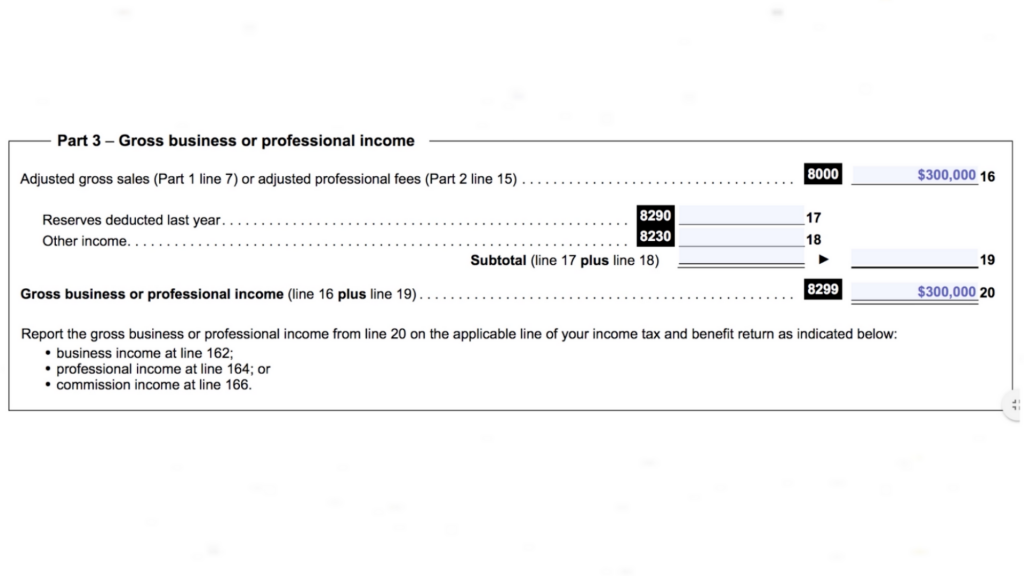

Step 2: In the first part of the form, enter the total sales for the current year. Let’s assume that Trump Wigs had total sales of $300,000. This amount is before GST or HST.

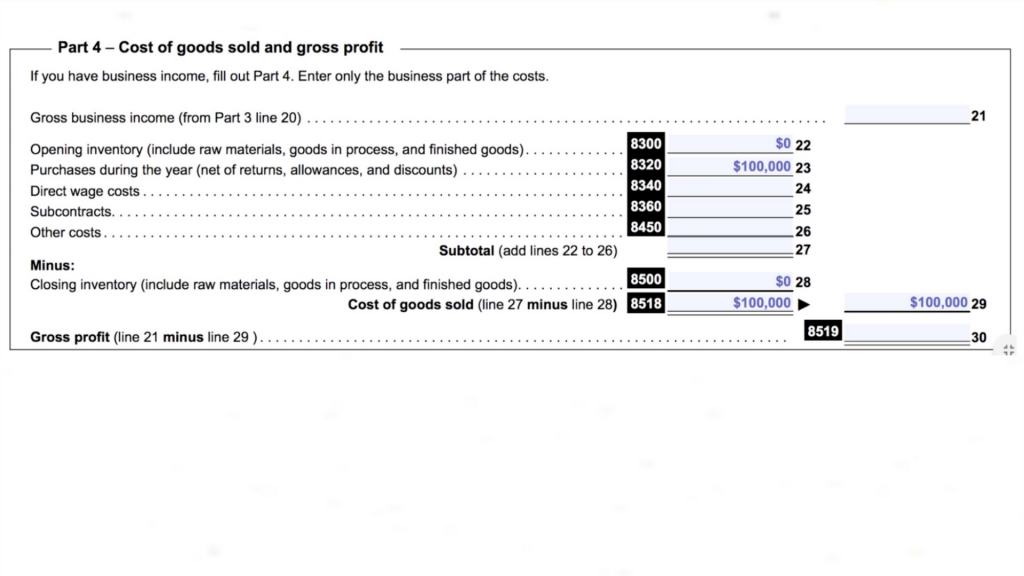

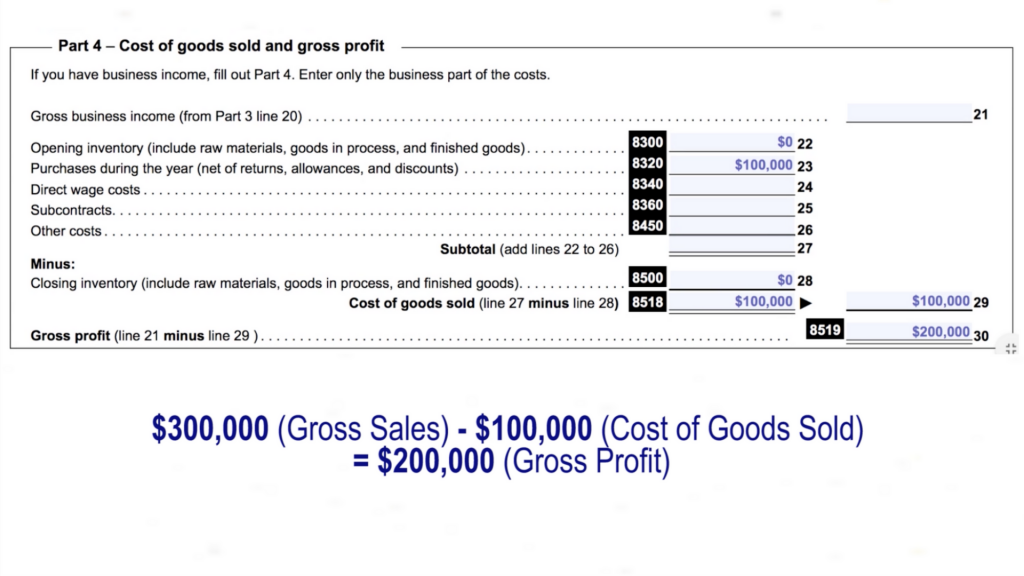

Step 3: In the fourth part of the form, enter the cost of goods sold during the year. Let’s assume that Trump Wigs purchased inventory worth $100,000 from its supplier and sold all of it during the year. Trump Wigs started with no inventory at the start of the year ($0).

Step 4: Enter the gross profit earned during the year in part 4. This is equal to the difference between the gross sales and cost of goods sold. In our example, the gross profit is $200,000

Gross Sales $300,000

Cost of Goods Sold ($100,000)

Gross Profit $200,000

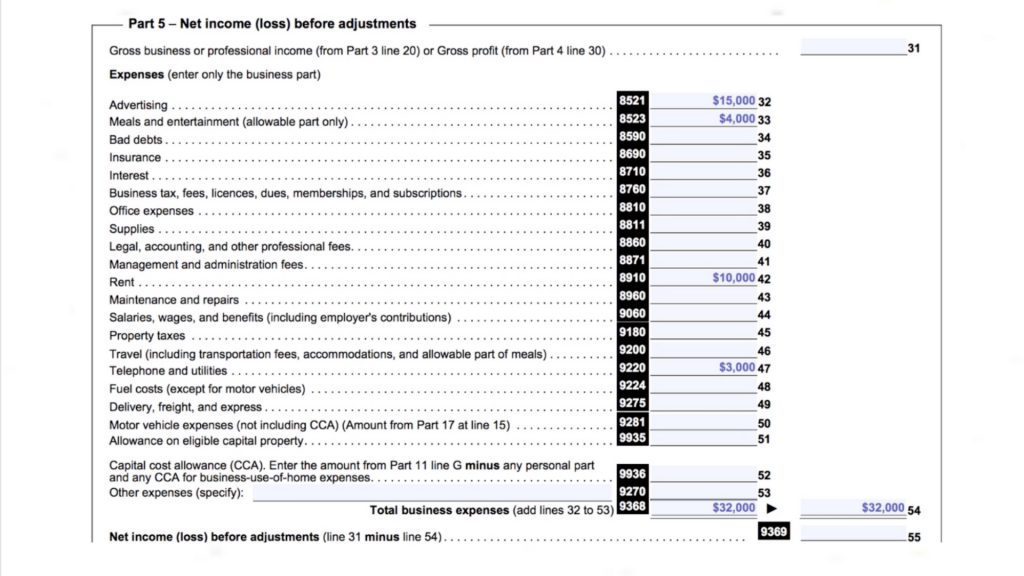

Step 5: Enter the expenses of the business in part 5. Note that only one-half of meals and entertainment expenses is tax deductible. The total business expenses incurred in the year is $32,000.

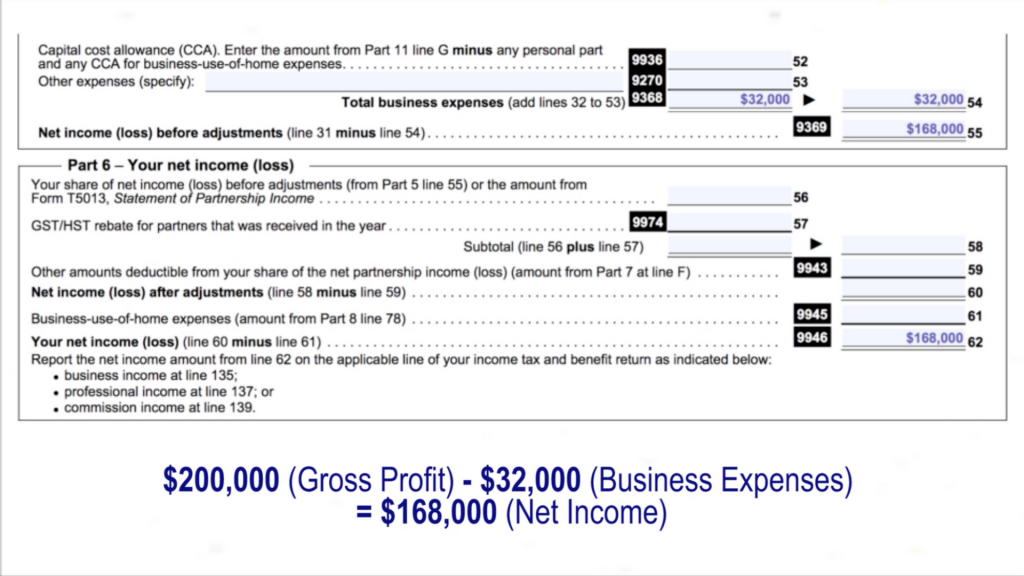

Step 6: Enter the net income in part 6. This is equal to the difference between the gross profit and the total business expenses. In our example, the net income is $168,000.

Gross Profit $200,000

Business Expenses ($32,000)

Net income $168,000

The net income from your business will be added to your personal income for the year, and you will pay tax on this amount based on your marginal tax rate.

See Part 2 For the next 3 Steps for Form T2125, the Statement of Business Activities. For self-employed individuals who would like to complete their tax return independently.

Disclaimer

The information provided on this page is intended to provide general information. The information does not take into account your personal situation and is not intended to be used without consultation from accounting and financial professionals. Allan Madan and Madan Chartered Accountant will not be held liable for any problems that arise from the usage of the information provided on this page.

SOCIAL CONNECT