Tax Implications of Mergers in Canada

Allan Madan, CPA, CA

Tax Implications of Mergers

Tax Implications of Mergers

Mergers and amalgamations encompass a broad range of transactions. Their tax issues vary depending on a number of factors, including: whether the target company is public or private, whether the target is a resident or non-resident of Canada, impact of the year-end of both companies, application of capital and non-capital losses, and the treatment of intercompany loans. Given the number of variables involved, it is not surprising that mergers are one of the most complex areas of taxation. Before proceeding, you might be asking yourself, what are the benefits of amalgamations? This article on why corporations should consider amalgamation or mergers will provide you with all the answers.

The purpose of this article is to provide a basic overview of mergers and highlight some of the common tax issues and consequences encountered during such transactions. What it does not is represent a comprehensive collection of tax issues surrounding mergers. As such, we strongly advise consulting a tax professional well in advance of any such transaction for guidance and assistance during this process.

Vertical vs. Horizontal Merger

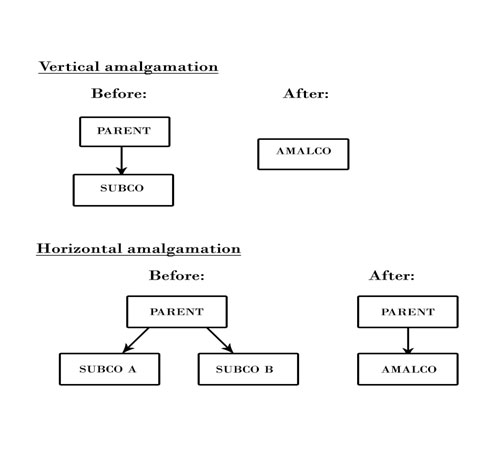

There are many forms of amalgamation, of which the most common are vertical and horizontal amalgamations. In cases where the merging corporations have a parent-subsidiary relationship, this is called a vertical amalgamation. In cases where the merging corporations are sister corporations (i.e.: owned by the same parent), this is referred to as a horizontal amalgamation. In an amalgamation, the predecessor companies are combined to form a new amalgamated company (Amalco); the predecessor companies would then cease to exist.

The diagrams below illustrate these transactions:

Tax Considerations

Tax deferral under Section 87 of Income Tax Act (ITA)

Section 87 of the ITA, provides for the merger of two or more taxable Canadian corporations (predecessor companies) into a new entity (amalgamated company) on a tax-deferred basis, under the following conditions:

- the merger must involve two or more corporations, each of which was immediately before the merger, a “taxable Canadian corporation”;

- all of the property of the predecessor corporations immediately before the merger must become the property of the amalgamated corporation;

- all of the liabilities of the predecessor corporations immediately before the merger must become liabilities of the amalgamated corporation;

- all of the shareholders of the predecessor corporations immediately before the merger must receive shares of the capital stock of the amalgamated corporation; and

- none of the above requirements has been accomplished through the acquisition of control of one corporation by another corporation, or as a result of the winding-up of one corporation into the another corporation.

Section 87 applies automatically so no election needs to be filed. If all the criteria are met, there will be no deemed disposition of shares and assets on the merger.

The shareholders of each predecessor corporation will be deemed to have disposed of their shares in the predecessor corporations (old shares) for proceeds equal to the adjusted cost base of those shares. The shareholders will then be deemed to have acquired shares of the amalgamated corporation at the price equal to the adjusted cost base of the old shares.

Fiscal Year-end on Amalgamations

An amalgamation triggers a deemed year-end for all companies involved immediately before the amalgamation. Depending on when the amalgamation occurs, the deemed year-end may result in an additional tax year for the amalgamated company. If the deemed year-end is different from the fiscal year-end, this will result in a short fiscal year for the amalgamated entity. As such, there will be an acceleration of the expiry period of any loss carry forwards.

For example, if companies with a December 31st year-end amalgamate on September 1st, there will be a deemed year-end on August 30th. This will create a short tax year from September 1st to December 31st, which will be considered a full tax year in calculating loss carry forwards.

It is important to note that when the predecessor companies share a fiscal year-end, they can avoid the deemed year-end issue by timing the amalgamation to occur immediately after the tax year-end (i.e.: in this case, January 1st). This way, there is no shortened tax year and no acceleration of the loss carry forwards period.

Also, an advantage of amalgamating is that it offers the newly amalgamated company (Amalco) the option of selecting a new fiscal year-end. However, triggering a deemed year-end may result in additional tax compliance costs associated with tax filings.

Utilization of capital and non-capital losses

Non-capital losses arise from operating losses from carrying on business and can be carried back 3 years and carried forward 20 years before they expire. Capital losses arise from the sale of capital property at a loss and can be carried back 3 year and carried forward indefinitely. Where the predecessor companies have losses, they may be utilized by the amalgamated company. As mentioned above, a short tax year will accelerate the loss carry forward period.

Non-capital losses arise from operating losses from carrying on business and can be carried back 3 years and carried forward 20 years before they expire. Capital losses arise from the sale of capital property at a loss and can be carried back 3 year and carried forward indefinitely. Where the predecessor companies have losses, they may be utilized by the amalgamated company. As mentioned above, a short tax year will accelerate the loss carry forward period.

The capital and non-capital losses will carry over into the newly amalgamated company to be used against any future income or gains generated after the amalgamation. The amalgamated company will be able to use the losses starting in the year that the amalgamation takes place. Note that any losses incurred by the amalgamated company cannot be carried back to be used against income from tax years prior to the amalgamation. You can find more information regarding using capital losses from the CRA website.

Impact of Intercompany Loans

On an amalgamation, intercompany debt is extinguished at its cost amount. If the cost amount is equal to the principal amount, there will generally be no tax consequences. If the cost amount less than its principal amount, the debt forgiveness rules will apply to the debtor company. In this case, there will be an income inclusion for the debtor company in the year of amalgamation, under Section 80 of the ITA. This can potentially have a significant adverse impact. If you want to learn more, have a look at this article on Canadian corporate shareholder loans. We recommend you contact a tax specialist to evaluate the impact of such an event and how to plan accordingly. A tax specialist would also be able to adequately plan ahead when preparing your corporate tax return with this in mind. For more information, please read this article on how to prepare corporation income tax returns in Canada . This article on tax rules for mergers in Canada, should have provided a better understanding of the tax repercussions within this context.

Disclaimer

The information provided on this page is intended to provide general information. The information does not take into account your personal situation and is not intended to be used without consultation from accounting and financial professionals. Allan Madan and Madan Chartered Accountant will not be held liable for any problems that arise from the usage of the information provided on this page.

Do the merged companies have to be in the same industry to use tax losses? Thx

Hi Bob,

Yes, they have to be in the same industry and in the same business for the merged company to use the losses of the predecessor companies. Furthermore, the merged company must carry on the business of the predecessors with an expectation of profit.