How to defer capital gains tax with section 85 rollover

Allan Madan, CPA, CA

If section 85 didn’t exist what would happen?

Without the rollover, a sole proprietor would sell their assets to a corporation for current market value instead of initial purchase price. This would result in the proprietor paying taxes on the assets difference in value. The sole proprietor is only trying to transferhis or her own assets. However, the CRA requires the assets to be sold to the corporation. Without the rollover the proprietor would be selling the assets to their corporation and be taxed on the gain based on the current market value that the asset was sold for.

For example, a sole proprietor has a single asset of a customer list worth $100,000. The cost amount is $0 to build the list. Without the section 85 rollover, the asset is sold with the profit of a $100,000 of which 50% is taxable. By using the rollover, the business owner does not trigger the tax, and is allowed to sell the asset to the corporation for the initial purchase price.

How is the fair market value determined?

The fair market value of your assets can be determined through appraisal or by examining its future cash flows.

What assets should you rollover? What assets shouldn’t you rollover?

The following can be transferred using section 85(1):

- Capital Properties

- Property that increases in value by favorable market conditions and any other property that when disposed of will result in capital gains.

- For example, Jane purchased land for $100,000 in 2005. It is now worth $1,000,000. Although there is a profit of $900,000 on the asset, using the rollover it can be transferred to a corporation for its cost amount of $100,000.

- Eligible Capital Property

- This refers to intangible assets.Examples include goodwill, customer lists, intellectual property, trademarks etc.

- Inventory

- Inventory that has increased in value from its initial purchase amount.

Assets not ideal for this rollover include:

- Accounts receivable

- Money owed to a company by its customers. For example when a company allows a payment to be paid over a course of days instead of at the time of purchase.

- Accounts receivables can be transferred via section 85(1); however, it is more beneficial to elect a transfer under a section 22 election.

- If accounts receivables are transferred under section 85(1), they are treated like assets that decreased in value during unfavorable market conditions with capital losses. Since this is a transfer to a related party, this qualifies as a superficial loss and is not allowed.

- With a section 22 election, losses on accounts receivable allow the transferer to get a business loss instead. To qualify for this election, 90% of the assets of the business must be transferred.

- Depreciable assets with a terminal loss

- An asset whose market value is less than its depreciated value. For example, Jane purchased equipment in 2005 for $50,000. It has depreciated in value to $30,000. An appraiser determined the market value of the equipment is only $10,000. Since there is no profit on this sale, a rollover is denied and it is better to sell for boot (cash) outside of the rollover.

- Non-depreciable assets with accrued capital losses

- This includes cash and prepaid assets (i.e. prepaid insurance, prepaid advertising, land and buildings that are bought for the intention of selling).

- For example,a sole proprietorship has a plot of land to park its company’s rucks. The land was bought for $90,000 and is now worth $50,000. This qualifies as a superficial loss (losses incurred from transaction between related parties) and is thus denied under section 85(1).

What are the conditions you need to meet under Section 85? If you don’t meet them, can you use this section?

In order to perform a section 85(1) rollover, the following conditions must be met:

- The consideration received (both share and non-share (cash)) must equal the Fair Market Value of the assets given up. For example, Jane owns a sole proprietorship with assets that are worth $80,000 now, but were initially purchased for $30,000, and would like to incorporate the company. Jane can take advantage of a section 85 Rollover by transferring her assets to a corporation in exchange for receiving shares of the corporation and cash that together are worth $80,000.

- The corporation receiving the assets from a rollover must be a taxable Canadian Corporation (i.e. incorporated in Canada).

- Consideration received by the proprietor from a rollover must include at least one share from the corporation.

Example:

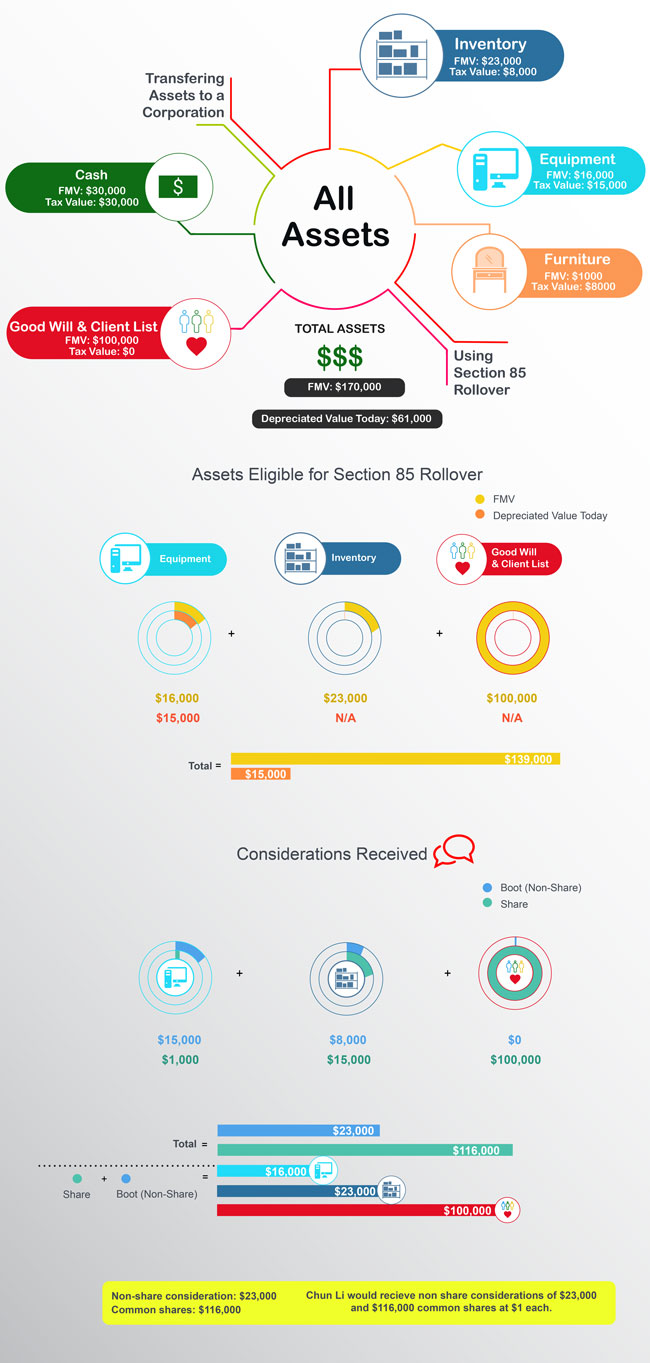

Chun Li has decided to incorporate her proprietorship and she is looking to avoid tax on the transfer of the assets to the corporation. She owns the following assets:

|

Asset |

FMV |

Initial Purchase Price |

Depreciated Value Today |

|

Cash |

$30,000 |

N/A |

N/A |

|

Inventory |

$23,000 |

$8,000 |

N/A |

|

Equipment |

$16,000 |

$20,000 |

$15,000 |

|

Goodwill and Client List |

$100,000 |

$0 |

N/A |

|

Furniture |

$1,000 |

$10,000 |

$8,000 |

|

Total Assets |

$170,000 |

$38,000 |

$23,000 |

To avoid tax on the transfer, Chun Li would like to transfer the above assets to her new corporation in exchange for common shares of the company, with each share worth $1 and cash.

Solution:

Let’s start off by analyzing the assets to determine their eligibility for a transfer to Chun Li’s corporation under section 85(1).

The assets that are eligible for the section 85 rollover are inventory, equipment and goodwill. This is because they have accumulated capital gains and fit under the categories of capital property (i.e. equipment), inventory and eligible capital property (i.e. goodwill).

Ineligible assets include cash and furniture. Cash is not a capital asset and although furniture is, it, has no added gain. The rollover would proceed as so:

|

Considerations Received |

||||||

|

Assets |

FMV |

Tax Value |

Elected Amount |

Boot (Non-Share) |

Share |

Total |

| Inventory | $23,000 | N/A | $8,000 | $8,000 | $15,000 | $23,000 |

| Equipment | $16,000 | $15,000 | $15,000 | $15,000 | $1,000 | $16,000 |

| Goodwill | $100,000 | $0 | $1 | $0 | $100,000 | $100,000 |

| Total | $139,000 | $23,000 | $23,001 | $23,000 | $116,000 | $139,000 |

Notes:

- The elected amounts for capital property are equal to the depreciated value today

- Since goodwill had a tax value of zero, the elected amount has to be $1 in order for the election to be valid

- The non-share consideration (boot/cash) cannot exceed the elected amount.

- Shares were transferred under each election

In the end, Chun Li would receive non-share considerations of $23,000 and 116,000 in common shares at $1 each. For more information on incorporating a proprietorship, refer to our article Converting a Sole Proprietorship to a Corporation.

Disclaimer

The information provided on this page is intended to provide general information. The information does not take into account your personal situation and is not intended to be used without consultation from accounting and financial professionals. Allan Madan and Madan Chartered Accountant will not be held liable for any problems that arise from the usage of the information provided on this page.

OK SO WE KNOW WHAT WE GET FOR CONSIDERATION

SO FOR EXAMPLE

ASSET FMV 1000 TAX VAlUE IS 700 ELECTED AMOUNT IS 300

HOW DOES THIS GET ENTERED ONTO THE T1?

Hi Charlene,

If this is a business, enter the proceeds of disposition of $300 (elected amount) on area A, column 4, of form T2125. Note: you cannot deduct a terminal loss when transferring property to a related corporation. The terminal loss becomes suspended and must be depreciated until the asset is sold or disposed.

Do you know if transfer taxes and any other required taxes etc are payable on a Section 85 rollover of a building. I know there wont be capital gains tax, but not sure of the others

Hi Daniel,

Land transfer tax will be payable on the sale of the land to your corporation.

Dear Allan

I still have questions about the assets that cannot rollover under section 85.

What will it happen to her furnitures? As a sole proprietorship, Chun Li still can claim furniture’s UCC of $ 8000 under CCA.

So she can claim slowly every year when she files her personal tax until it is done. So how can she claim UCC of assets that cannot roll over ? Can you please explain? Thanks so much for your help.

Hi Eglinton,

Do not use Section 85 to transfer assets that have decreased in value to a corporation. Section 85 is meant to transfer appreciating assets to a corporation in order to defer / prevent capital gains tax. Furniture is an example of a depreciating asset that shouldn’t be transferred pursuant to Section 85.

Assets that are worth less today than the amount you originally paid for them should be transferred by way of a journal entry. In other words, debit the net book value (or UCC) and credit shareholder payable to account for the transfer of depreciating assets. In exchange for the transfer, the shareholder usually receives a promissory note with no fixed terms of repayment.

Note that a sole proprietor cannot continue to depreciate assets that are no longer used in a business. So your idea of continuing to depreciate assets personally when the business has been transferred to a new corporation will not be possible.

Hello Madan,

What if I personally own limited partnership units in a private CCPC (1% of the company)? Can I roll over these under Section 85 into a corporation as the CCPC is going to be sold to another investor to defer taxes and potentially setup a lifetime capital gain exemption?

Jorge

Hi Jorge, Limited Partnership units should be able to be transferred to a corporation (CCPC) pursuant to Section 85 of the Income Tax Act, since they are capital property (i.e. eligible property).

a client has a large capital loss in his company from the sale of securites.

his personal assets include non-registered investments that have an accrued capital gain.

he would like to offset the two as he will not be able to use the capital loss in the company in the future

i understand if he transfers in personal securities the capital gain can be deffered but the offset would be he would need to take dividends from the company and pay personal tax on these

any advice you could provide would be helpful

Hi Pat, I understand that your client would like to transfer (rollover) securities that have accrued gains to his corporation, in order to offset the capital losses that the corporation has. This is possible. However, the corporation would either have to have positive retained earnings, or a shareholder payable balance, in order to pay cash to the owner from the sales proceeds.

Can you rollover software that you developed under sole prop into the corporation using sec 85 rollover?

Since it’s intangible, how would you value it and the Tax Value would be $0 as it was developed by me.

& if FMV lets say is $50,000 I would then take a share capital of $50k correct

Hi Haider, yes, you can rollover software that you developed to a corporation pursuant to Section 85 of the income tax act. Elect to transfer the software at $1 and take back shares equal to the fair market value of the software transferred (i.e. $50,000 worth of shares in your example).

Valuation of software can be difficult. To value the software, calculate the present value of the future cash-flows that the software will generate for your business.

Can section 85 be used to transfer the beneficial interest in a bare trust of a rental property in Canada from one corporation to another related corporation? The companies and owner of bare trust is all the same person.

Hi Terra, yes, section 85 can be used for this purpose.

A personally owned rental property was originally purchased at $150,00 and its current fair market value is $400,000. When rolled over to a corporation with section 85, is land transfer tax payable based on original purchase price or current fair market value?

Thanks,

Ken

Hi Ken,

Land transfer tax is payable based on the outstanding mortgage balance at the time of the rollover.

Other than the form T2057/8. Does the corporation needs to document a resolution and the company needs to amend the articles of incorporation to issue more shares for the transfer, if there is not any addtional share capital ?

Hi Archibald,

Yes, a director’s resolution should be prepared to amend the articles of incorporation.

In the set up there should be 300 shares purchased for $1/share total of $300 as follows:

100 Class A Shares – May 30, 2014

100 Class B Shares – Jan 28, 2020

100 Class H Shares – Jan 28, 2020

On Feb 1,2020 – 350,000 Shares were purchased (transferred) $350,000

The transfer of the $350,000 came to me via S.85 Agreement.

I am not too sure as to how to do the entries for all of this, would you be able to help me out with this.

Hi Mel,

Yes, I can help you record the journal entries in respect of the Section 85 Agreement. I will need a copy of the rollover agreement, and the instructions prepared by the lawyer/accountant to implement the Section 85 rollover. Please send the details to my email: amadan@madanca.com