Navigating Tax Implications of Assignment Sales

Allan Madan, CPA, CA

Assignment sales have become a common way for individuals to make a profit on their real estate assets. However, these transactions come with tax implications that many people may not be aware of. In this blog, we’ll explore the tax implications of assignment sales in Canada through a practical example.

What is an Assignment Sale?

Many new real estate developments in Canada are condominiums, and since the time between breaking ground and completion is typically a few years, developers have taken that opportunity to sell units before the building construction is complete.

An assignment sale is when the original purchaser or a unit chooses to sell it before the condo building is complete and is ready for final closing. This real estate tool allows the original purchaser (or, the “assignor”) to sell their property months or even years before the closing date. It is often done when the assignor no longer wishes to proceed with the purchase or sees an opportunity to make a profit.

The benefits to buyers (also known as the “assignee”) of assignment sales are that there are rarely multiple offers on the unit, and the price of the unit will likely be below market value. In addition, the assignee does not have to wait years to get ownership of a brand-new housing unit.

Example Of An Assignment Sale

To better understand how this works, let’s take the example of Ringo:

- Ringo entered into a purchase agreement with a builder on June 1, 2022, for a 1-bedroom condominium in Toronto. The agreed sales price for the condo was $500,000, and Ringo paid a deposit of 10% ($50,000) to the builder.

- The final closing date for the condominium was set for September 1, 2024.

- However, before the closing date, Ringo decided he no longer wanted to proceed with the purchase.

- On August 31, 2023, Ringo assigned his purchase agreement to Daniel (assignee) for a price of $600,000, plus reimbursement for the $50,000 deposit he had already paid.

- In this transaction, Ringo made a profit of $100,000 by simply assigning the purchase agreement to Daniel.

The profit is calculated as follows:

| Assignment Price: | $600,000 |

| Original Purchase Price: | $500,000 |

| Profit | $100,000 |

While this profit may seem like an easy win, there are important tax implications that Ringo must consider. Let’s explore these in detail.

Tax Implications of the Assignment Sale

1. HST on the Assignment Sale

The first tax implication to Ringo is that he will owe HST to the Canada Revenue Agency (CRA). The HST liability is calculated by multiplying the HST rate of 13% (Ontario) by the Assignment Profit, and in Ringo’s case is $13,000. This calculation would be based on the local GST or HST in the province the sale occurs. Note that the deposit amount of $50,000 reimbursed by Daniel to Ringo is not subject to HST.

| Assignment Price: | $600,000 |

| Purchase | $500,000 |

| Profit | $100,000 |

| HST Payable @ 13% | $13,000 |

2. Income Tax on the Assignment Sale

The second tax implication on Ringo’s assignment sale is that he will have to pay personal income tax on the profits made. In our example, Ringo made a profit of $100,000 from assigning the purchase agreement for the condominium.

Assuming that Ringo is in the highest tax bracket and his marginal tax rate is 50%, he will pay $50,000 of personal income tax on the profit made.

| Profit from Assignment Sale | $100,000 |

| Ringo’s Marginal Tax Rate | x 50% |

| Personal Income Tax Payable | $50,000 |

3. Tax Write-offs on an Assignment Sale

The third implication relates to tax write-offs, which will lower his payable personal income tax. Ringo can claim a tax deduction for expenses incurred in relation to an assignment sale.

Most commonly, these expenses include:

- Sales commissions paid to a realtor

- Legal fees

- Accounting fees

- Assignment fees paid to the builder

Assume that Ringo incurred a total of $30,000 in expenses in the course of assigning his purchase agreement. This reduces his profit from $100,000 to $70,000 and his income tax from $50,000 to $35,000.

| Profit from Assignment Sale | $100,000 |

| Selling Costs | ($30,000) |

| Profit After Selling Costs | $70,000 |

| Ringo’s Marginal Tax Rate | x 50% |

| Personal Income Tax Payable | $35,000 |

4. Input Tax Credits on an Assignment Sales

The next tax implication relates to input tax credits. When selling a piece of property, the seller is responsible for collecting and submitting HST to the CRA in the case of a taxable assignment sale.

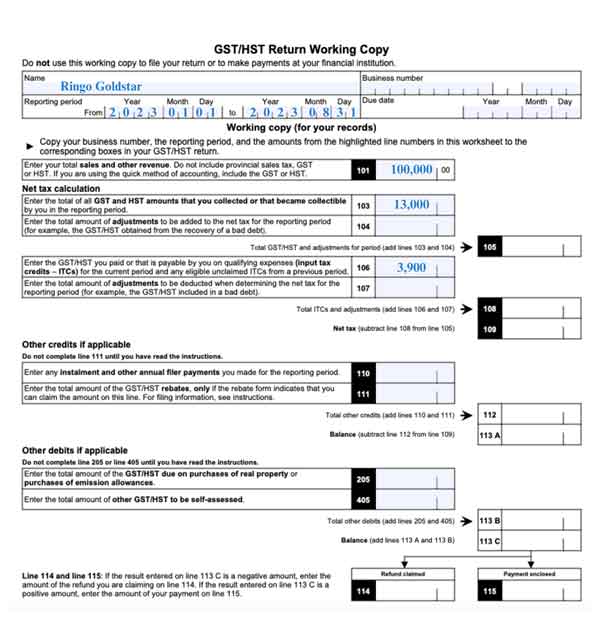

Ringo can reduce his HST liability by claiming the HST paid on the expenses he incurred. Assume that Ringo paid $3,900 of HST on top of the $30,000 of expenses he incurred. When completing the HST return, Ringo should enter the amount of $3,900 in the field for input tax credits. By doing so, his HST liability is reduced from $13,000 to $9,100.

| Total Assignment Profit (before selling expenses) | $100,000 |

| HST Collected (13%) | $13,000 |

| Input Tax Credits | ($3,900) |

| HST payable ($13,000 – $3,900) | $9,100 |

Note that the GST/HST return must be filed by no later than one month after the month in which the assignment sale occurred. Since the assignment sale occurred on August 31, 2023, Ringo must file his HST return by September 30, 2023.

Ringo’s GST/HST Return form would look like this:

5. GST/HST Housing Rebate for New Residential Construction

The final tax implication with respect to an assignment sale relates to the GST/HST housing rebate. Purchasers of a newly constructed residential property are entitled to an HST rebate from the builder for an amount up to $24,000 – which varies by Province – if they intend to occupy the property as their primary residence. In most circumstances, the housing rebate is already included in the selling price, and is assigned to the builder.

However, when a purchase agreement is assigned to a new purchaser by the original purchaser (assignor), the new purchaser (assignee) must reimburse the builder for the Housing Rebate at the time of closing. This can come as a shock to many new purchasers, who did not budget an additional expense of up to $24,000. The good news is that the new purchaser (assignee) can recover the $24,000 housing rebate by completing the form GST/HST-190 , which is available for download from the CRA’s website.

In our example, Ringo is not directly impacted, but the new purchaser, Daniel, will have to cough-up an additional $24,000 on closing.

Leveraging These Tax Implications

To leverage the tax implications of assignment sales effectively, it’s essential to engage in careful planning and seek professional advice. By understanding the taxes owed—such as HST, personal income tax, and the potential for tax write-offs—you can better assess the profitability of an assignment sale. With the right approach, you can minimize your tax liability and ensure you’re making smart real estate decisions that boost your overall returns.

If you have any questions about the profitability of your assignment sale, contact us for a no-obligation consultation.

Disclaimer

The information provided on this page is intended to provide general information. The information does not take into account your personal situation and is not intended to be used without consultation from accounting and financial professionals. Allan Madan and Madan Chartered Accountant will not be held liable for any problems that arise from the usage of the information provided on this page.