International Tax Advice Guide for Canadians

Allan Madan, CPA, CA

I am an International Tax Accountant in Canada. I wrote this International Tax Guide for Canada to inform taxpayers of everything they need to know about international tax from a Canadian perspective. Whether you are an American moving to Canada, or a Canadian business expanding overseas, this guide is for you.

My International Tax Guide for Canadians is broken down into the following topics:

- Non-resident corporations doing business in Canada

- Canadian corporations expanding outside of Canada into international markets

- Non-residents selling Canadian real estate

- Non-residents working in Canada

- Canadians working in the United States and Overseas

1. Doing Business in Canada – International Tax Accountant in Canada

Foreign companies that plan on doing business in Canada may have to pay Canadian income tax and Canadian sales tax. They must also file a Canadian tax return.

Canadian Income Tax for Foreign Corporations

Foreign corporations that carry on business in Canada are liable for Canadian income tax on the profits derived from Canada. The term ‘profits’ is not defined in the Income Tax Act, but is computed in accordance with Generally Accepted Accounting Principles.

The term ‘carrying on business’ is extremely broad, and even includes sales made in a foreign country to Canadians. For example, assume that you have a call center in New York. The New York Call Center makes sales to Canadians in the amount of $800,000 annually, and has expenses of $300,000. The New York Call Center does not have a physical presence in Canada, nor does it have any Canadian employees. All sales are concluded in New York. The products sold are picked-up from a warehouse in Buffalo and transported by truck for delivery to Canadian customers across Canada.

The New York Call Center is certainly carrying on business in Canada, and as such, will be liable for Canadian income taxes on the profits it earned in Canada, i.e. $500,000. The tax rate applicable on these profits is approximately 30%.

As you can see, it would create an administrative headache and an unfair tax burden if every company across the world had to pay Canadian income taxes just because it sold products to Canadians. Fortunately, Canada has entered into bilateral treaties with most countries across the world. The Canadian tax treaties normally stipulate that a foreign corporation is only liable for Canadian income tax on business profits, if those profits were derived from a Canadian Permanent Establishment. The term ‘permanent establishment’ means a fixed place of business, like an office or construction site. It specifically excludes a public warehouse situated in Canada. [For more information see Permanent Establishment in Canada]

Based on the facts above, the New York Call Center would not be liable for Canadian income tax because it does not have a permanent establishment in Canada.

Canadian Tax Return

Foreign corporations that carry on business in Canada must furnish a Canadian income tax return. In the case where a foreign corporation has a permanent establishment in Canada, it will have to file a Canadian corporate tax return and pay Canadian income taxes (at a rate of 30%) on the Canadian branch profits. The foreign corporation will also have to pay a special branch tax, which can be as high as 25%.

Foreign corporations that carry on business in Canada must furnish a Canadian income tax return. In the case where a foreign corporation has a permanent establishment in Canada, it will have to file a Canadian corporate tax return and pay Canadian income taxes (at a rate of 30%) on the Canadian branch profits. The foreign corporation will also have to pay a special branch tax, which can be as high as 25%.

Foreign corporations that carry on business in Canada, but do not have a permanent establishment in Canada, will have to file a Treaty-based tax return. This is an information return that accomplishes two objectives:

• It discloses certain financial information about the foreign corporation to the Canada Revenue Agency, as required, and

• Includes a statement that the corporation is not liable for Canadian income tax because it has no permanent establishment in Canada.

If a Treaty-based tax return is not filed, the Canada Revenue Agency has the power to levy income taxes on the gross Canadian sales made by the foreign corporation. This is a very harsh penalty.

As an International Tax Accountant in Canada, I can file your company’s Canadian Treaty-based tax return or Canadian corporate tax return.

Canadian Sales Taxes

Foreign corporations that sell to Canadian customers must collect and remit sales taxes or ‘value-added-tax’. Each Canadian province has a different sales tax rate, ranging from a low of 5% to a high of 14%. Failure to collect sales taxes from Canadian customers means that the collector (i.e. foreign corporation) becomes liable for paying the uncollected Canadian sales tax to the Canada Revenue Agency.

For more information on Canadian sales tax, please see Cross Border Taxes – Tips on Doing Online Business in Canada

2. Canadian Corporations Expanding Outside of Canada

Before expanding your business into the Canadian marketplace, it’s very important that you read this International tax guide for Canada, or seek the advice of an experienced, International Tax Accountant for Canadians.

Business Expansion to the United States

The first international destination that Canadian entrepreneurs normally expand to is the Unites States of America. Below, I will briefly describe the tax structures that Canadians can use to expand to the United States.

LLCs

Limited Liability Corporations (LLCs) are very advantageous for Americans. LLCs do not pay tax, but rather the individual members (or shareholders) are liable for taxes on the profits earned by a LLC. This avoids double taxation for Americans, since there is only one layer of tax – i.e. personal income tax.

Additionally, LLCs provide limited liability protection to their members. Since the US is a very litigious country, LLCs provide peace of mind to business owners.

However, LLCs cause double taxation for Canadians. This is because LLCs are not recognized as flow-through entities by the Canada Revenue Agency.

- The first incidence of taxes occurs when the Canadian shareholders of the LLC pay personal income taxes in the US on their share of the LLCs` profits.

- The second incidence of tax occurs when the profits of the LLC are paid to Canadian investors. The Canada Revenue Agency treats the distributions made as taxable dividends, and does not provide any tax relief for the US taxes paid.

For more information on the tax implications of LLCs owned by Canadians, please see Demystifying LLCs for Canadians

What is the alternative, if LLCs are not appropriate for Canadians? This leads me to my next point in my international tax guide for Canadians.

LLPs and US C-Corporations

A LLP, also known as a limited liability partnership, does not cause double taxation for Canadians. The mechanics of the LLP are as follows:

- Each limited partner pays US personal income tax on his/her share of the LLPs’ profits

- Each Canadian limited partner reports his/her share of the LLPs profits on his/her Canadian personal tax return and pays Canadian income taxes accordingly

- Canadian limited partners will claim a foreign tax credit for the US taxes they paid, thereby eliminating double taxation

- The LLP does not pay income tax in the US or Canada

- The general partner is usually a US C-Corporation and owns 1% of the LLP. The general partner bares most of the risk, but receives only 1% of the LLPs’ profits.

- Cash earned by a LLP can be paid to Canadians without any income tax being charged on the payment

As you can see, the LLP structure not only eliminates double taxation, but also provides Canadians with limited liability protection.

US C-Corporations

US C-Corporations are similar to Canadian corporations in that they are separate legal entities and are distinct from their individual shareholders. US C-Corporations pay US income taxes on the profits they earn at both the State and Federal levels. Generally speaking, the combined federal and state income tax rate for US C-Corporations is 30%. The rate of tax varies from state to state.

Distributions paid by a US C-Corporation to its shareholders are called dividends. Canadian investors in a US C Corporation must included dividends received in their personal Canadian tax return and pay Canadian income tax on those dividends at their marginal tax rate. Unlike Canadian dividends, Canadian shareholders cannot claim a dividend tax credit in respect of foreign dividends they receive.

Note that dividends paid to Canadian shareholders are subject to US withholding taxes. The withholding tax rate pursuant to the Canada-US tax treaty is 5% on dividends paid to corporate shareholders and 15% on dividends paid to individual shareholders. Both Canadian individual and corporate shareholders can claim a foreign tax credit for the withholding taxes paid to the IRS.

Many Canadian entrepreneurs prefer the US C-Corporation structure because of its similarity to Canadian corporations.

Tax Entity Creation in the US

As an International Tax Accountant in Canada, I can develop an effective tax structure such that your business pays the least amount of worldwide income tax.

3. Taxation for Non-Resident Real Estate Investors

If you are a non-resident individual that has sold real estate in Canada, you must file a “Request for a Clearance Certificate” with the Canada Revenue Agency. By doing so, the amount of tax withheld on the sale of your real estate in Canada will be significantly reduced. The withholding tax rate will be reduced from 25% of the sale proceeds to only 25% of the capital gain.

Example of Non Resident Taxes on Sale of Canadian Real Estate

For example, assume that you purchased a rental property in Canada for $500,000 in 2004. Further assume that you left Canada in 2013 and sold the property in 2014 for $800,000.

If you do not obtain a Clearance Certificate from the Canada Revenue Agency, then the buyer’s lawyer will withhold $200,000 from the sales proceeds; this represents 25% of the selling price. If you obtain a Clearance Certificate, then the buyer will not withhold any taxes whatsoever.

Taxes Paid with Clearance Certificate Application

When you file an application of for a Clearance Certificate, you must attach a cheque or bank draft (in Canadian dollars) for 25% of the capital gain. In the example above, the withholding taxes will amount to $75,000 (i.e. $300,000 x 25%).

Section 116 Non Resident Tax Return to Report Sale

You will also need to file a Non-Resident Income Tax Return to report the gain or loss on the sale of your Canadian real estate. In the example above, you would report half of the capital gain on your personal tax return or $150,000 [($800,000 – $500,000) x 50%]. You only report half, because the Canadian tax code exempts 50% of the capital gain from tax.

What happens to the withholding tax of 25% of the capital gain (e.g. $75,000) that you submitted with your Application for a Clearance Certificate? Is this tax credited to you when you file a Non Resident Income Tax Return? The answer is ‘Yes’. The withholding tax paid will be credited to you when you file your Non Resident Income Tax Return.

Should the income taxes payable as shown on your Non Resident Income Tax Return be greater than the withholding taxes paid, you will be responsible for paying the difference in taxes to the Canada Revenue Agency. Likewise, should the Canadian income taxes be less than the withholding taxes paid, then the Canada Revenue Agency will refund the difference in taxes to you.

For additional information on Non Resident Taxes pertaining to the sale of Canadian real estate, please see the article called Do Non Residents of Canada Pay Capital Gains Tax?

Part of my international tax services for Canadians includes preparing Clearance Certificate Applications and Non Resident Tax Returns.

4. Americans and Other Non Residents Working in Canada

Non residents, including Americans, working in Canada must file a Canadian personal tax return and pay Canadian income taxes on their Canadian employment income. The rate of tax paid varies according to the amount of employment income in Canada that you earn. Generally speaking, the rate of tax increases as your employment income increases.

For a complete listing of Canadian personal tax rates, please see Personal Income Tax Rates Canada

In order to avoid double taxation, Canada has entered into tax treaties with most countries. As a temporary worker in Canada, you will most likely:

- Be responsible for paying personal income taxes in your home country.

- Receive a foreign tax credit in your home country for Canadian income taxes paid, thereby avoiding double taxation.

Note that non-residents working in Canada are also liable for Canadian social security taxes:

- Canada Pension Plan premiums

- Employment Insurance premiums

You may be able to obtain a ‘certificate of coverage’ from your employer so that you do not have to pay Canadian social security taxes.

For more information see my blog post on Canadian taxes for non residents employed in Canada

5. Canadians working in the United States & Overseas

Canadians working in the United States or other foreign countries overseas have to deal with a multitude of tax issues, including:

- Impact on Canadian residency status

- Departure return and departure tax

- Tax filing requirements for non residents

Impact on Canadian Residency Status

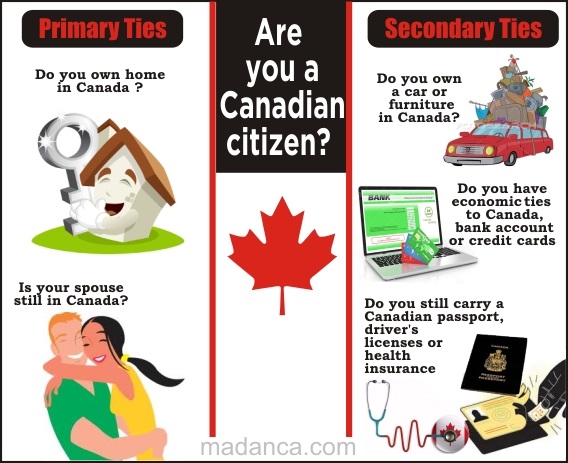

Canadians that permanently leave Canada to work abroad and sever their ties with Canada will effectively become non-residents of Canada. Non residents of Canada do not pay income tax on income earned abroad.

Ties to Canada include:

- Home in Canada

- Spouse in Canada

- Dependent children in Canada

- Canadian driver’s license

- Personal possessions in Canada

- Memberships in professional organizations and clubs

- Canadian bank accounts

- Canadian investment accounts, including RRSPs, TFSAs and RRIFs

- Canadian health card or health insurance

If the above ties are broken, then you will become a non resident of Canada. However, if you maintain some or all of the above ties, then you will continue to be a resident of Canada. Residents of Canada pay tax on their world wide income. This includes income earned overseas / abroad.

As a Canadian accountant specializing in international taxes, I can help you plan for your departure from Canada, so that you do not remain a tax resident of Canada. Relinquishing your Canadian ties can be very advantageous if you are earning (or plan on earning) significant sums of money aboard.

Departure Tax

When you sever your ties to Canada and depart from Canada, you are deemed to dispose of all of your assets at their fair market value as of the date of departure. This can trigger capital gains if the value of your property is more than the cost of your property. Half of the capital gains are taxable and the taxable portion is included in your income in the year of departure.

Certain types of property are exempt from departure tax. Also, in the year of departure from Canada, you are required to file a departure tax return. On this return you have to disclose all of the assets that you continue to hold in Canada. Failure to file can result in significant penalties.

Tax Filing Requirements for Non Residents

Non residents of Canada are only required to file a non-resident tax return in Canada if they:

- Worked in Canada

- Sold Canadian real estate

- Received rental income from a Canadian property

- Carried on a business in Canada

If the 4 scenarios described above to not apply to you, then DO NOT file a Canadian tax return.

Disclaimer

The information provided on this page is intended to provide general information. The information does not take into account your personal situation and is not intended to be used without consultation from accounting and financial professionals. Allan Madan and Madan Chartered Accountant will not be held liable for any problems that arise from the usage of the information provided on this page.