Tax Implications for Non-Residents Earning Income from Canadian Rental Property

Allan Madan, CPA, CA

The Canadian real estate market has been a lucrative investment opportunity for foreign investors due to Canada’s relatively stable economy. If you are a non-resident or a foreign investor looking to enter the Canadian real estate market, this article is for you! The article will help you understand your tax obligations, provide strategies to reduce your tax implications and will paint an overall picture of the benefit of filing a section 216 return.

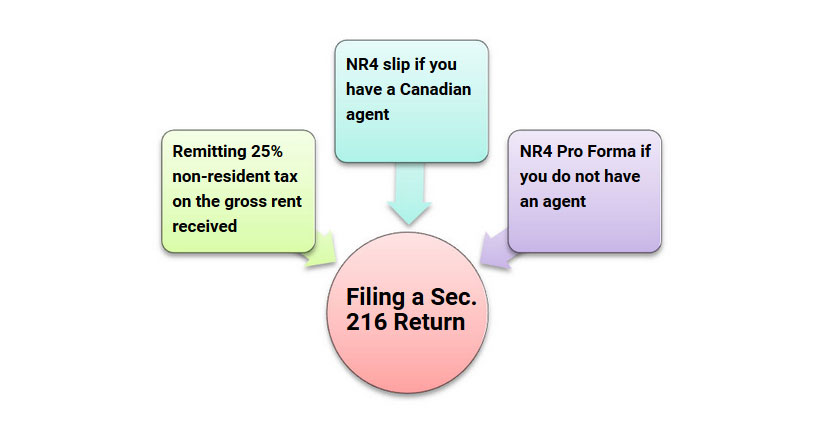

Requirements of Electing Under Section 216

Remitting 25% non-resident tax on the gross rent received

NR4 slip if you have a Canadian agent

Filing a Sec. 216 Return

NR4 Pro Forma if you do not have an agent

Withholding & Remitting Non-Resident Tax

- As a non-resident earning rental income from a Canadian property, the payer, such as a tenant or an agent, is obligated to withhold and remit a non-resident tax at a rate of 25% on the gross rental income.

- The tax must be remitted to CRA on or before the 15th day of the month following the month the rental income was paid.

- Failure in remitting the non-resident tax will result in CRA charging compound daily interest on the non-resident tax that should have been remitted. CRA may also charge a penalty.

How to Remit the Non-Resident Tax?

- The non-resident tax payments should be made to your non-resident account number (i.e. NRF#, NRK#)

- If you do not have a non-resident account number assigned, you should call CRA to set one up and they will instruct you on how to make the remittance.

- 1-855-284-5946 (From anywhere in Canada & the United States)

- 613-940-8499 (From outside of Canada & the United States)

- The monthly tax payment can be made directly through your CRA account using the following link http://www.cra-arc.gc.ca/mypayment/. You must select to make the payment to Part XIII-non-resident withholding tax and apply the payment to your assigned non-resident account number.

Difference between an NR4 Slip & NR4 Pro Forma

- With your section 216 return, either an NR4 slip or NR4 Pro Forma must be attached for CRA to accept your return.

- An NR4 slip is prepared if you have an agent who is acting on your behalf (i.e. a family member who is a Canadian resident or a property manager). The NR4 slip reflects the amount of gross rent earned and the non-resident tax withheld and remitted for the year. If the property is jointly owned, each co-owner is required to have an NR4 slip prepared which will reflect each individuals share of the gross rent and non-resident tax remitted.

- On the other hand, an NR4 Pro Forma is required when an individual does not have an agent. The NR4 Pro Forma is a letter that requests CRA to produce the NR4 slip. Just like the NR4 slip, if the property is jointly owned, an NR4 Pro Forma will be required for each co-owner and must reflect each individuals share of the gross rent and non-resident tax remitted. The following information must be included in the NR4 Pro Forma:

Non-Resident Name

SIN

Non-Resident Account Number

Rental Property Address

Gross Rent for the Year

Non-Resident Tax Withheld and Remitted

Mailing address the NR4 slip should be sent to once prepared by CRA

Signature of the non-resident if they are preparing the Pro Forma

- The NR4 slip and NR4 Pro Forma should be submitted to CRA by March 31st. If you fail to submit the NR4 slip by this due date it may result in a penalty of $100.

Benefit of Filing a Section 216

- Generally, the non-resident tax withheld and remitted is considered the non-resident’s final tax return obligation to Canada on the rental income. However, if the non-resident elects under section 216 of the Income Tax Act, he or she may pay less income tax or even receive a tax refund of some or all of the non-resident tax withheld.

- For the purposes of section 216, you are typically considered a “non-resident” if you permanently live outside Canada and you do not have any residential ties with Canada.

How can you reduce the Amount of Tax Withheld & Remitted?

Tip 1: File an NR6

- You can reduce the amount of tax you remit by filing an NR6, which is an optional filing and is to be filed annually.

- The NR6 is a form that reflects the estimated gross rent and expenses for the tax year. If approved by CRA, it allows your agent to remit tax at 25% of the net rental income instead of the gross. In order for the NR6 to be approved by CRA, all sections of the form must be completed and a spreadsheet with a breakdown of your estimated expenses must be attached.

- However, in order to file an NR6, you must appoint an agent. The agent must be a resident of Canada and can be a family member. The agent’s obligation is to act on behalf of the non-resident and is required to remit the non-resident tax.

- The agent must continue withholding and remitting the non-resident tax at the gross amount until CRA has approved in writing the NR6. Once approved, the agent can begin remitting at 25% of the net amount. The payment must still be made on or before the 15th day of the month following the month the rental income was paid.

- The NR6 should be submitted to CRA before the first rental income is due. We suggest contacting Madan CA in October to have the NR6 filed early so that CRA has enough time to process and approve it before Jan 1st.

Tip 2: Claim Depreciation

- To reduce the net income reported on your section 216 return, you can depreciate the building portion of your rental property and claim capital cost allowance. In the initial years, the capital cost allowance claimed may equal the net rental income or a figure close to it and you may get a higher amount of refund

- However, if you are going to sell your rental property in the near future or change its use (i.e. stop renting and move back into the property), you may not want to depreciate, as the depreciation claimed will be recaptured in the final year.

What Happens if You Sell Your Rental Property?

- A non-resident who disposes their Canadian rental property must apply for a clearance certificate by filing form T2062 (which reports the capital gain) and form T2062A (which reports any recapture if the building portion of the property was depreciated).

Important Filing Requirements of Form T2062 and Form T2062A

- These forms must be completed and mailed to the CRA no later than 10 days after the date of disposition.

- Failure to complete the notice on time may result in a penalty amounting to $25 a day. The minimum penalty is $100 and the maximum is $2,500.

- Any rental income that was generated in the year you disposed of the rental property will need to be reported by completing a section 216 return.

- In regards to the disposition of the rental property, 25% of the capital gain will need to be remitted to CRA. A separate return known as a section 116 return will be filed once CRA issues the clearance certificate. By filing the section 116 return, you will be able to get a refund on the portion of the 25% tax remitted on the capital gain.

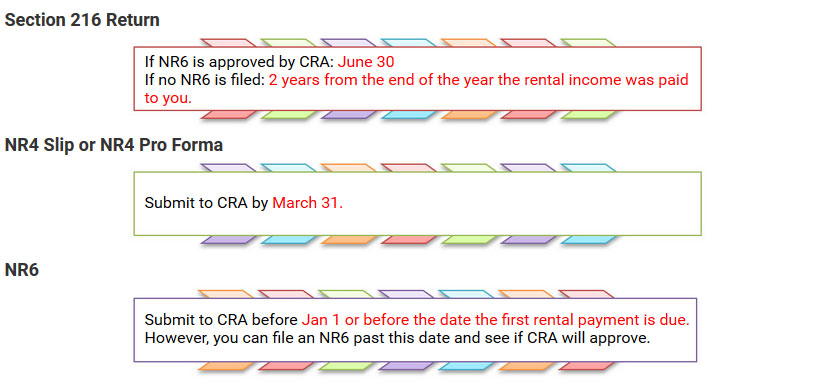

Summary of Key Due Dates:

Section 216 Return

If NR6 is approved by CRA: June 30

If no NR6 is filed: 2 years from the end of the year the rental income was paid

to you.

NR4 Slip or NR4 Pro Forma

Submit to CRA by March 31.

NR6

Submit to CRA before Jan 1 or before the date the first rental payment is due.

However, you can file an NR6 past this date and see if CRA will approve.

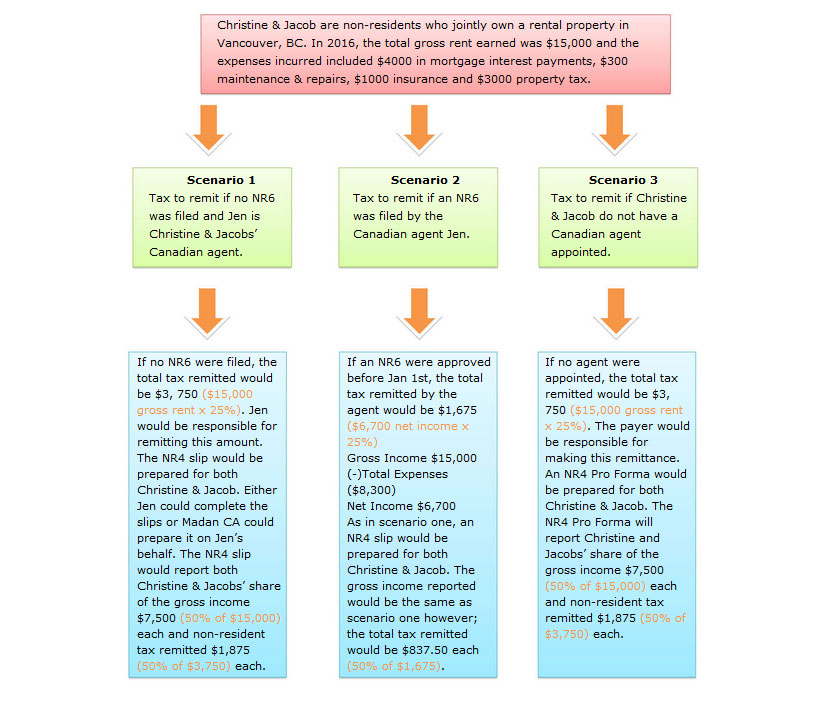

Scenario Example

Christine & Jacob are non-residents who jointly own a rental property in Vancouver, BC. In 2016, the total gross rent earned was $15,000 and the expenses incurred included $4000 in mortgage interest payments, $300 maintenance & repairs, $1000 insurance and $3000 property tax.

Scenario 1

Tax to remit if no NR6 was filed and Jen is Christine & Jacobs’ Canadian agent.

Scenario 2

Tax to remit if an NR6 was filed by the Canadian agent Jen.

Scenario 3

Tax to remit if Christine & Jacob do not have a Canadian agent appointed.

If no NR6 were filed, the total tax remitted would be $3, 750 ($15,000 gross rent x 25%). Jen would be responsible for remitting this amount.

The NR4 slip would be prepared for both Christine & Jacob. Either Jen could complete the slips or Madan CA could prepare it on Jen’s behalf. The NR4 slip would report both Christine & Jacobs’ share of the gross income $7,500 (50% of $15,000) each and non-resident tax remitted $1,875 (50% of $3,750) each.

If an NR6 were approved before Jan 1st, the total tax remitted by the agent would be $1,675 ($6,700 net income x 25%)

Gross Income $15,000

(-)Total Expenses ($8,300)

Net Income $6,700

As in scenario one, an NR4 slip would be prepared for both Christine & Jacob. The gross income reported would be the same as scenario one however; the total tax remitted would be $837.50 each (50% of $1,675).

If no agent were appointed, the total tax remitted would be $3, 750 ($15,000 gross rent x 25%). The payer would be responsible for making this remittance.

An NR4 Pro Forma would be prepared for both Christine & Jacob. The NR4 Pro Forma will report Christine and Jacobs’ share of the gross income $7,500 (50% of $15,000) each and non-resident tax remitted $1,875 (50% of $3,750) each.

Disclaimer

The information provided on this page is intended to provide general information. The information does not take into account your personal situation and is not intended to be used without consultation from accounting and financial professionals. Allan Madan and Madan Chartered Accountant will not be held liable for any problems that arise from the usage of the information provided on this page.

Im a non resident owner of a realestate property and want to know what happens if I don’t deduct and remit to CRA the 25% withholding tax on gross rental income monthly and just include the income I received when I file my tax returns by June 30th? What is the penalty or interest if i only submit when I file my taxes on June 30th of every year?

Hi Alia, the penalty will be 2.5% of the gross monthly rent per month plus interest. Rather than pay a penalty, apply for a NR6 waiver to reduce the monthly withholding tax to 25% of the estimated net monthly profit.

The non-resident tax payments should be made to your non-resident account number (i.e. NRF#, NRK#)

What is the significance of NRF and NRK numbers, what do these numbers mean?

Hi Abe,

In order to process and apply non-resident tax payments made to the Canada Revenue Agency (CRA), the CRA assigns a NR account number to the non-resident payer. You will need to contact the CRA to apply for an NR account number.

I am wondering if I need to create an NRK number for each property. I have two….or I can take care of the payment under one…

Thank you

Hi Kate,

You only require one NRK number even if you own multiple properties.

Hi

I sent the NR4 pro forma to the CRA and got a notice of assessment back, but I never filed the S216 to CRA. if I have received the NOA from the CRA do I still need to file S216?

Thank you

Hi

I sent the NR4 pro forma to the CRA and got an NOA back. However, I have never filed S216 to the CRA. If I have got the NOA do I still need to file S216?

Thank you

You received an assessment regarding your NR4 slip / summary. If you want a tax refund, file a Section 216 Return.