How to Prepare a T4 Slip

Allan Madan, CPA, CA

What is a T4 slip?

A T4 slip reports salary and wages paid by a Canadian corporation to its employees. In order to prepare a T4 slip, you must follow these 12 easy steps below.

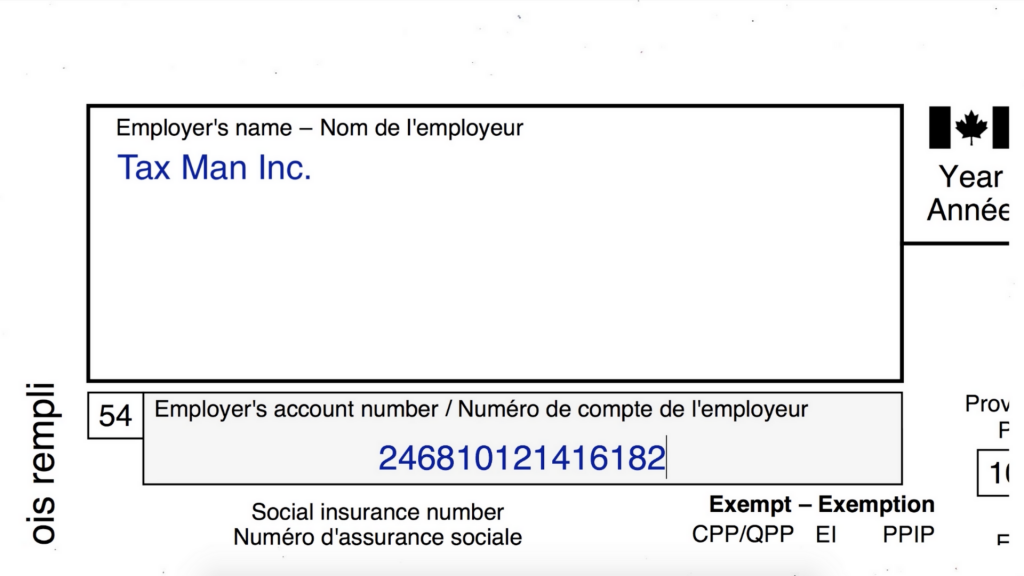

Step 1: Fill in the corporation’s (i.e. employer’s) information:

- Enter the employer’s name in the top left box; and

- Enter the employer’s payroll account number in box 54

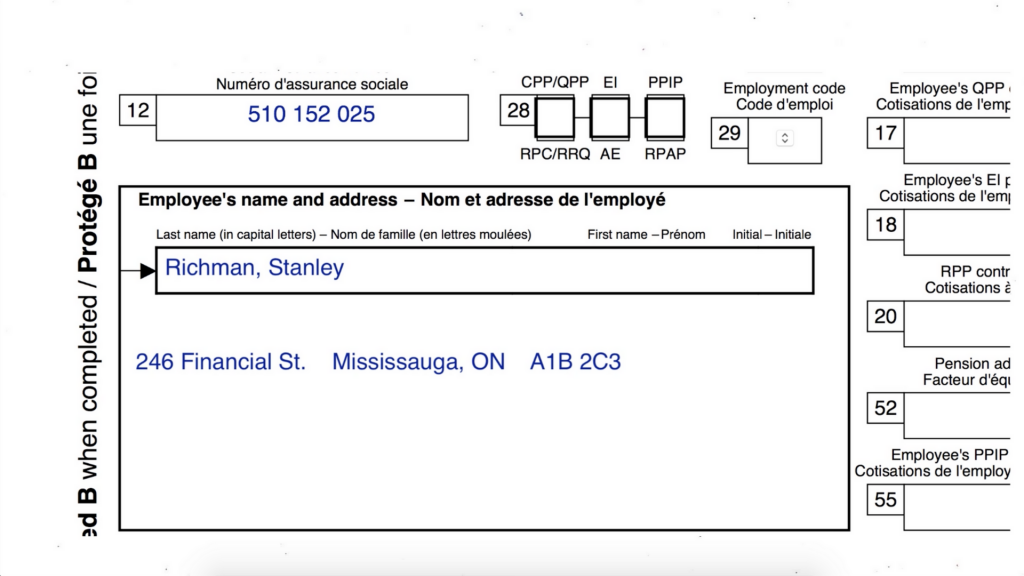

Step 2: Fill in the employee’s information:

- Write the employee’s name and address

- Put the employee’s social insurance number in box 12

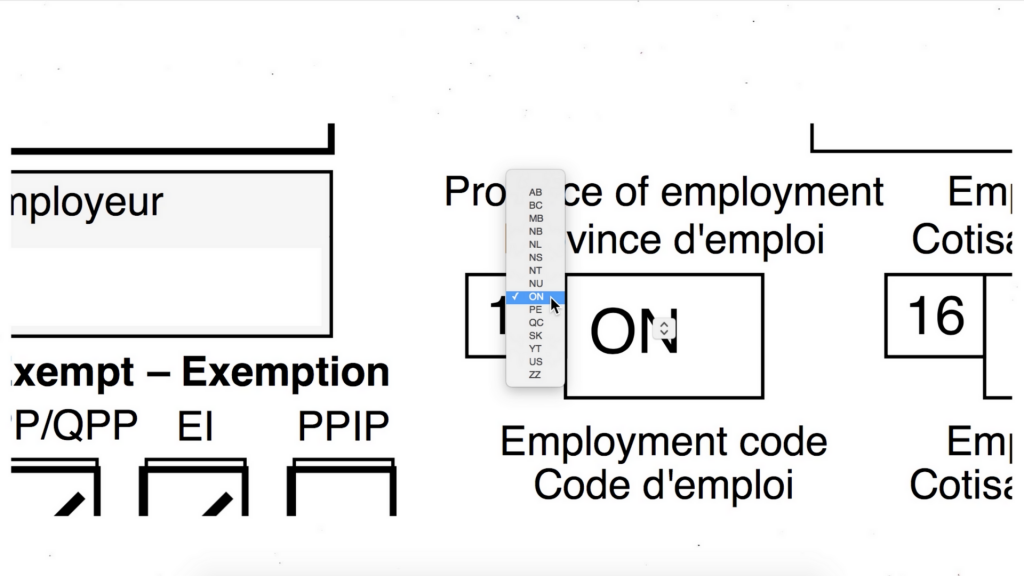

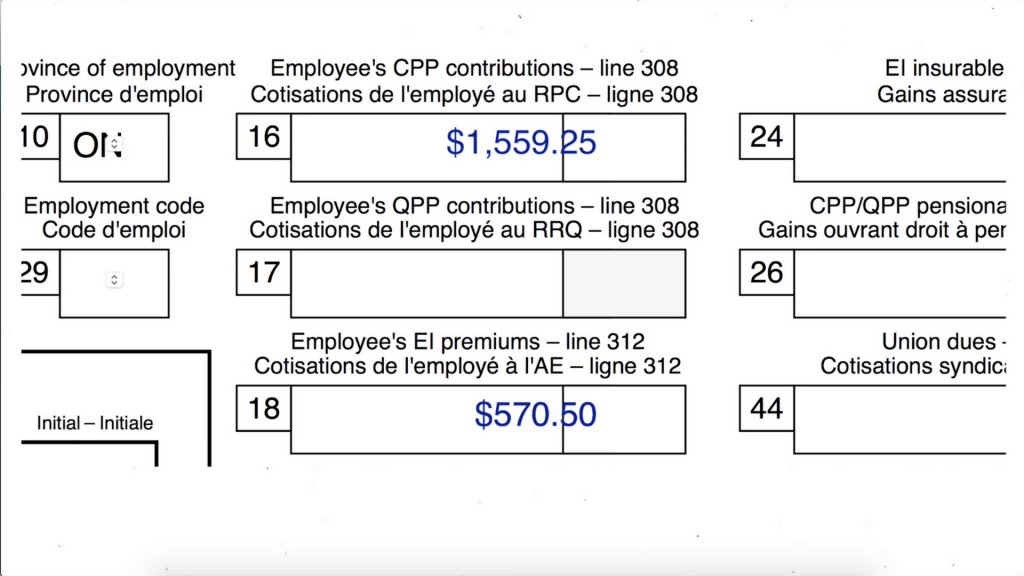

Step 3: Enter the province of employment. If the employee is working in Ontario, then the province of employment in Ontario.

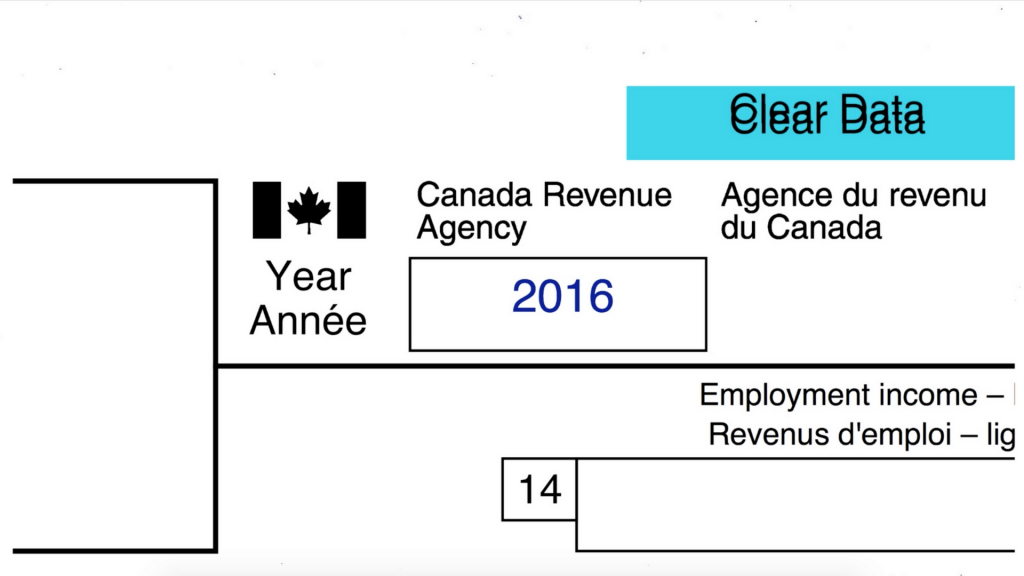

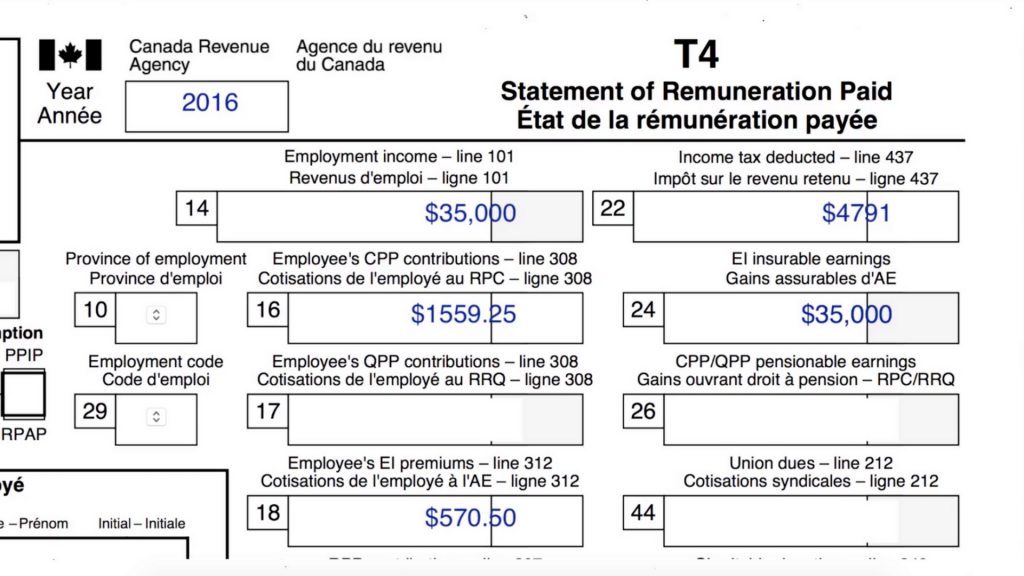

Step 4: Write the year in which the salary was received, e.g. 2016.

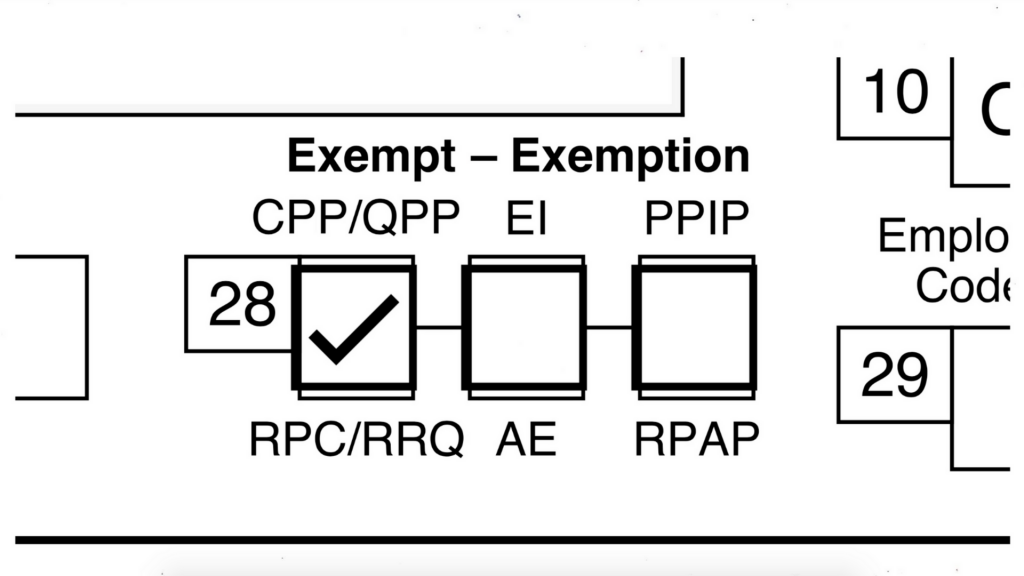

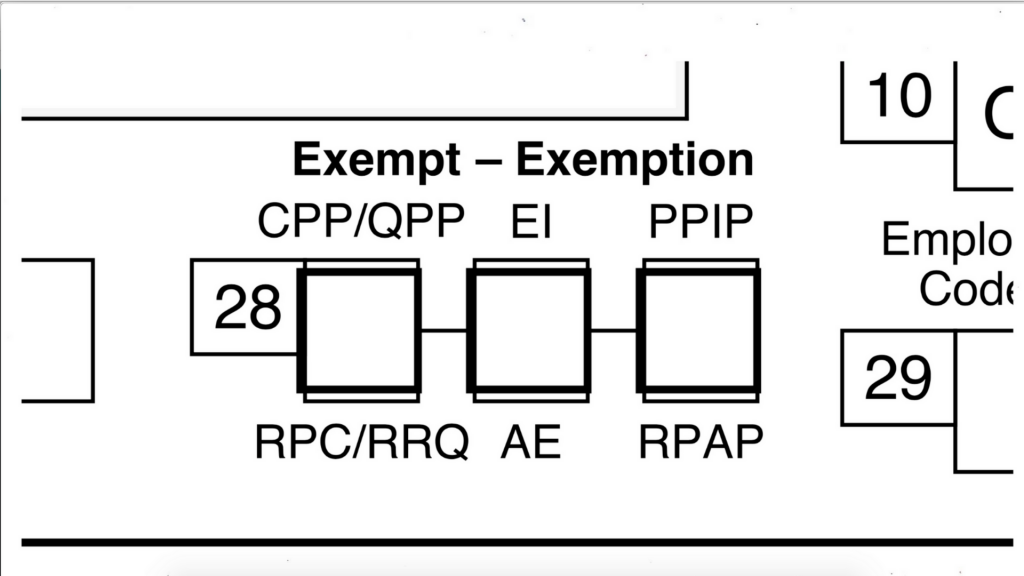

Step 5: Determine if the employee is exempt from paying EI (employment insurance) premiums. Generally speaking, shareholders and family members of shareholders that own more than 40% of the company’s voting stock are EI exempt. Everyone else has to contribute to the EI program. In this example, let’s assume that the employee must contribute to the EI program, so box 28 is not checked.

Step 6: Determine if the employee is exempt from contributing to the Canada Pension Plan. Most Canadians must contribute to the Canada Pension Plan, and so in this example, box 28 is not checked.

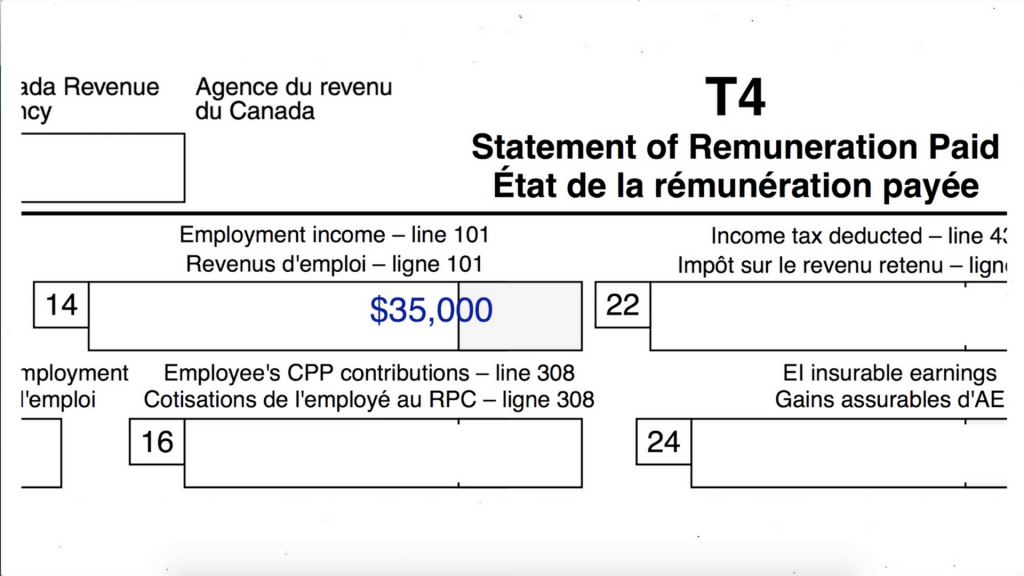

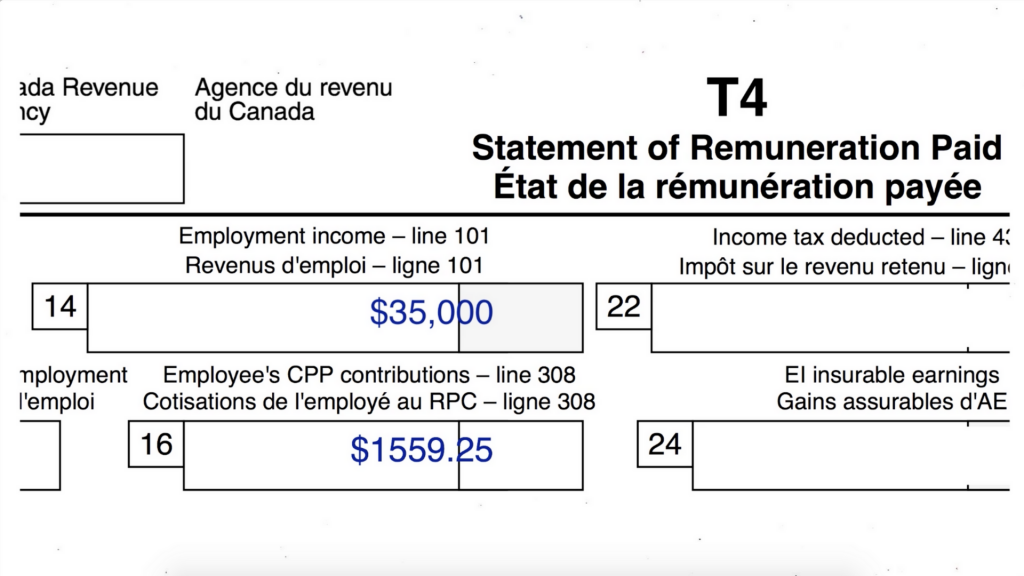

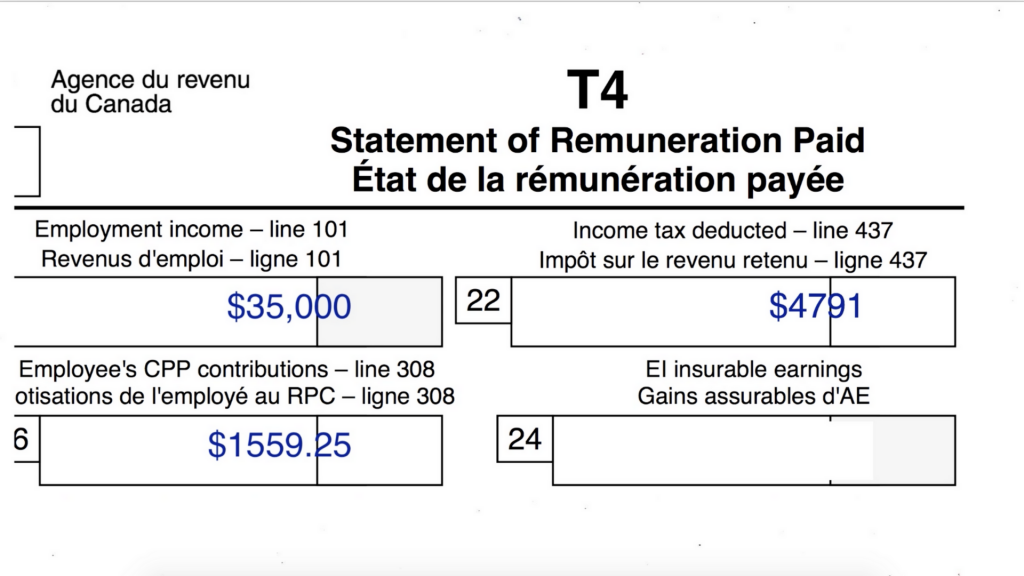

Step 7: Enter the amount of gross salary or wages paid to the employee in the 2016 calendar year in box 14. In this example, let’s assume that the employee earned $35,000 in the 2016 calendar year.

Step 8: Enter the amount of CPP contributions deducted from the employee’s paycheques during the 2016 calendar year.

According to the CCP chart, the CPP contribution rate is 4.95% of the employee’s salary in excess of $3,500.

In our example, the employee earned $35,000 in the 2016 year. So their CPP contributions for the 2016 year are $1,559.25, which is entered on box 16. This is calculated as follows: ($35,000 less the exemption amount of $3,500) x 4.95%.

Step 9: Enter the total amount of Employment Insurance (EI) premiums deducted from the employee’s paycheques during the 2016 calendar year in box 18. According to the EI chart, the EI contribution rate is 1.63% of the employee’s salary and wages. In our example, the employee earned $35,000 and so their EI premiums are $570.50 (1.63% x $35,000).

Step 10: Enter the total amount of income tax deducted from the employee’s paycheques during the 2016 calendar year in box 22. I recommend using the CRA’s online payroll calculator to calculate the CPP, EI and income tax to be deducted from each paycheque issued to an employee.

In this example, assume that a total of $4,791 of income tax was deducted from the employee’s paycheques. I calculated this amount using Simple Tax Calculator.

Step 11: Enter the amount of EI insurable earnings. This amount is equal to the gross salary and wages already entered in box 14, which is $35,000 in our example. (Box 24 = Box 14).

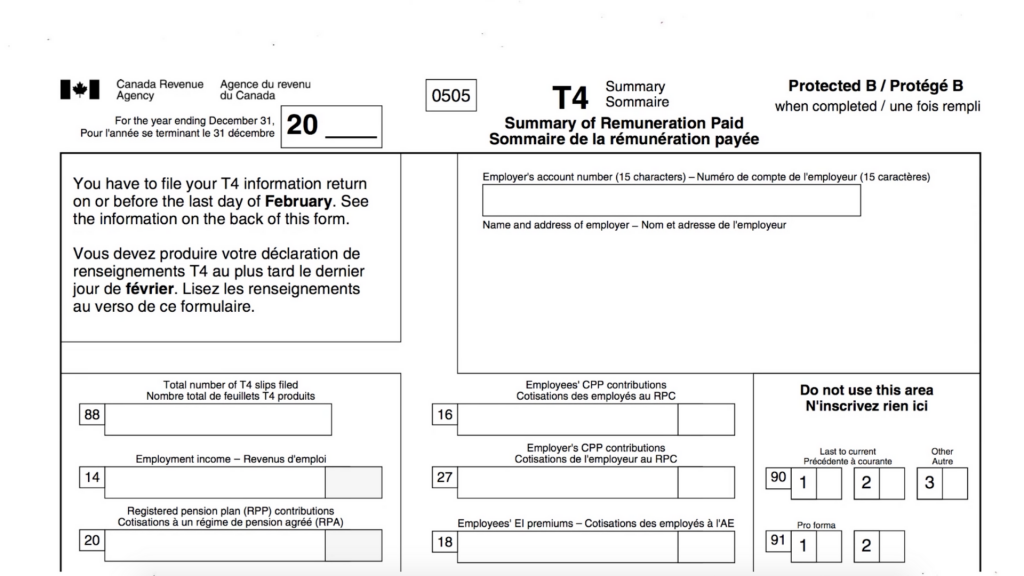

Step 12: Complete the T4 summary. The T4 summary adds up all of the figures reported on each T4 slip. A corporation may issue multiple T4 slips if it has multiple employees. Remember to write the year (e.g. 2016) and your company’s payroll account number on the T4 summary form.

Disclaimer

The information provided on this page is intended to provide general information. The information does not take into account your personal situation and is not intended to be used without consultation from accounting and financial professionals. Allan Madan and Madan Chartered Accountant will not be held liable for any problems that arise from the usage of the information provided on this page.